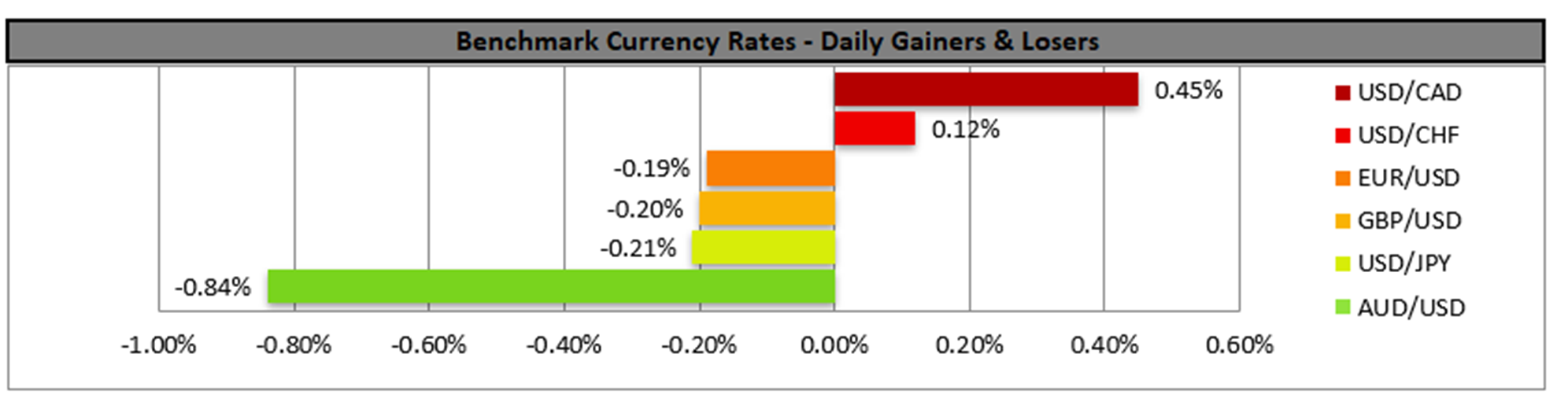

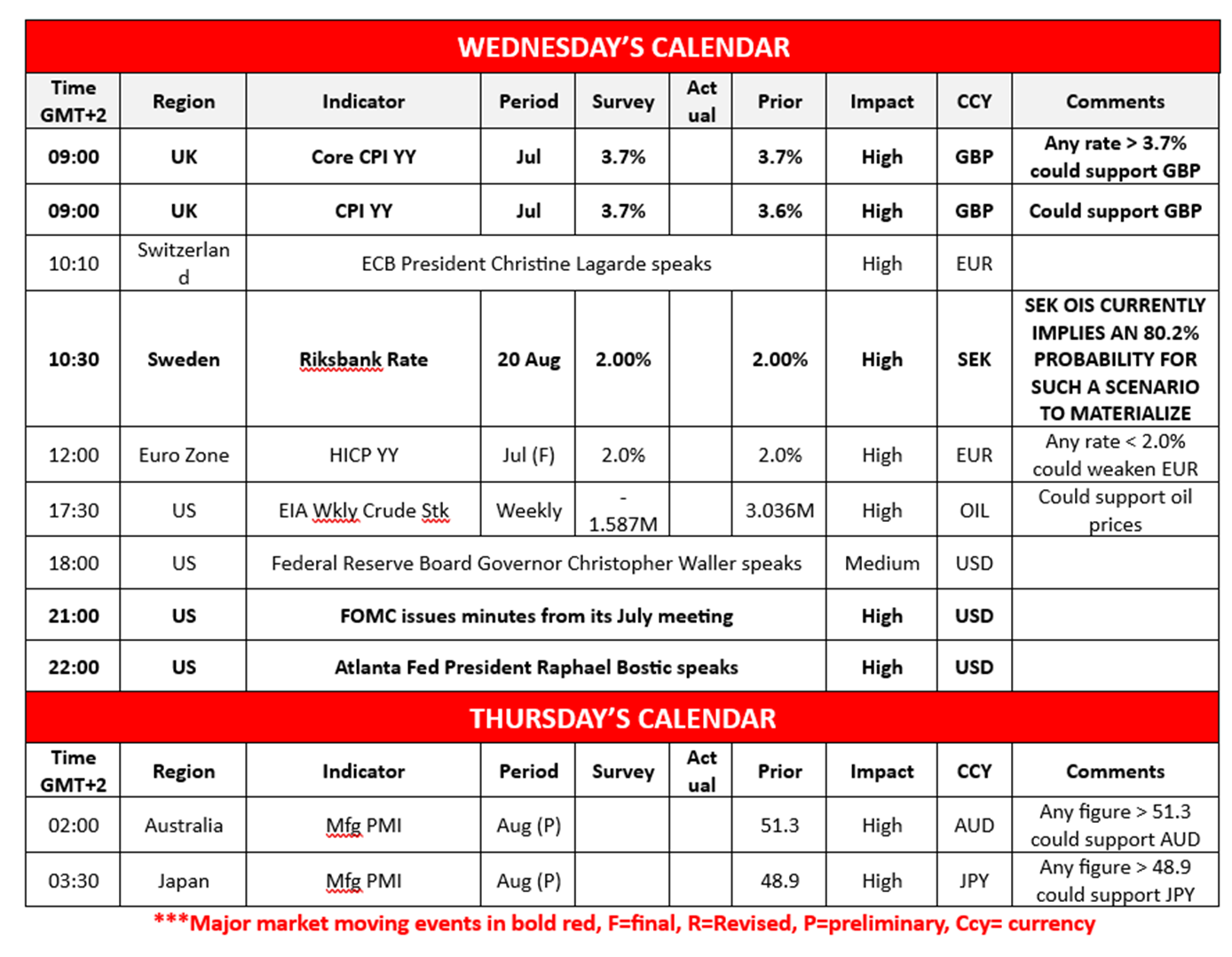

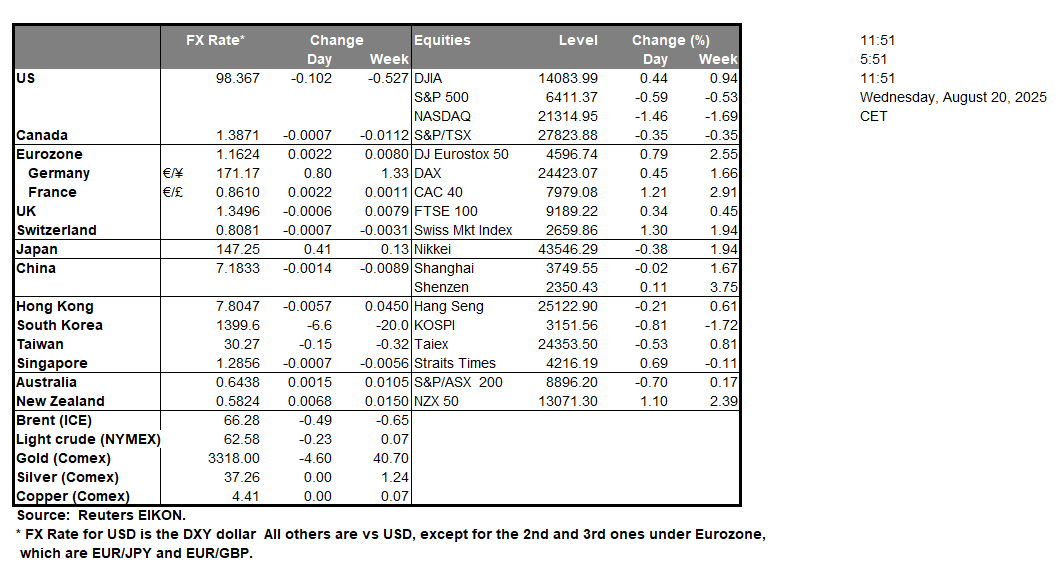

The FOMC’s July meeting minutes are set to be released during today’s American session. The minutes are set to garner attention from market participants considering that in the bank’s prior meeting two board Governor’s dissented from the decision to keep interest rates steady, marking the first time two board Governor’s have dissented since 1993. In our opinion, we would like to see if the minutes showcase that more policymakers may have considered dissenting or a case being made for rate cuts in the near future. Overall, should the minutes imply that the bank may be preparing to cut rates in the near future it could weigh on the dollar and vice versa.The UK’s CPI rates for July which were released earlier on today came in hotter than expected with the headline rate accelerating to 3.8% from 3.6% and the Core CPI from 3.7% to 3.8%. The inflation print showcases an acceleration of inflationary pressures in the British economy, which in turn could increase pressure on the Bank of England to refrain from cutting rates in the near future as a resurgence of inflationary pressures could lead to undesirable circumstances. In turn the hotter than expected inflation print may provide support for the sterling. The Riksbank’s interest decision is set to occur during today’s European trading session, with the majority of market participants currently anticipating the bank to remain on hold at 2% with SEK OIS currently implying an 80.2% probability for such a scenario to materialize. Australia’s preliminary manufacturing PMI figure for August is due out tomorrow and could possibly influence the Aussie.

