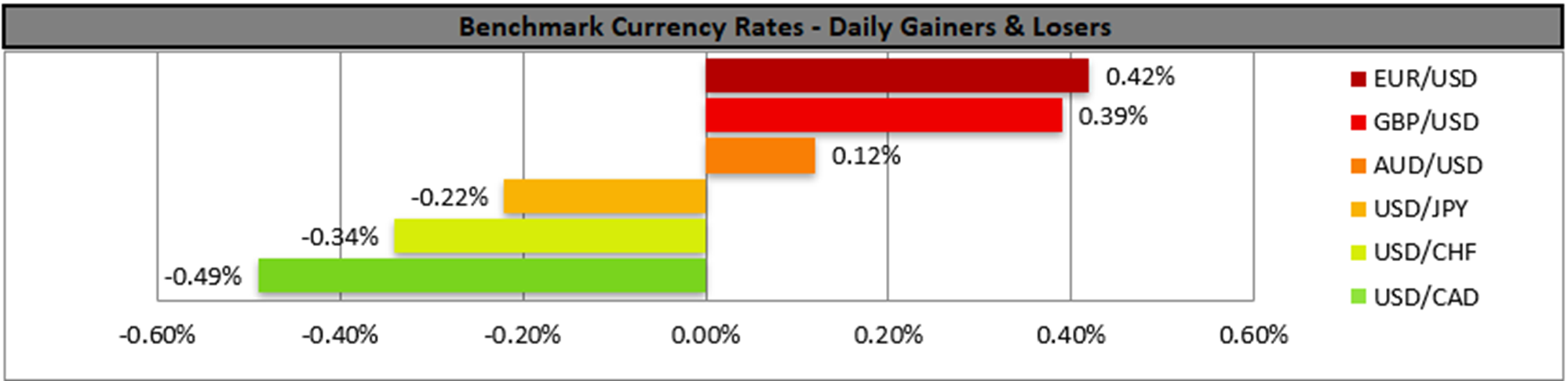

The USD was on the retreat yesterday ahead of the release of the Fed’s interest rate decision tomorrow Wednesday. The market’s expectations remain clearly dovish, while on political level US President Trump exercised additional pressure on the Fed to cut rates by posting on social media by referring to Fed Chairman Powell “Too late” “MUST CUT INTEREST RATES, NOW, AND BIGGER THAN HE HAD IN MIND. HOUSING WILL SOAR!!!.“. On a macroeconomic level for the greenback, we note the release of the US retail sales and industrial output growth rates, both being for August. The releases provide a simultaneous, practically, view on activity of the production and demand sides of the US economy. A possible beyond market expectations slowdown of the rates, could weigh on the USD yet at the same time seems to support gold’s price.

