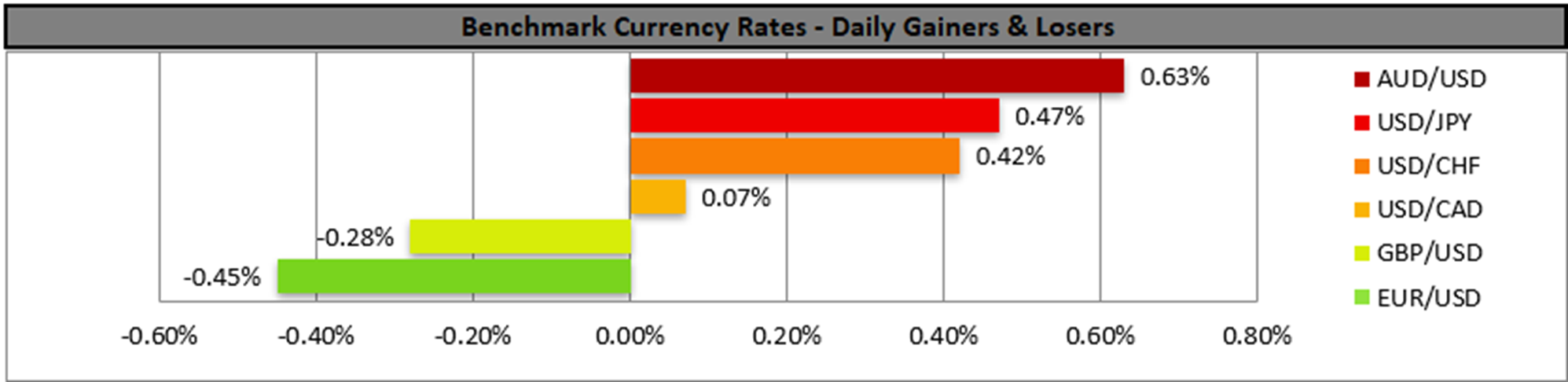

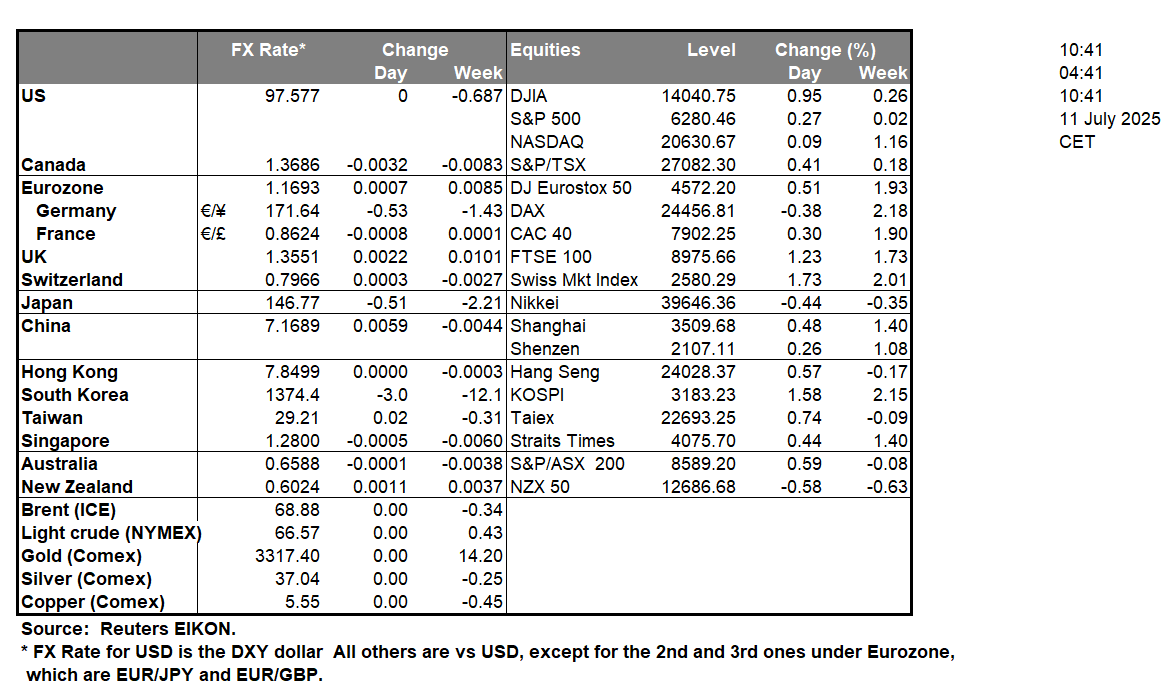

The greenback gained against its counterparts yesterday and during today’s Asian session, as tensions in international trading are intensifying. US President Trump publicized new import tariffs, aiming Canada with a 35% tariff and also announcing intentions for blanket tariffs of 15% or 20% on many US trading partners. Next big question mark is EU and Trump stated that a tariff letter could be send even today and the announcement tended to through a shadow on the US-EU trade negotiations. Nevertheless and as stated in yesterday’s report there seems to be a relevant resilience of the market’s optimism with riskier assets gaining. Bitcoin has reached ATH levels, supported by the positive market sentiment and from market expectations for the US “crypto week” where US Congress is to discuss laws providing a framework for stable coins.

