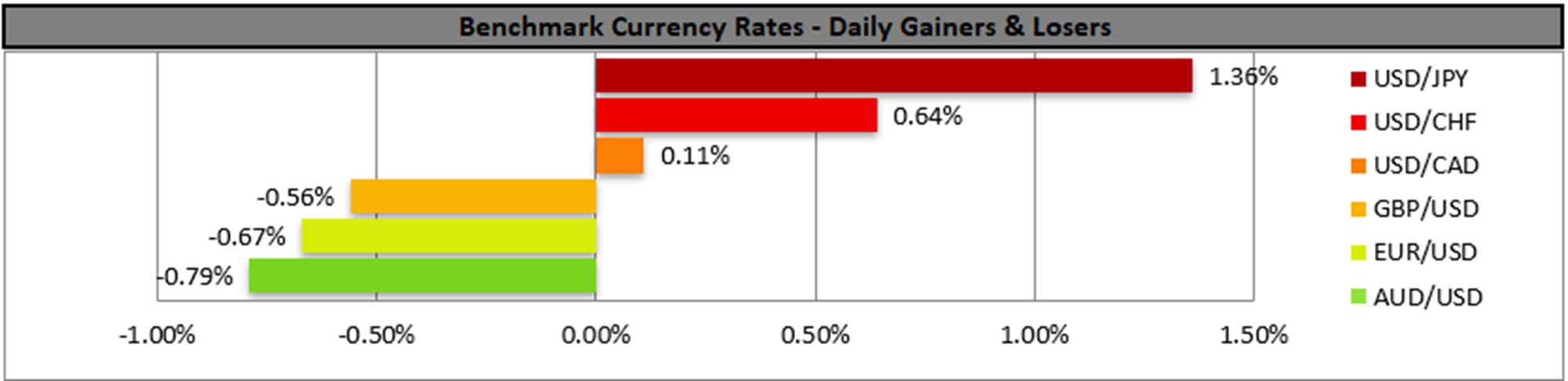

The USD was on the rise against its counterparts yesterday and during today’s Asian session. Market focus today is on the release of the Fed’s September meeting minutes. The market’s expectations for the time being are clearly on the dovish side and the US Government shutdown tends to increase the pressure on the bank to ease its monetary policy. Also, we note that some Fed policymakers are actively pushing for a faster and wider easing of the bank’s monetary policy like Stephen Miran. On the contrary some Fed policymakers like Kansas Fed President Schmidt, seem to hesitate. Overall, there seems to be a power struggle within the Fed between the doves and hawks. Should the document reaffirm or even enhance the market’s expectations for the bank to ease its monetary policy further we may see the USD weakening once again, while should the bank take by surprise by Fed Policymakers underscoring their doubts for the necessity of extensive monetary policy easing, we may see the USD gaining ground while in such a case the release could weigh on gold’s price and US equity markets.

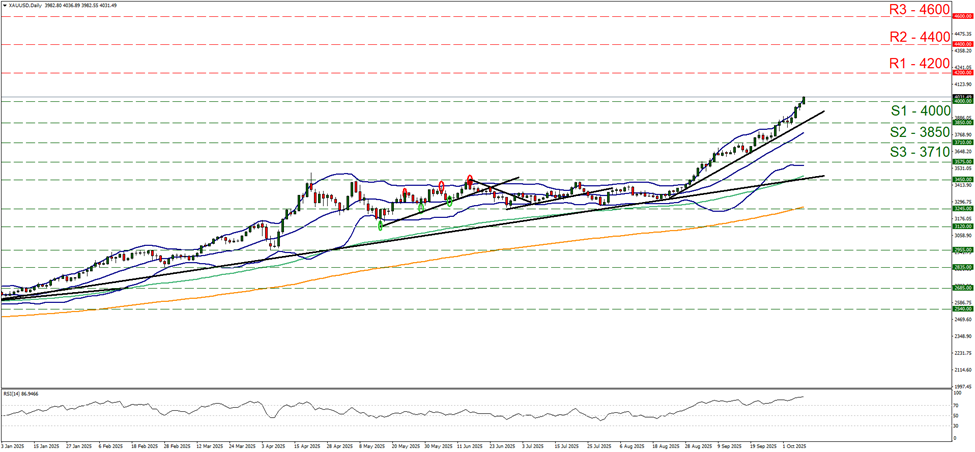

On a technical level, we note that gold’s price continued to rally reaching new All Time Highs, by breaching the 4000 (S1) resistance hallmark, now turned to support. We maintain our bullish outlook for the precious metal’s price as long as the upward trendline guiding the precious metal’s price since the 22nd of August remains intact. Yet at the same time given that the RSI indicator is way above the reading of 70, signaling that gold’s price is at over bought levels and the price action has broken above the upper Bollinger band sending similar signals, we accompany our bullish outlook with a warning for a possible correction lower. Should the bulls maintain control as expected, we set as the next possible target for gold’s price the 4200 (R1) resistance level. For a bearish outlook to be adopted we would require the precious metal’s price to break the 4000 (S1) support line, continue to break also the prementioned upward trendline, in a first signal of an interruption of the upward motion and continue to also break the 3850 (S2) support level.

