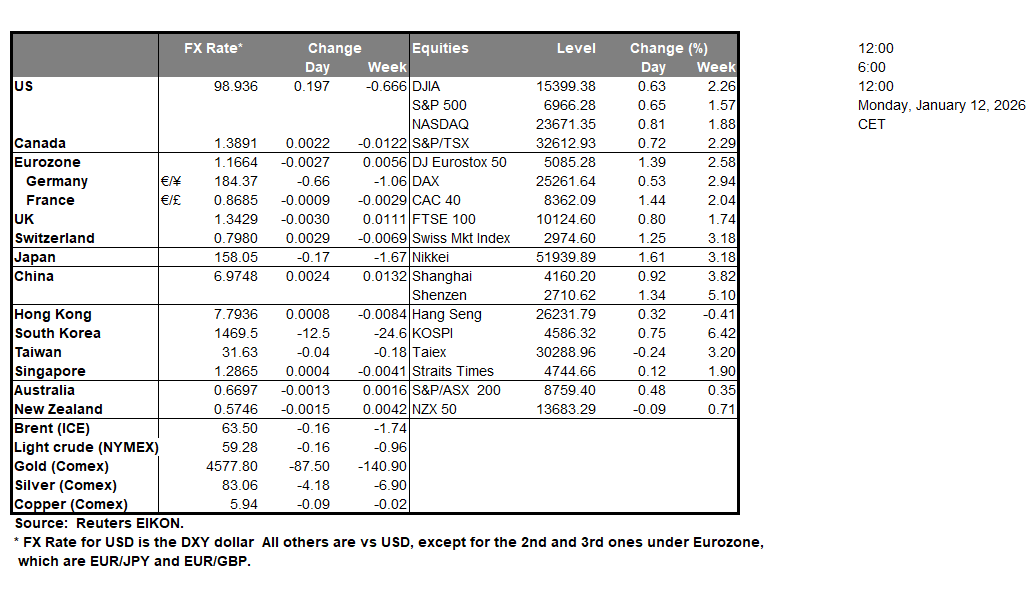

The US President and his team seem to be intensifying their efforts to oust Fed Chairman Powell and set the bank under their control. It should be noted that, according to media reports, the Department of Justice has subpoenaed the central bank and has threatened it with a criminal indictment in regards to his testimony in the US Congress about the building renovation of the Fed. Trump’s action was called by the Fed Chairman as a “pretext” in order for the US Government to get control over the level of interest rates, which US President Trump wants to cut dramatically. The USD seems to be losing ground from tomorrow’s Asian session, relenting any gains made by the release of the US employment report for December, as despite the NFP figure dropping more than expected, the unemployment rate was also lowered, which may allow the Fed to keep rates high for longer, should the CPI rates for December show some resilience tomorrow. The stakes are high given the gravity of the Fed and the prospect of lower rates by the Fed pushed gold’s price higher as it may also provide support for US equities.

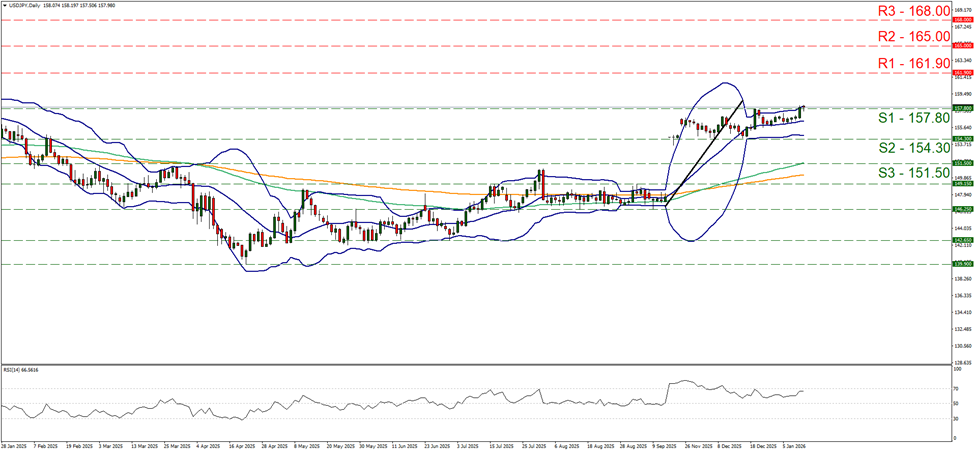

In the FX market, USD/JPY rose on Friday breaking the 157.80 (S1) resistance line, now turned to support. The pair’s bullish intentions are obvious given the breaking of the 157.80 level and failed to materially weaken in today’s Asian session, despite the slipping of the USD against other currencies but also the fact that the RSI indicator is nearing the reading of 70, implying a strengthening bullish market sentiment for the pair. On the other hand the pair’s price action has neared the upper Bollinger band which may slow down the bulls or even cause a correction lower for USD/JPY. Should the bulls maintain control, we may see the pair start aiming for the distant 161.90 (R1). On the flip side, should the bears take over, we may see USD/JPY breaking the 157.80 (S1) support line and continue to break also the 154.30 (S2) support base.

Gold’s price broke the 4550 (S1) resistance line, now turned to support and has now reached new All Time High levels. We have a bullish outlook for gold’s price and intend to keep it as long as the upward trendline guiding it since the 28th of October remains intact. Yet the price action has hit on the upper Bollinger band which may be reason for a correction lower. For the bullish outlook to be maintained we would require the precious metal’s price to start actively aiming for the 4800 (R1) resistance line. A bearish outlook currently seems remote and for it to be adopted we would require gold’s price to break the 4550 (S1) support line and continue to break also the prementioned upward trendline in a first signal of an interruption of the upward movement and continue even lower to break the 4380 (S2) support level.

