WTI briefly touched the $90 per barrel this week as the EIA 그리고 API crude oil inventories reported unexpected falls beyond market expectations, but during yesterday’s session it retraced its steps to the $88 per barrel after the Fed’s jumbo 75 basis points decision alongside the hawkish remarks of Fed Chair Powell. Nonetheless, oil traders continue to grapple with conflicting fundamentals of OPEC+ supply cuts, European Union’s embargo on Russian oil and the deteriorating demand outlook from China. Furthermore, growing fears for a potential global economic recession, inject additional uncertainty in the equation. In this report we aim to shed light on the catalysts driving WTI’s price, assess its future outlook and conclude with a technical analysis.

Fed’s decision raises concerns over oil demand

The Fed delivered as expected its fourth straight supersized 75 basis points rate hike in the November meeting raising the feds funds rate to 4%, reaching a level once seen before during the global financial crisis of 2008, in an attempt to bring down soaring inflation closer to its 2% benchmark level. In its accompanied statement the FOMC acknowledged the widespread concerns that the pace of rate hikes can severely damage the economy which could trigger a recession, stating that it will take into account the effects of the cumulative tightening of its monetary policy. Following the decision, Fed Chair Powell practically eliminated any hopes for a pivot but cited there will be ongoing hikes until rates are sufficiently restrictive and explicitly stated that the central bank prefers to over-tighten, rather than under-tighten as that would increase the odds of inflation becoming deeply entrenched within the economy for longer. Furthermore, the Fed sees the terminal rate closer to 5% rather than the 4.5% initially estimated, hinting there is more ground to cover as inflation remains persistently elevated 그리고 chips away US consumers’ purchasing power. As a result, the prospect of even higher interest rates weighs on the demand outlook of oil, as the effect of the Fed’s aggressive monetary policy practices contributes to the slowdown of economic activity in the US economy and increases the odds for global economic recession.

US oil inventories unexpectedly fall

On another note, the US crude oil inventories pointed to an increase in oil demand during the past week, as the EIA yesterday reported an unexpected fall of -3.115 million barrels in inventories, despite expectations for a built up of 0.367 million barrels. Furthermore, the API weekly crude oil inventories figure reported on Tuesday, also unexpectedly fell by -6.530 million barrels for the same period. Moreover, we would note that last Friday the Baker Hughes oil rig count showed that the number of active oil rigs in the US has dropped by 2 reaching a total of 610, which could be another indication of increased demand levels, matching the upwards trajectory of oil prices observed this week.

China disputes rumors for loosening of Covid restrictions

Earlier this week rumors surfaced that China is set to lift Covid restrictions on big cities across the mainland which sparked hopes for betterment of the whole economic outlook of the country and spurred a rally in the Chinese equities sector. Earlier today, the government disputed those rumors, unequivocally citing that zero covid policy is to remain intact and without a doubt, renewed covid lockdowns are expected to put extra pressure on consumer confidence as well as business activity within the Chinese economy. As a result, the sentiment shifted on the prospect of an extension of the slowdown of the second largest consumer of oil 그리고 WTI retraced its steps back to the $88 per barrel level in today’s session.

Experts see EU’s embargo on Russian oil as ineffective

The EU’s embargo on Russian oil is set to begin early on December the 5 and in February all imports of oil will be cease. The embargo imposes shipping restrictions should an oil tanker transports oil above the agreed price threshold, which indirectly forces the shipowners to comply with the G7 price cap agreement. The decision follows suit after the escalation of the war in Ukraine and is seen as another counter-offensive measure at restricting revenues arising from oil flowing back to Russia, which are used to finance the prolonging of the war. Having said that, market analysts and economists see the embargo as having no or very little impact on the supply as well as the prices of oil, as they anticipate that Russia could easily reroute its shipments towards the east, mainly targeting the insatiable oil-consuming giant China alongside India.

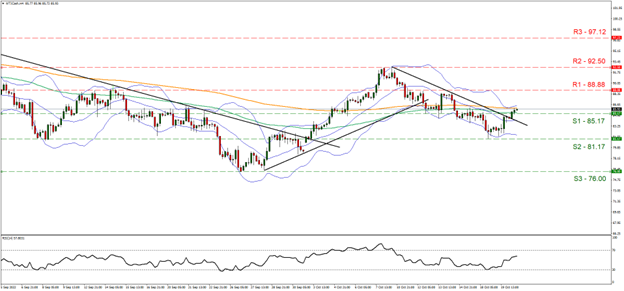

기술적 분석

WTI H4

Looking at WTICash 4-hour chart we observe the price action failing to break successfully above the $90 level and the confinement of the price action between 88.88 (R1) resistance and 85.17(S1) support base. We hold a sideways price action bias given the stabilization and the convergence of both the short 그리고 long moving averages right below the price action. Supporting our case is the RSI indicator below our 4hour chart, which currently registers a value of 50 showcasing indecision surrounding the commodity. Should the bears take control, we may see the price action retreating below the 85.17 (S1) support level and moving closer to the 81.17 (S2) support base. Should on the other hand, the bulls dominate over the commodity’s direction, we may see the break above the 88.88 (R1) resistance level and the move close to the 98.50 (R2) resistance barrier.

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 정보는 투자 자문이나 투자 권유가 아닌 마케팅 커뮤니케이션으로 간주해야 합니다.