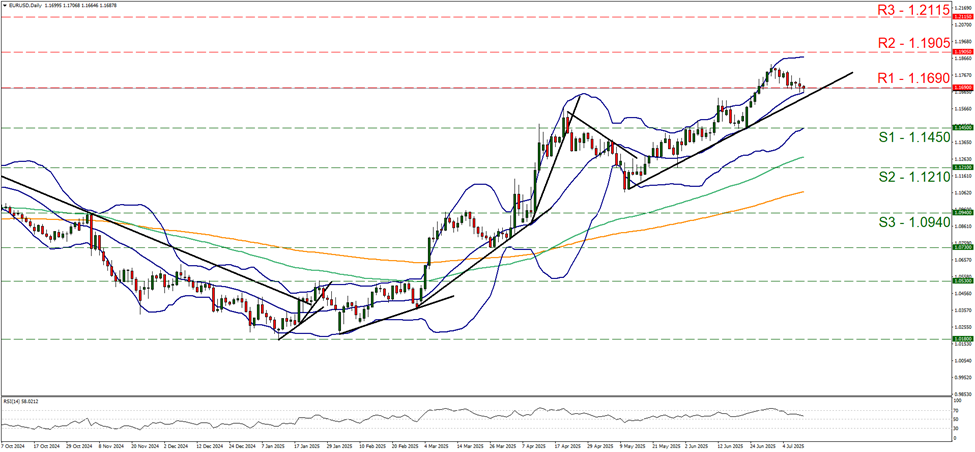

Back in the FX market EUR/USD edged lower yesterday and during today’s Asian session and dropped just below the 1.1690 (R1) support line, temporarily turned to a resistance level. Despite the drop of the pair’s price action, which may continue, as long as the upward trendline guiding the pair since the 13th of May remains intact we intend to maintain our bullish outlook for the pair. We also note that RSI indicator despite dropping lower remains above the reading of 50, implying that the market’s bullish sentiment for the pair has eased, yet no bearish sentiment has been initiated yet. Overall the downward motion of the pair since the 2nd of July, resembles more a correction lower rather than a change of trend. For a bearish outlook to emerge we would require the pair to initially break the prementioned upward trendline, in a first signal of an interruption of the upward movement and continue lower to break the 1.1450 (S1) support line, with the next possible target for EUR bears being the 1.1210 (S2) level. For a bullish outlook we would require the pair to break the 1.1690 (R1) line and aim if not breach the 1.1905 (R2) level.