금일 주요 경제뉴스

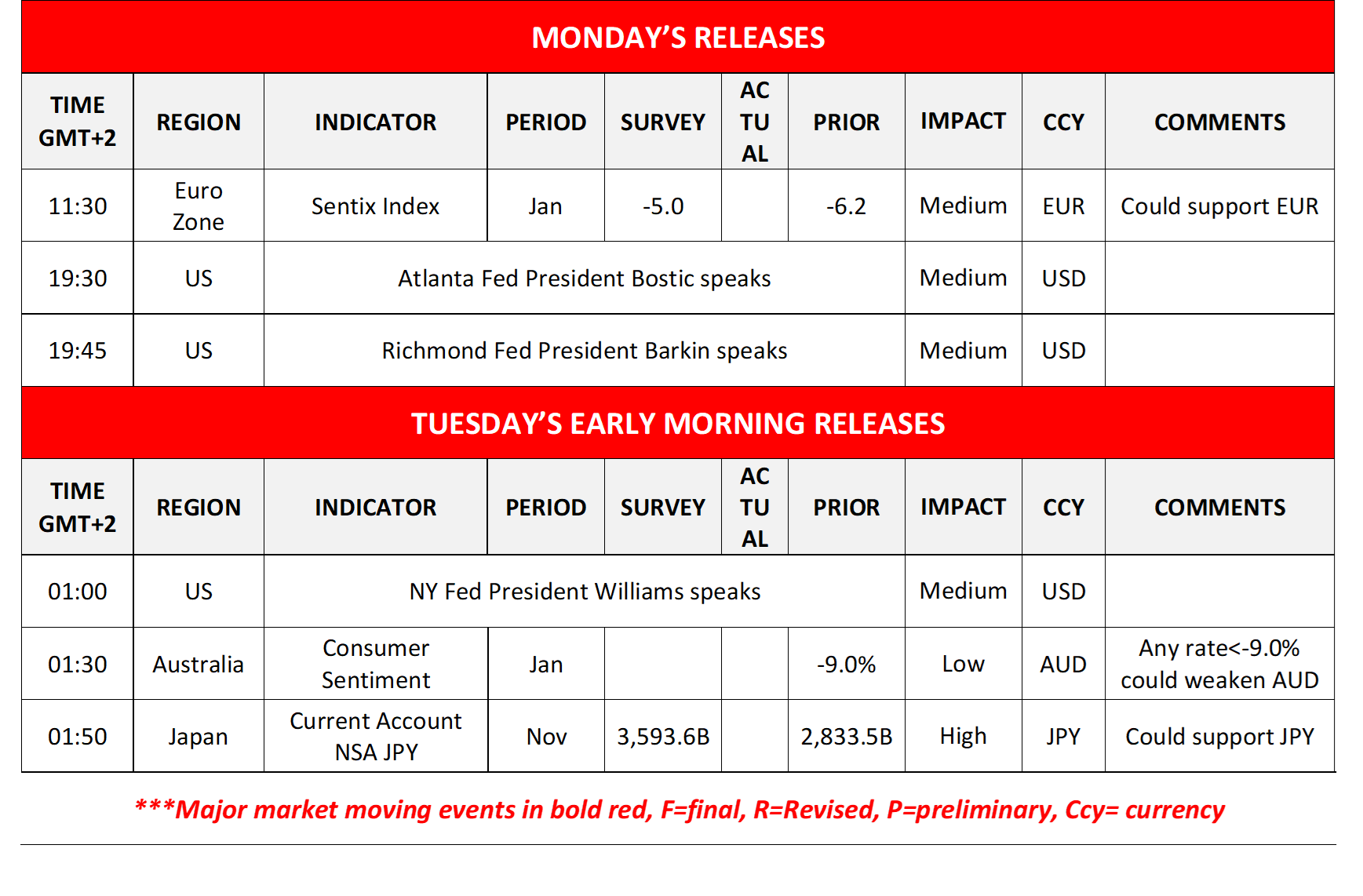

Today, we get the Euro Zone’s Sentix index for January, while Atlanta Fed President Bostic and Richmond Fed President Barkin speak. In tomorrow’s Asian session, we note the release of Australia’s consumer sentiment for January and Japan’s current account balance for November, while NY Fed President Williams speaks.

As for the rest of the week:

On Tuesday we note the release of Japan’s current account balance for November, the Czech Republic’s final CPI rates for December and we highlight the release of the US CPI rates for the same month. On Wednesday we note the release of China’s December trade data for December and from the US the PPI rates for November and retail sales for the same month. On Thursday, we get Japan’s PPI rates for December, UK’s GDP and manufacturing output growth rate for November, Canada’s House starts for December, from the US the weekly initial jobless claims figure and the Philly Fed Business index for January and Canada’s manufacturing sales for November. On Friday we get the US industrial output for December and Germany’s Full Year GDP rate for 2025.

USD/JPY Daily Chart

- Support: 157.80 (S1), 154.30 (S2), 151.50 (S3)

- Resistance: 161.90 (R1), 165.00 (R2), 168.00 (R3)

XAU/USD Daily Chart

- Support: 4550 (S1), 4380 (S2), 4245 (S3)

- Resistance: 4800 (R1), 5000 (R2), 5200 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.