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30 of April, despite some breakouts. Nonetheless, we opt for a sideways bias for gold’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

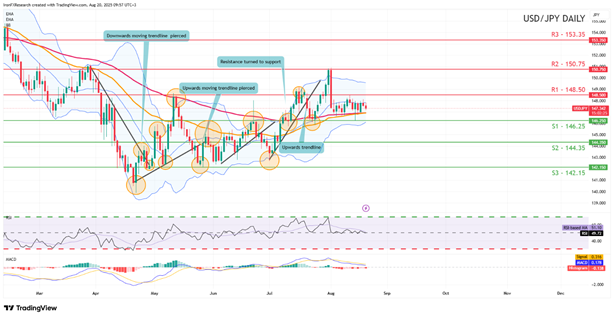

USD/JPY appears to be moving in a sideways fashion. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 146.25 (S1) support level and our 148.50 (R1) resistance line and our 146.25 (S1) support level. On the other hand for a bullish outlook we would require a clear break above the 148.50 (R1) resistance line with the next possible target for the bulls being the 150.75 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 146.25 (S1) support level with the next possible target for the bears being the 144.35 (S2) support line.

금일 주요 경제뉴스

Today we get the UK’s CPI rates for July, the Zone’s final HICP rate for July, the weekly EIA crude oil inventories figure. In tomorrow’s Asian session we note Australia’s and Japan’s preliminary manufacturing PMI figures for August. On a monetary level we highlight today the possible speech by ECB President Lagarde , the Riksbank’s interest rate decision, the speech by Fed Governor Waller, we highlight the release of the FOMC’s July meeting minutes and lastly we note the speech by Atlanta Fed President Bostic.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 144.35 (S2), 142.15 (S3)

- Resistance: 148.50 (R1), 150.75 (R2), 153.35 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.