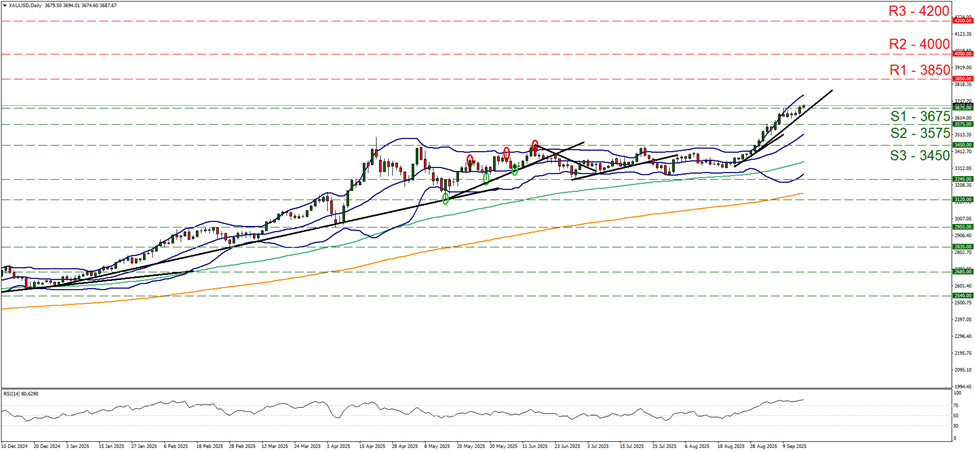

Gold’s price was able yesterday to finally break the 3675 (S1) resistance line, now turned to support. The breaking of the level, rejuvenates the bullish outlook for the precious metal shifting the upward trendline guiding it to the right as a new higher peak seems to be forming. The RSI indicator remains above the reading of 70, showcasing a strong bullish market sentiment for the precious metal, yet at the same time implies that a correction lower is also possible. On the flip side the distance between the upper Bollinger band and gold’s price action suggests that there is still room for the precious metal’s price to rise further. Should the bulls maintain control as expected, we may see it aiming for the 3800 (R1) resistance line. Should the bears take over, we may see gold’s price tumbling, breaking the 3675 (S1) support line and continuing to break the prementioned upward trendline in a first signal that the upward motion has been interrupted and continue even lower to breach the 3575 (S2) support base.

North of the US border we note the release of Canada’s CPI rates for August. The release gains on attention, given that BoC is to release its interest rate decision tomorrow. The US-Canadian trade war is expected ot have intensified inflationary pressures in the Canadian economy. The rates are expected to accelerate both on a core and headline level, and should the acceleration exceed market expectations we may see the Loonie gaining ground as the release may not affect the expectations for a rate cut tomorrow, yet may ease expectations for more rate cuts to come.

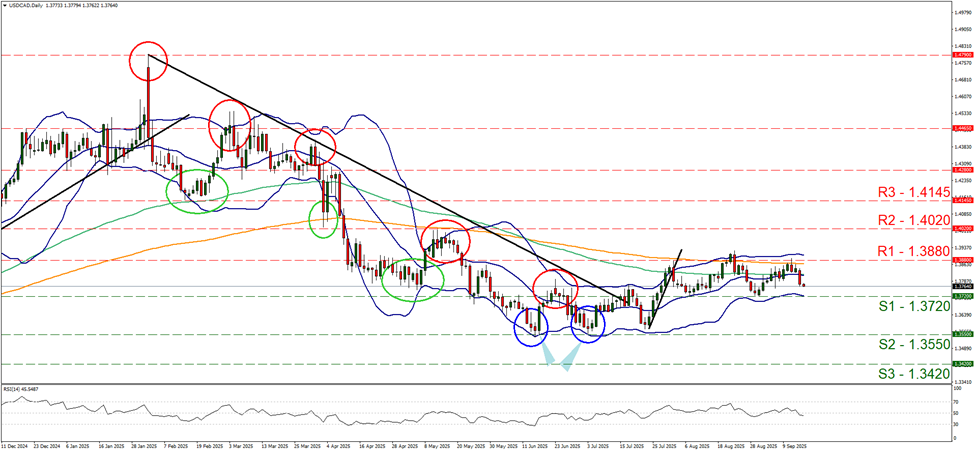

USD/CAD edged lower yesterday, yet remains well between the 1.3880 (R1) resistance line and the 1.3720 (S1) support line. We maintain our bias for the sideways motion to continue as long as the pair’s price action remains within the corridor formed by the prementioned levels. For a bullish outlook to emerge, we would require the pair’s price action to break the 1.3880 (R1) resistance line and start aiming for the 1.4020 (R2) resistance level. For a bearish outlook to be adopted, we would require the pair to break the 1.3720 (S1) support line and start aiming for the 1.3550 (S2) support base.

Across the pond, the UK’s employment data for August came in better than expected as the unemployment rate remained unchanged at 4.7%, yet employment change figure dropped less than expected. Yet we have to note that the claimant count for August rose to 17.4k which is not positive. The pound got some support across the board from the release and pound traders now focus on the release of August’s CPI rates in tomorrow’s early European session.