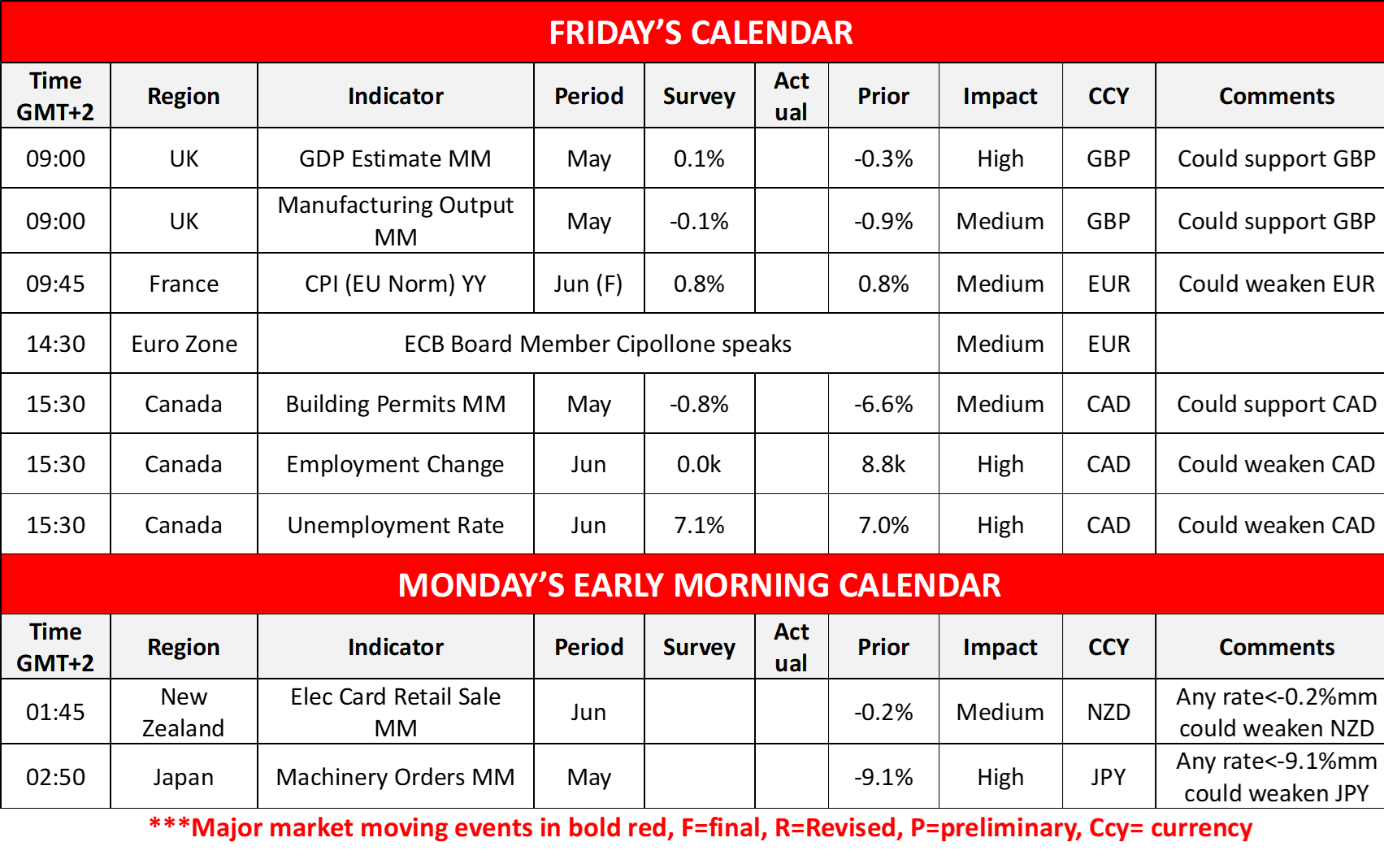

Today we highlight the release of Canada’s employment data for June in the early American session today. Forecasts show that the unemployment rate is expected to tick up to 7.1% and the employment change figure to drop to 0.0k if compared to May’s 8.8k. Should the actual rates and figures meet their respective forecasts we may see the Loonie slipping as the release would imply further easing of the Canadian employment market and thus adding pressure on BoC to restart rate cuts. It should be noted that the market currently expects the bank to deliver only one more rate cut, in its September meeting and that is to be the only cut until the end of the year. Yet should the forecasts be disproven and the data shows less easing of the Canadian employment market or even a tightening, we may see the Loonie getting asymmetric support.

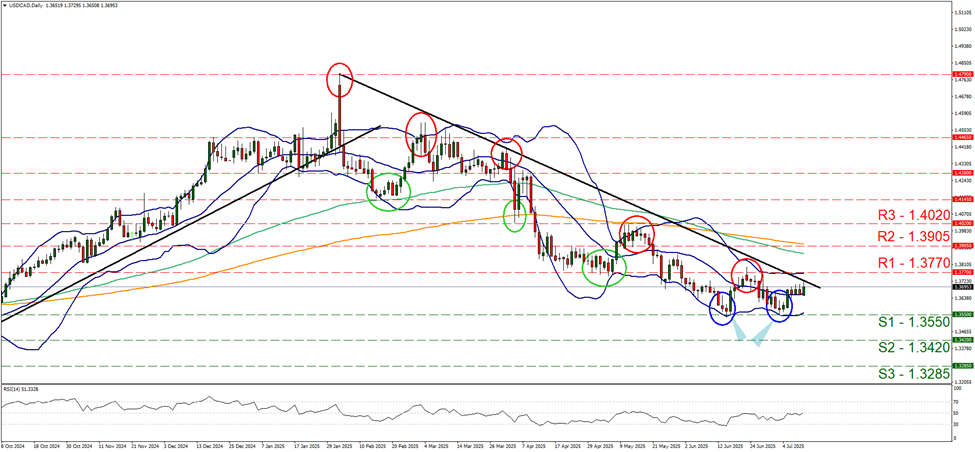

USD/CAD remained in a rangebound movement in the past few days right between the 1.3550 (S1) support line and the 1.3770 (R1) resistance level. The downward trendline guiding the pair dictates a bearish outlook, yet that seems to be under doubt as the RSI indicator remains close to the reading of 50, implying an indecisive market and the pair seems unable to break the 1.3550 (S1) line despite attempting twice since the midst of June. Should the bears dominate over the pair we may see USD/CAD breaking the 1.3550 (S1) line and continue lower aiming for the 1.3420 (S2) level. Should the bulls take over we may see the pair reversing course, breaking initially the prementioned downward trendline in a sign of an end of the downward motion and continuing higher breaking the 1.3770 (R1) line, paving the way for the 1.3905 (R2) level.

금일 주요 경제뉴스

Today we get UK’s GDP and manufacturing output rates for May, France’s final HICP rates for June and ECB’s Cipollone is scheduled to speak while from Canada we note the release of number of May’s building permits and we highlight the release of June’s employment data. On Monday’s Asian session, we get New Zealand’s electronic card sales for June and Japan’s machinery orders for May.

EUR/USD Daily Chart

- Support: 1.1690 (S1), 1.1450 (S2), 1.0940 (S3)

- Resistance: 1.1690 (R1), 1.1905 (R2), 1.2115 (R3)

USD/CAD Daily Chart

- Support: 1.3550 (S1), 1.3420 (S2), 1.3285 (S3)

- Resistance: 1.3770 (R1), 1.3905 (R2), 1.4020 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.