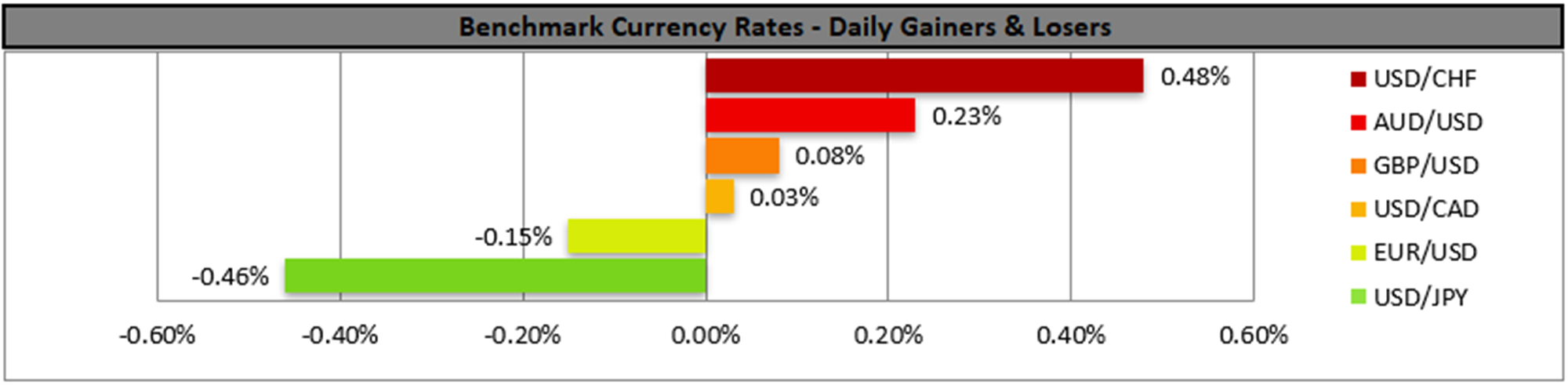

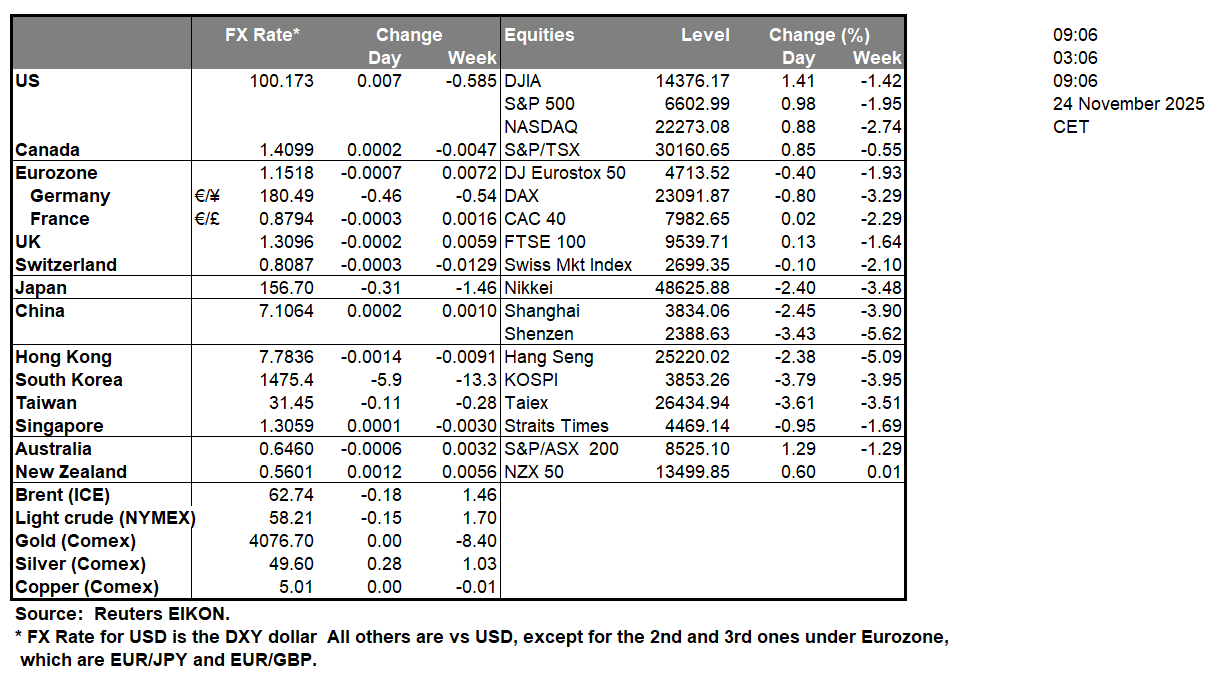

The market is relatively calm as the week begins, with the USD being rather stable against its counterparts in the FX Market. EUR traders remained relatively indifferent for the US peace plan for the war in Ukraine, yet any further indications for a ceasefire at the front could benefit the common currency. In the UK, market focus, is to be on the release of the Autumn budget on Wednesday, while on the same day, in the Asian session, RBNZ is to release its interest rate decision and is expected to cut rates by 25 basis points. In the US, the Fed’s intentions remain a key driver for the markets with NY Fed President Williams signalling the possibility of a rate cut in the December meeting, while others seem to remain sceptical for the necessity of further easing of the bank’s monetary policy. US stock markets seem to be sending mixed signals, while we’ll have a better understanding for the market’s mood with the American opening. We should note that META seems to have concealed evidence of harm by social media, as per US Court filings, which could weigh on its share price. Finally, gold’s price seems to remain relatively stable, maintaining a wait-and-see position.