금일 주요 경제뉴스

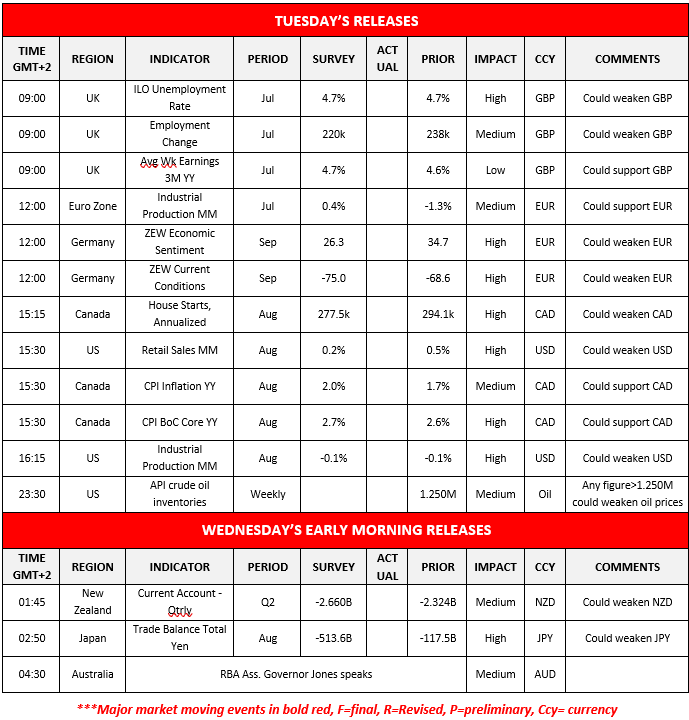

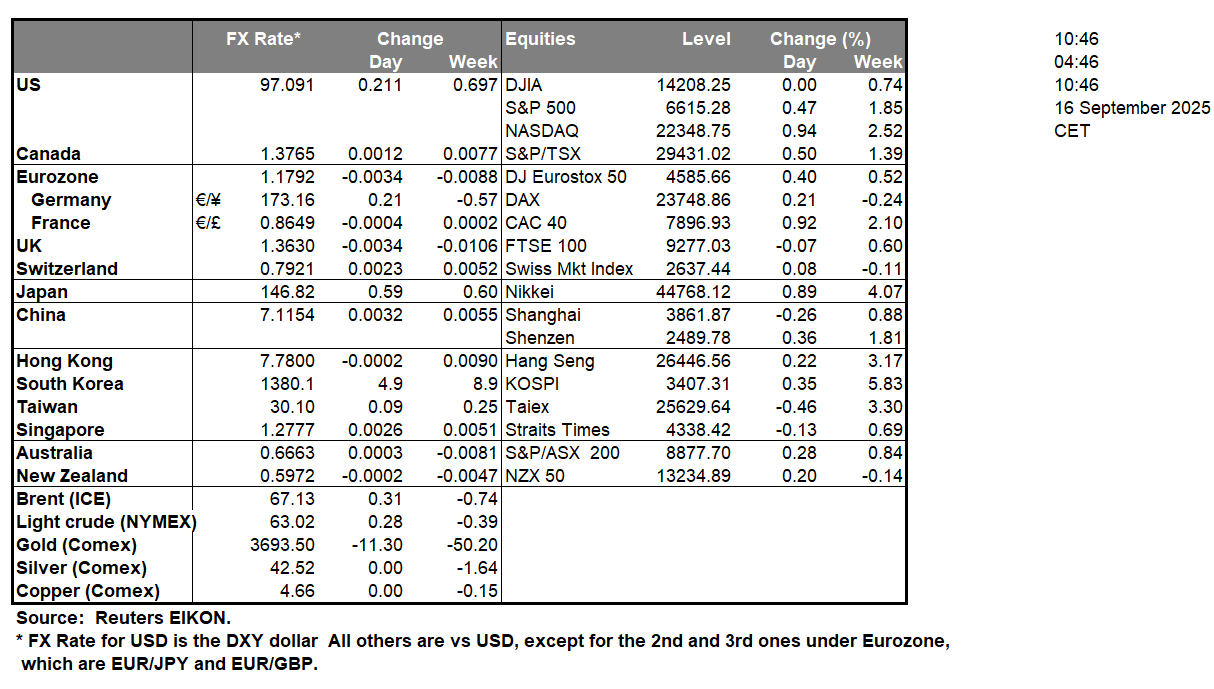

Today, we get Euro Zone’s industrial output for August, Germany’s ZEW indicators for September, Canada’s House Starts for August, the US retail sales for August, Canada’s CPI rates also for August, the US industrial output for August and the weekly API crude oil inventories figure. Tomorrow during the Asian session, we get New Zealand’s current account balance for Q2 and Japan’s trade data for August, while RBA Assistant Governor Jones speaks.

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

XAU/USD Daily Chart

- Support: 3675 (S1), 3575 (S2), 3450 (S3)

- Resistance: 3850 (R1), 4000 (R2), 4200 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.