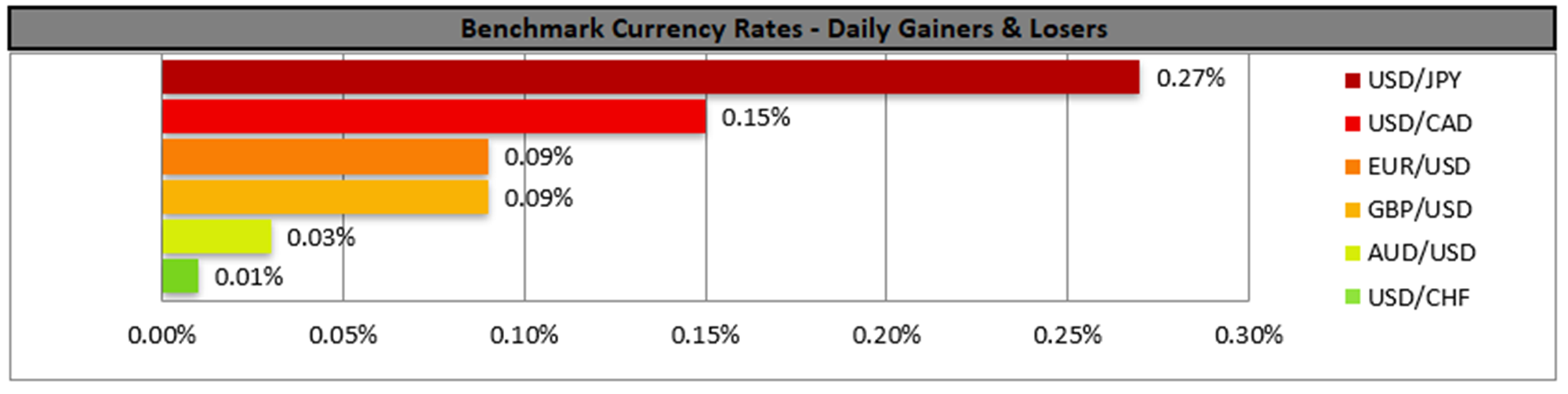

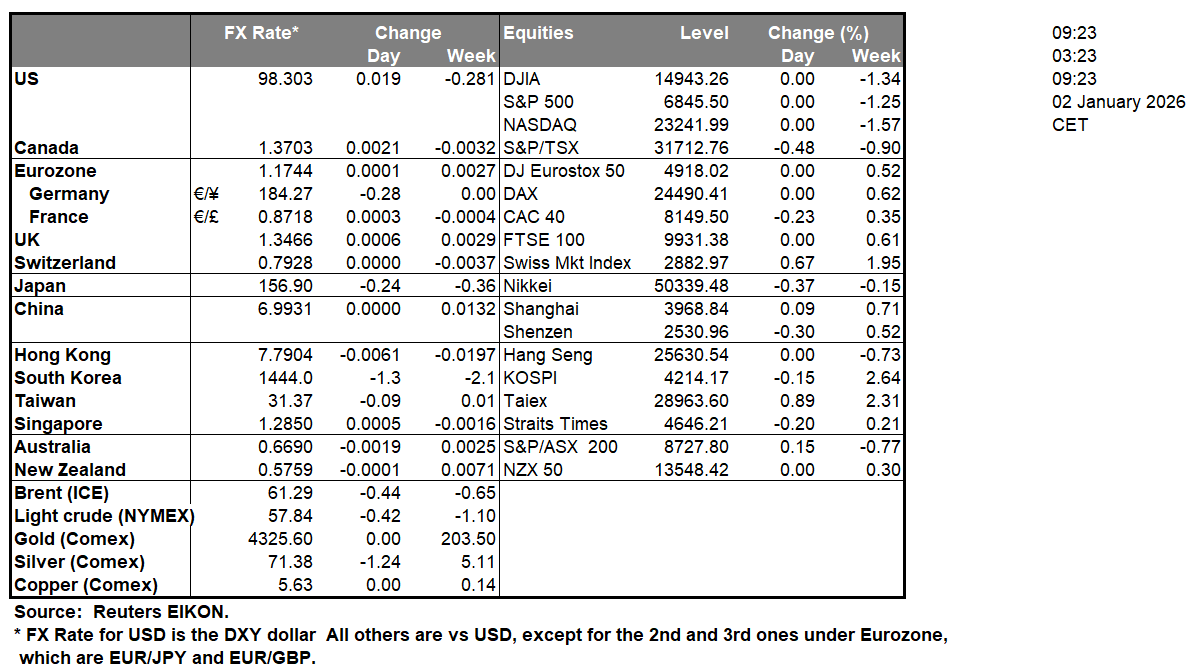

President Donald Trump stated the following today “If Iran shots and violently kills peaceful protesters, which is their custom, the United States of America will come to their rescue. We are locked and loaded and ready to go.” The comments by the US President showcase a willingness to engage in direct military conflict with Iran, which could aid gold prices. Yet, our view is that the comments are simply bravado for now.The UK’s nationwide HPI rates for December which were released today, tended to come in lower than expected. The lower-than-expected rates on a month-on-month and year-on-year level, could possibly weigh on the sterling as the new year begins.On a geopolitical level, China has begun exercises near Taiwan, prompting the US State Department to comment that the exercises raise tensions unnecessarily. However, since Chinese exercises are not that uncommon, the impact on the market may be relatively muted. On the other hand, should the situation evolve into a military confrontation, it could raise tensions in the region, which in turn could provide support for gold’s price.In the US, the S&P manufacturing PMI figure for December is set to be released later on today. According to economists, the manufacturing PMI figure is set to come in lower than expected at 51.8 which would be lower than the prior figure of 52.2. Hence despite the possibility of showcasing an expansion in the manufacturing sector overall, the figure could instead weigh on the dollar. On the other hand, should the figure come in higher than anticipated it may have the opposite