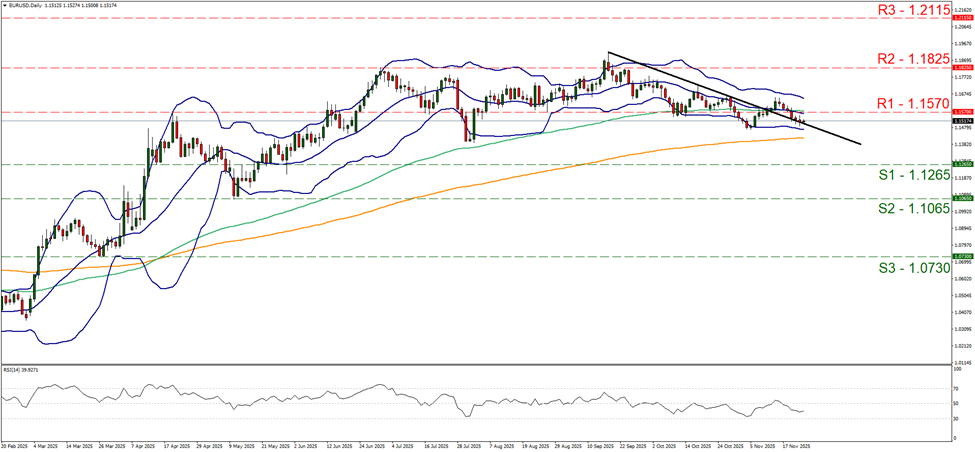

In the FX market we note that EUR/USD continued to edge lower distancing its price action from the 1.1570 (R1) resistance line. For the time being we tend to maintain a bias for a sideways motion of the pair, yet note that the RSI indicator remains between the readings of 50 and 30, implying some bearish tendencies on behalf of the market. Also the downward motion of the median of the Bollinger bands, that being the 20 moving average, tends to imply a downward direction for the pair. For a bearish outlook to emerge we would require the pair’s price action to form a new lower trough and start aiming for the 1.1265 (S1) support line. For the adoption of a bullish outlook the bar is high, as EUR/USD’s price action would have to break the 1.1570 (R1) resistance line clearly and start aiming for the 1.1825 (R2) resistance base.

Also on a technical level, we note that gold’s price remained stable on Friday and during today’s Asian session, well between the 4155 (R1) resistance line and the 3890 (S1) support level. Please note that the RSI indicator continued to run along the reading of 50, implying a rather indecisive market which could allow the sideways motion to be maintained, while similar signals are being send by the converging Bollinger bands implying less volatility for gold’s price. Should the bulls regain control over gold’s price, we may see it breaking the 4155 (R1) resistance line and start aiming for the 4380 (R2) resistance level, which marks an All Time High (ATM) for the precious metal’s price. Should the bears take over we may see gold’s price breaking the 3890 (S1) support line and continue lower to aim the 3615 (S2) support level.

금일 주요 경제뉴스

Today we get Germany’s Ifo indicators for November and the US the Dallas Fed manufacturing index also for November.

As for the rest of the week:

On Tuesday we get UK’s CBI distributive trades for November, the US PPI rates for September and the US consumer confidence for November. On Wednesday, we get Australia’s CPI rates for October, from New Zealand, RBNZ’s interest rate decision, Norway’s GDP rates for Q3, and from the US we may get the PCE rates for October, the durable goods orders for October, the 2nd estimate if Q3’s GDP rate and the weekly initial jobless claims figure. On Thursday we get Australia’s capital expenditure for Q3, Germany’s GfK for December and Euro Zone’s economic sentiment for November. On Friday we get Japan’s Tokyo CPI rates for November and preliminary industrial output for October, Sweden’s final GDP Rate for Q3, France’s and Germany’s preliminary HICP rate for November, from Switzerland the GDP rate for Q3 and the KOF indicator for November and from Canada, Q3’s GDP rate.

EUR/USD Daily Chart

- Support: 1.1265 (S1), 1.1065 (S2), 1.0730 (S3)

- Resistance: 1.1570 (R1), 1.1825 (R2), 1.2115 (R3)

XAU/USD Daily Chart

- Support: 3890 (S1), 3615 (S2), 3450 (S3)

- Resistance: 4155 (R1), 4380 (R2), 4600 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.