Fed remains on hold, sounds hawkish

The Fed remained on hold yesterday as was widely expected, yet appeared in no rush to lower rates, as it seems to perceive risks related to the US economy to some degree as under control, with inflation still above the bank’s target and the Fed’s worries for the US employment market easing, all in all being supportive for the USD.

Yet we highlight the intentions of US President Trump to name the successor of Fed Chairman Powell, which tends to weigh on the USD and may be the main issue tantalising the markets at the current stage.

US stock markets remain muted

US stock markets remained relatively muted yesterday with S&P 500 and Nasdaq edging marginally higher, despite the somewhat hawkish tone in the Fed’s interest rate decision. The release of Mega-Cap tech companies like Microsoft, Meta and IBM left mixed feelings despite the figures reported outperforming market expectations.

On the one hand the prospects of AI advertising presented by Meta tended to excite buyers, while the increased spending by Microsoft on AI tended to feed worries. Today we highlight the release of Apple’s earnings report in today’s after market hours.

Market expectations are high as the company is anticipated to release record high figures for its revenue and earnings per share. Should the company be able to overshoot the market’s expectations we may see substantial support building for its share price and vice versa.

Oil prices rise on Iran attack worries

Oil prices were on the rise yesterday for a third day in a row as market concerns of a possible US attack on Iran mounted. At the same time, a tighter-than-expected US oil market and outages given the US winter storm helped lift oil prices.

Charts to keep an eye out

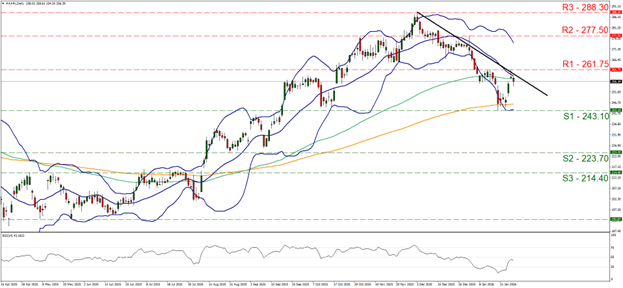

#AAPL edged lower yesterday after hitting the 261.75 (R1) resistance line. The downward trendline guiding it since the 3rd of August remains intact stressing the continuance of a bearish outlook, yet the share’s price action has to cover a substantial distance to form a new lower trough below the 243.10 (S1) support level.

Also the RSI indicator has risen implying an easing of the bearish market sentiment. For the bearish outlook to be maintained we require Apple’s share price to breach the 243.10 (S1) support line. For a bullish outlook to emerge, Apple’s share price would have to rise by breaking the prementioned downward trendline, the 261.75 (R1) resistance line and start actively aiming for the 277.50 (R2) resistance level.

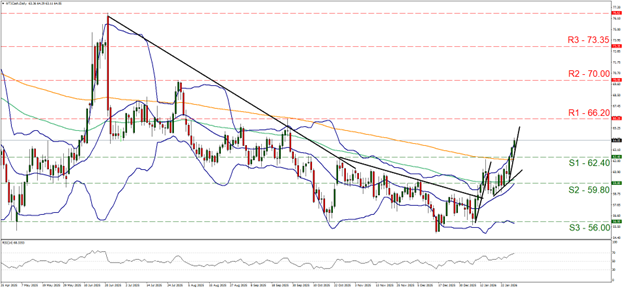

WTI’s price rose yesterday and in today’s Asian session, aiming for the 66.20 (R1) resistance line. We maintain a bullish outlook for the commodity’s price, yet highlight the risk of a possible correction lower as the RSI indicator reached the reading of 70, implying that the commodity neared overbought levels and the price action is above the upper Bollinger band.

Should the bulls maintain control, we may see WTI breaking the 66.20 (R1) line, putting the 70.00 (R2) resistance level in its sights. For a bearish outlook to emerge we require WTI’s price to break the 62.40 (S1) support line and continue to also break the 59.80 (S2) support level.

금일 주요 경제뉴스

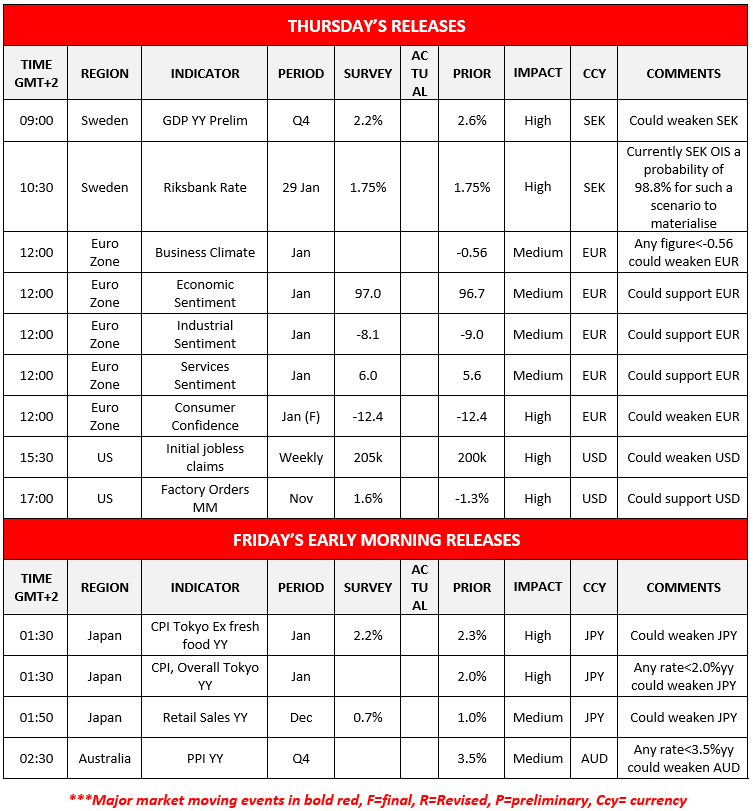

Today we get Sweden’s preliminary GDP rate for Q4 25, and Riksbank’s interest rate decision, which is expected to remain on hold, Euro Zone’s business climate, economic sentiment, industrial sentiment, services sentiment and final consumer confidence, all for January and from the US the weekly initial jobless claims figure and factory orders for November.

In tomorrow’s Asian session, we get from Japan Tokyo’s CPI rates for January, and retail sales for December and Australia’s PPI rates for Q4.

#AAPL Daily Chart

- Support: 243.10 (S1), 223.70 (S2), 214.40 (S3)

- Resistance: 261.75 (R1), 277.50 (R2), 288.30 (R3)

WTI Daily Chart

- Support: 62.40 (S1), 59.80 (S2), 56.00 (S3)

- Resistance: 66.20 (R1), 70.00 (R2), 73.35 (R3)

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.