effect and could thus aid the greenback. In Monday’s Asian session, Japan’s final manufacturing PMI figure is set to be released. An improvement in the manufacturing PMI figure could provide support for the JPY during Monday’s Asian trading session and vice versa.

XAU/USD appears to be moving in an upwards fashion, having cleared our resistance turned back to support at the 4380 (S1) level. We opt for a bullish outlook for the commodity’s price considering the current break above our S1 level, yet for our bullish outlook to be maintained we would require gold’s price to remain above our S1 level if not also clearing our 4450 (R1) resistance line. On the other hand, for a sideways bias we would require gold’s price to remain confined between our 4380 (S1) support level and our 4450 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4380 (S1) support level with the next possible target for the bears being our 4310 (S2) support line.

EUR/USD appears to be moving in a downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the pair’s failure to clear our 1.1815 (R1) resistance line, with the pair now seemingly taking aim for our 1.1685 (S1) support level. For our bearish outlook to continue we would require a clear break below our 1.1685 (S1) support level with the next possible target for the bears being our 1.1560 (S2) support line. On the flip side, for a sideways bias we would require the pair to remain confined between our 1.1685 (S1) support level and our 1.1815 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 1.1815 (R1) resistance line, with the next possible target for the bulls being our 1.1917 (R2) resistance level.

