Since our last report US equities indexes seem to have edged higher. In today’s report we are to discuss fundamental issues surrounding US equities such as the Fed’s stance, the US Government shutdown and the upcoming earnings reports. We are to conclude the report with a technical analysis of S&P 500’s daily chart.

The release of the Fed’s September meeting minutes

We note the Fed’s stance as a key factor affecting gold’s direction. A possible extensive further easing of the bank’s monetary policy could ease the financial conditions in the US economy thus leading to more business opportunities and quite possibly increased profitability. The market’s expectations for the time being are clearly on the dovish side as Fed Fund Futures currently imply that the market expect the bank to deliver 25 basis points rate cuts in both the October and December meetings. Also it seems that Fed Policymakers are split in whether and by how much the bank should ease its monetary policy further. On the one hand we have Fed policymakers such as Stephen Miran which are favouring and actively pushing for a faster pace of monetary policy easing while on the flip side other Policymakers such as Kansas Fed President Schmid would prefer the bank to halt its rate cutting path and focus on the danger of too-high inflation despite the obvious employment market weakness. Overall there seems to be a power struggle within the Fed between the doves and hawks. We highlight the release of the Fed’s September meeting minutes today and should the document reaffirm or even enhance the market’s expectations for the bank to ease its monetary policy further we may see US stock markets getting some support. Yet should the document outline increased doubts on behalf of Fed on the flip side should the market be forced to ease its dovish expectations we may see the release weighing on gold’s price. Tomorrow, the bank is to release Fed Chairman Powell’s pre-recorded welcome remarks before the Community Bank Conference. We see the case for the Fed Chairman to maintain doubts in regards to the necessity of extensive easing of the bank’s monetary policy and should such doubts be reflected in his comment we may see US stock market indexes slipping.

US Government shutdown continues

Another key fundamental issue for US equities is the continuance of the US Government shutdown which is entering its 8th day. Both the US Government and Democrats seem to be digging in and no resolution is on the horizon. The possibility of a prolonged shutdown tends to intensify uncertainty in the markets. It’s characteristic that the release of the US employment report for September was delayed, leaving the markets in the dark for the state of the US employment market for the past month and thus increasing the market’s worries. It’s understandable that the prolonged shutdown is weighing on market sentiment turning the markets more cautious and thus could weigh on US stock markets should it be prolonged further.

Earnings report to be released

The earnings season is slowly restarting and is expected to intensify market interest. The report is for Q3 and is expected to show a clearer picture about the effect that US President Trump’s tariffs may have had on companies. Tomorrow Thursday we note the release of PepsiCo’s earnings report, yet interest may be enhanced on Tuesday as a number of big banks are to release their earnings reports including JPMorgan, Goldman Sachs, Wells Fargo&Co, BlackRock and Citigroup. On Wednesday the banking sector is to deliver the earnings reports of Bank of America and Morgan Stanley. The reports beyond being an indication of financial health for each company on its own, in an aggregated manner are also to show how healthy the banking sector in the US has been and could be pivotal for other equities. Earnings reports which would be better than the market’s expectations could lift the spirits of traders and provide an improvement of market sentiment thus allowing US stock markets to rise further and vice versa.

기술적 분석

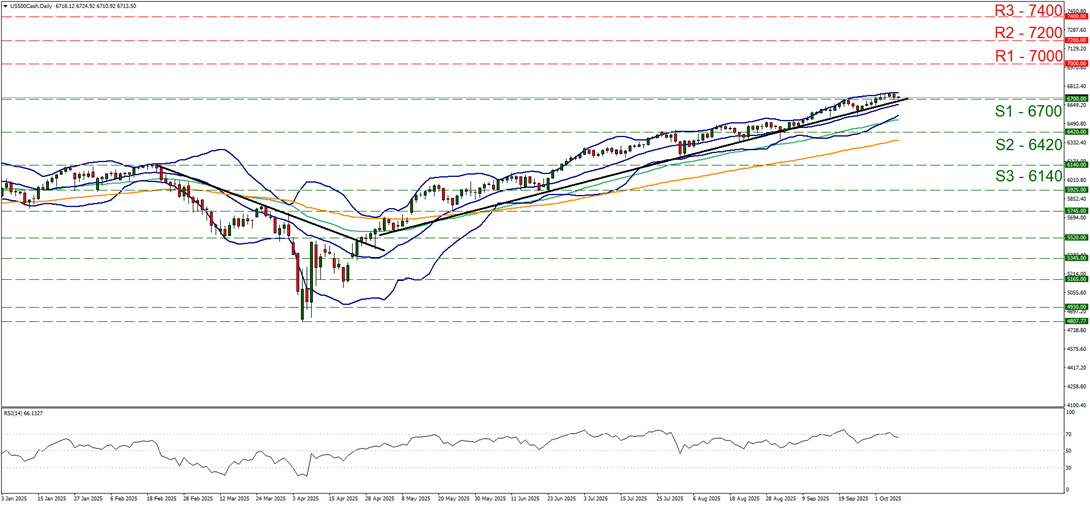

US500 Daily Chart

- Support: 6700 (S1), 6420 (S2), 6140 (S3)

- Resistance: 7000 (R1), 7200 (R2), 7400 (R3)

Since our last report, S&P 500 edged higher reaching new All Time Highs and despite a correction lower yesterday the index managed to break the 6700 (S1) resistance line, now turned to support. We intend to maintain our bullish outlook for the index as long as the upward trendline guiding the index higher and incepted since the 1st of May, remains intact. We have to note though that US Equity bulls seem to be getting tired and need a breather. The RSI indicator has retreated below the reading of 70, which may imply some easing of the market’s bullish sentiment, yet it’s still there. Should the bulls continue to lead the index as expected, we set as the next possible target the 7000 (R1) resistance line. On the other hand for a bearish outlook to emerge we would require the index’s price action to break the 6700 (S1) support line , break the prementioned upward trendline in a first signal that the upward motion of the index has been interrupted and continue to break also the 6420 (S2) support level.

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.