Oil bulls seem to be hesitating as the international oil market is caught between conflicting fundamentals. Uncertainty seems to be enhanced as on both sides, supply and demand, worries for the future path of oil prices seem to rise. In this report, we aim to shed light on the factors driving WTI’s price, assess its future outlook and conclude with a technical analysis of Brent.

US oil market seems to remain tight

We make a start with the latest data concerning the US oil market. The US oil market seems to remain tight given that API reported another drawdown albeit narrower this time of -5.5 million barrels. It should be noted that EIA is also expected to release another narrower drawdown and if combined that would imply that the US oil market remained tight in the past week as demand levels exceeded production. It should be noted that the Baker Hughes oil rig count remained unchanged at 512 implying some hesitation on behalf of oil producers to close down a number of active rigs in the US. Overall should indications of a tight US oil market continue to emerge we may see oil prices getting some support over the coming days.

The demand side

Market worries for the demand side seem to be enhanced and may currently be predominantly stemming from the worries about China’s economic outlook. It’s characteristic that China’s trade data for August indicated another contraction of both, the export and import growth rates on a yearly level, and the country’s trade deficit was narrowed, implying the inflow of less wealth in the economy from the country’s international trading activities. Overall given the wide consumption of oil, China’s demand is considered a major factor for oil’s price. Should there be further indications that the Chinese economy is slowing down, or even China’s manufacturing sector is facing a shrinking economic activity, we may see the market’s worries for the commodity’s demand outlook intensifying and thus have an adverse effect on oil prices.

Furthermore, we highlight that the winter months are approaching and may have a substantial effect on oil prices. Currently, there are signs that summer’s peak seasonal demand is over and demand is easing and such a scenario may weigh on oil prices.

The supply side

On the supply side of the commodity’s trading we highlight that Saudi Arabia and Russia extended their voluntary production cuts until the end of the year. The announcement tended to lift oil prices to levels not seen in ten months both for Brent as well as WTI. It’s characteristic that large organisations have revised upward their expectations regarding oil’s price, under the assumption that oil production levels are to remain low for rest of the year. Characteristically Goldman Sachs expects that the Saudi cuts are to reduce its supply by 500k barrels per day and highlights the risk that the Saudi kingdom may retain the low production levels even after the end of the year. On the other hand, should oil prices reach triple-digit figures, which is currently a not-so-distant scenario, then we may also see shale oil producers being enticed to increase their production levels and thus ease the market tightness somewhat with possible adverse effects on oil prices. Until then as long as there are signs that the supply side of the oil market remains tight, oil prices may remain supported. Another issue that we had mentioned in a past report is that Iran and Venezuela may start increasing their exports and thus provide some additional liquidity in the international oil market and ease oil bulls somewhat.

기술적 분석

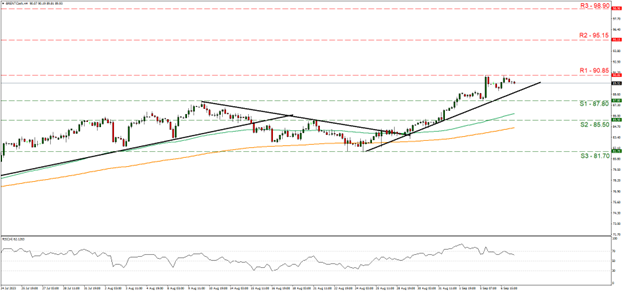

WTI Cash 4H Chart

- Support: 87.80 (S1), 85.50 (S2), 81.70 (S3)

- Resistance: 90.85 (R1), 95.15 (R2), 98.90 (R3)

WTI’s price was on the rise over the past week, yet seems to have hit a ceiling at the 90.85 (R1) resistance line as it twice tested and failed to breach the level. We tend to maintain our bullish outlook as long as the upward trendline, initiated on the 24 of August, remains intact. Yet the fact that the commodity’s price seems unable to breach the R1 in conjunction with an easing of the bullish sentiment as the slight drop of the RSI indicator implies may allow for Brent’s price to stabilise somewhat. Yet for a switch of our bullish outlook in favour of a sideways motion bias, the commodity’s price has to break the prementioned upward trendline, signaling exactly the interruption of Brent’s upward movement. Should the bulls maintain control over Brent’s price action, we may see the commodity’s price breaking the 90.85 (R1) resistance line clearly and take aim at the 95.15 (R2) resistance base, which was able to cap the upward movement of the commodity’s price in late October and early November, last year. On the flip side, should the bears take over, we expect Brent’s price to drop, breaking the prementioned upward trendline yet for a bearish outlook we would require Brent’s price to also break the 97.80 (S1) support line that held its ground against downward pressure on the 5 of the month, and take actively aim of the 85.50 (S2) support level.

면책 조항:

본 정보는 투자 자문이나 투자 권유가 아닌 마케팅 커뮤니케이션으로 간주해야 합니다.