금일 주요 경제뉴스

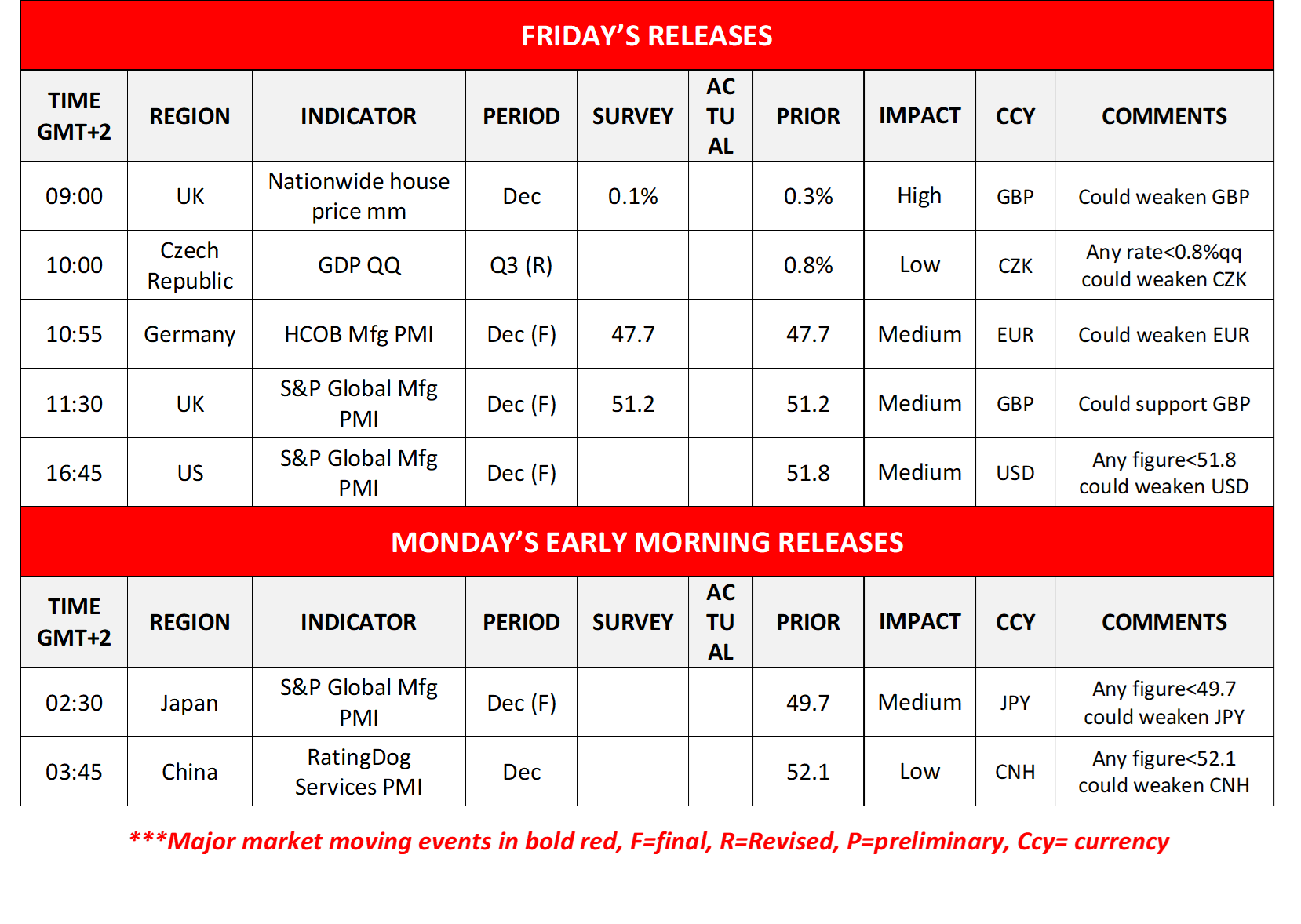

Today we get UK’s nationwide house prices for December, the Czech Republic’s GDP rate for Q3, and Germany’s, the UK’s and the US final manufacturing PMI figures for December. On Monday’s Asian session, we get Japan’s final manufacturing PMI figure for December and from China we get the RatingDog Services PMI for the same month.

XAU/USD H4 Chart

- Support: 4380 (S1), 4310 (S2), 4240 (S3)

- Resistance: 4450 (R1), 4530 (R2), 4610 (R3)

EUR/USD DAILY Chart

- Support: 1.1685 (S1), 1.1560 (S2), 1.1460 (S3)

- Resistance: 1.1815 (R1), 1.1917 (R2), 1.2000 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.