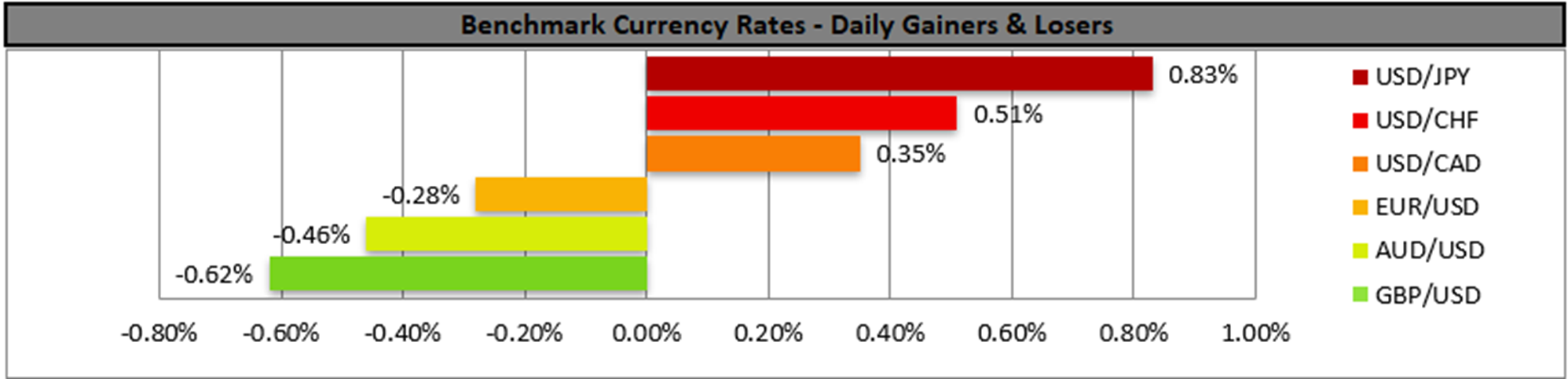

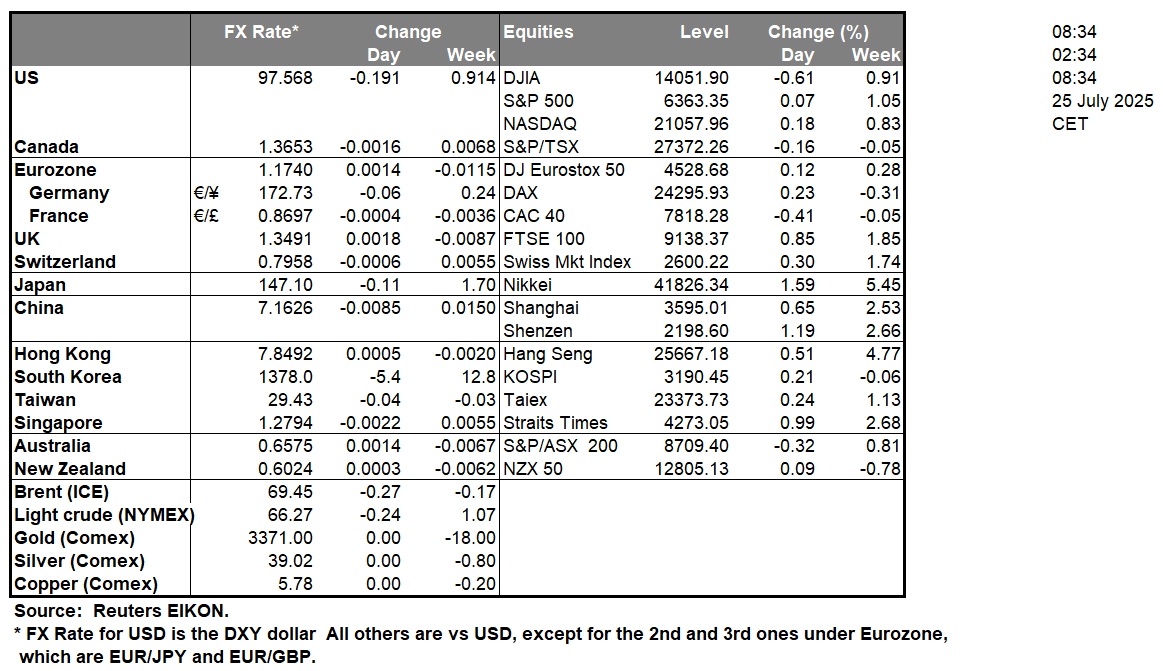

The USD edged higher against its counterparts yesterday, probably getting some support from fundamentals surrounding the USD. US President Donald Trump visited the Fed’s building which is under extensive renovation, an issue that Trump used to criticize Fed Chairman Powell. The US President renewed his criticism for the Fed’s monetary policy in a new attack on the institution, an issue that gets additional attention given the Fed’s interest rate decision next week. Overall, should we see the US President’s pressure on Fed Chairman Powell to lower rates intensifying we may see it weighing on the USD. On a macro level, the weekly initial jobless claims figure unexpectedly dropped again implying a relative tightening of the US employment market in the current month, while the PMI figures provided mixed signals.

In Japan Tokyo’s CPI rates for the current month slowed down in a prelude for a possible wider easing of inflationary pressures in the Japanese economy which may be contradicting BoJ’s narrative. It should be noted that the US-Japanese trade deal announced by U.S. President Trump, tends to renew some hawkish tendencies on behalf of BoJ, yet any rate hike is expected to take place near the end of the year if at all. For the time being should we see market expectations for a possible tightening of the Japanese central bank’s monetary policy intensifying we may see the Yen getting some support.

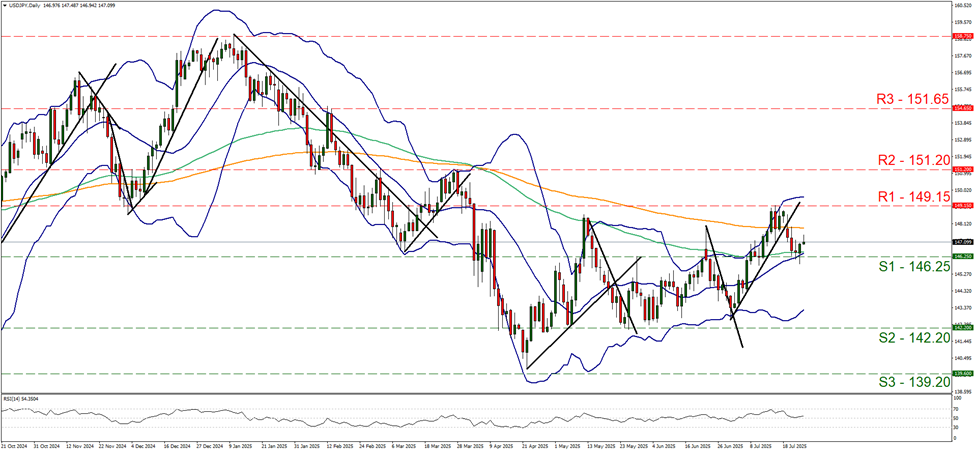

USD/JPY edged higher yesterday after bouncing practically on the 146.25 (S1) support line. Hence we maintain a bias for a sideways motion at the current stage, and note that the RSI indicator despite rising slightly remains close the reading of 50, implying a rather indecisive market. