January’s US CPI rates to shake the markets

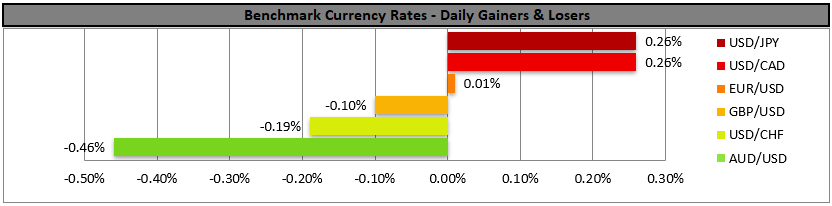

With the release of the stronger-than-expected US employment data for January, the market’s expectations for the Fed to cut rates were dialled back, allowing for the greenback to regain some of its confidence.

The next big test for the USD is expected to be the release of the US CPI rates for the same month, and analysts expect the rates to slow down a bit.

Should we see the CPI rates slowing beyond market expectations, we may see the USD losing further ground as expectations for the Fed to cut rates earlier may intensify, while a possible acceleration of the rates could take the market’s by surprise and cause the USD to rally.

US tech shares tumble on AI worries

US stock markets were on the retreat yesterday, with tech shares leading the way lower.

Market worries for the excessive investments in AI from the sector were rekindled and tended to lead to a risk-off market sentiment, weighing on equities.

A possible intensification of market worries for the issue could lead to further losses for US stock markets.

Oil prices drop on demand worries

Oil prices were on the retreat yesterday as market worries for the future level of demand in the oil market surfaced. We note that China, which is one of the main consumers of oil is increasingly turning towards renewable energy forms, while at the same time, IEA expects oil demand to continue to grow yet at a slower pace.

At the same time US-Iran tensions seem to thaw, which in turn tends to ease market worries for a possible bottleneck on the supply side of the international oil market.

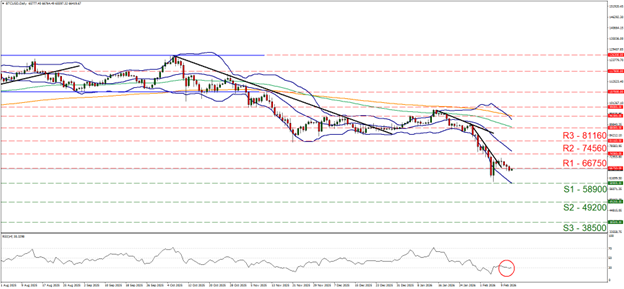

Crypto king continues to fall

In the crypto market, Bitcoin’s price continued to fall yesterday and in today’s Asian session as the market’s favorite crypto gauge, the CMC Crypto Fear and Greed Index fell to record low levels.

Overall, the bearish sentiment continues to weigh on the crypto’s price and if it intensifies, we may see the crypto-king’s price falling even further.

금일 주요 경제뉴스

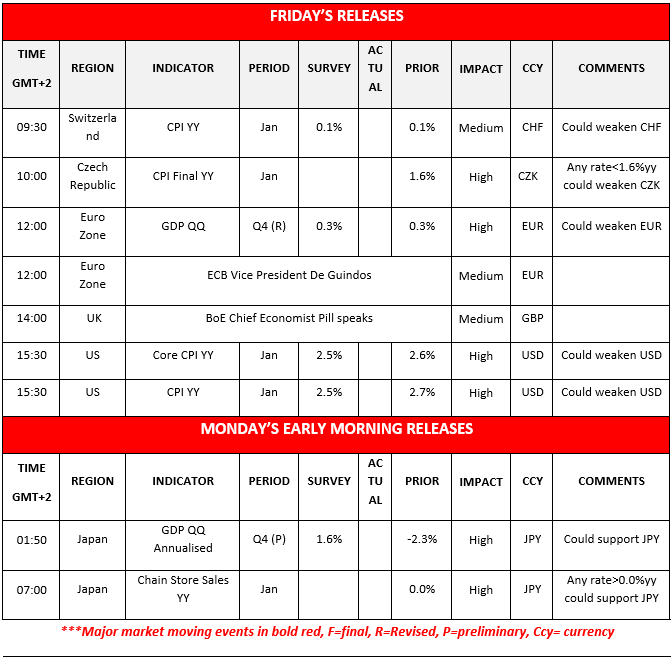

Today we get Euro Zone’s revised GDP rate for Q4 and on a monetary level, we note that ECB Vice President De Guindos 그리고 BoE Chief Economist Pill speak. In tomorrow’s Asian session, we get from Japan the preliminary GDP rate for Q4.Charts to keep an eye out.

Charts to keep an eye out

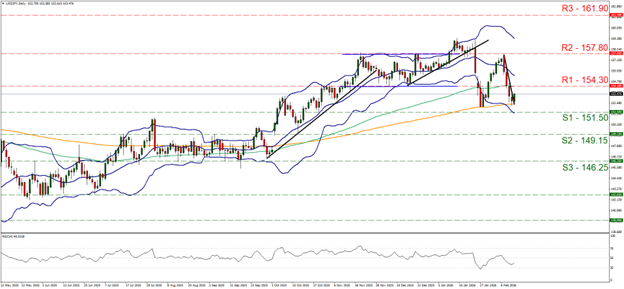

USD/JPY dropped yesterday yet reversed the losses and then some in today’s Asian session, remaining well between the 151.50 (S1) support line and the 154.30 (R1) resistance level. The correction higher of the pair’s price action has interrupted its downward motion, breaking the downward trendline guiding it, hence we temporarily switch our bearish outlook in favour of a sideways motion bias. At the same time we note that the RSI indicator remains low indicating a bearish market sentiment, thus we issue a warning for any bearish tendencies of the pair.

Should the bears renew their dominance, we may see USD/JPY breaking the 151.50 (S1) support line and start aiming for the 149.15 (S2) support level. Should the bulls take over, we may see USD/JPY breaking the 154.30 (R1) resistance line and start aiming for the 157.80 (R2) resistance base.

BTC/USD continued to edge lower by breaking the 66750 (R1) support line, now turned to resistance. We still maintain a bias for a sideways motion for now, yet note that the market sentiment remains strongly bearish.

For a bearish outlook to re-emerge we would require the cryptos’ price action to break the 58900 (S1) support line. For a bullish outlook to be adopted, Bitcoin’s price has to break the 66750 (R1) level and continue to break also the 74560 (R2) resistance barrier clearly.

USD/JPY Daily Chart

- Support: 151.50 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 154.30 (R1), 157.80 (R2), 161.90 (R3)

BTC/USD Daily Chart

- Support: 58900 (S1), 49200 (S2), 38500 (S3)

- Resistance: 66750 (R1), 74560 (R2), 81160 (R3)

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.