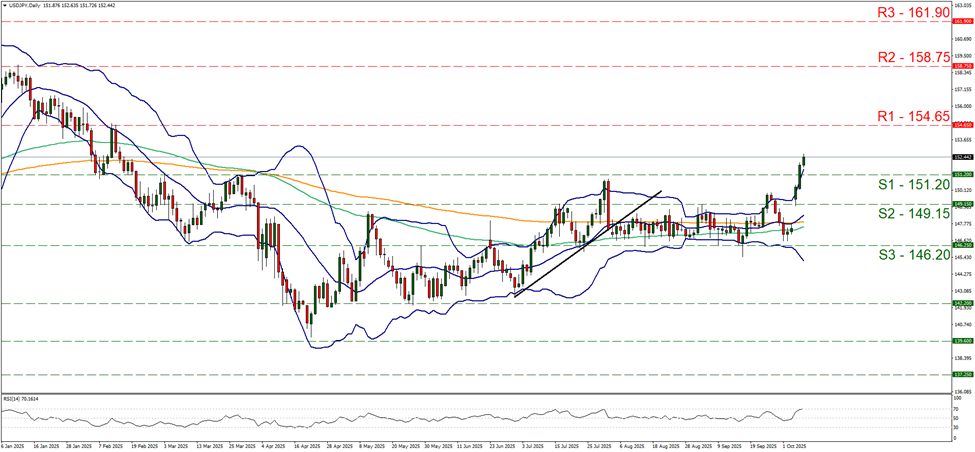

In the FX market, USD/JPY continued to rally yesterday and during today’s Asian session, breaking the 151.20 (R1) resistance line, now turned to support. We adopt a bullish outlook for the pair yet note that the RSI indicator has reached the reading of 70 implying a strong bullish market sentiment and at the same time that the pair may be nearing overbought levels. Similar signals are being sent by the fact that the price action has clearly surpassed the upper Bollinger band. Should the bullish outlook be maintained we set the next possible target for USD/JPY the 154.65 (R1) resistance line. Should the bears find a chance and lead the pair lower we may see USD/JPY breaking the 151.20 (S1) support line and start aiming for the 149.15 (S2) support level.

As we mentioned in yesterday’s report New Zealand’s, RBNZ cut rates by 50 basis points and in its accompanying statement it signaled that it remains open to further easing of its monetary policy. The bank highlighted its expectations for inflation to converge around the 2 percent target mid-point over the first half of 2026. At the same time, it also notes that economic activity through the middle of 2025 was weak, and it regards that lower interest rates will support a recovery in growth. The release took the markets by surprise enhancing the market dovish expectations for the bank’s intentions, thus weighing on the Kiwi. Overall, we view the bank’s dovish intentions as weighing on the Kiwi on a fundamental level as it widens the interest rate differential outlook with other central banks.

금일 주요 경제뉴스

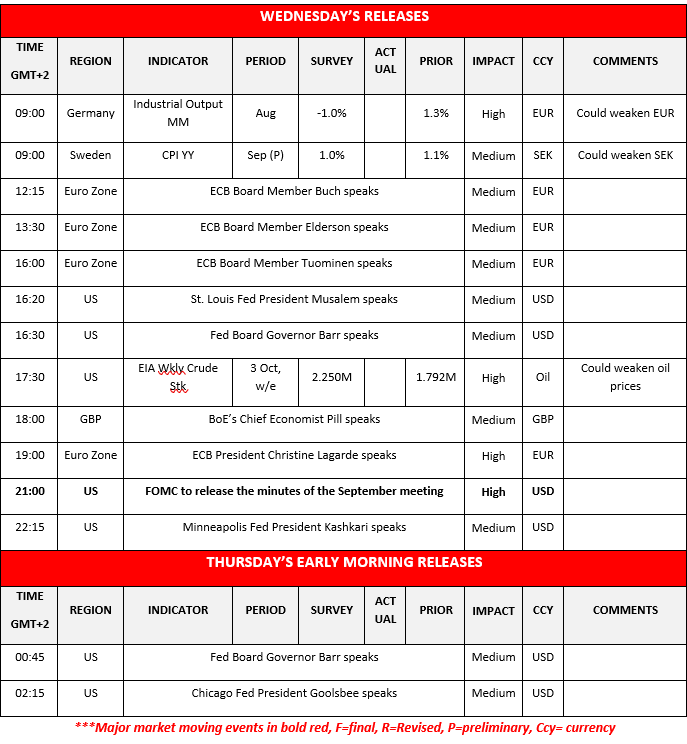

Today we get Germany’s industrial output for August, Sweden’s preliminary CPI rates for September, while later on, oil traders may be more interested in the release of the EIA weekly crude oil inventories figure. On a monetary level we note that ECB’s Buch, Elderson, Tuominen and Lagarde as well as BoE’s Pill and the Fed’s Musalem, Barr, Kashkari and Goolsbee are scheduled to speak.

XAU/USD Daily Chart

- Support: 4000 (S1), 3850 (S2), 3710 (S3)

- Resistance: 4200 (R1), 4400 (R2), 4600 (R3)

USD/JPY Daily Chart

- Support: 151.20 (S1), 149.15 (S2), 146.20 (S3)

- Resistance: 154.65 (R1), 158.75 (R2), 161.90 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.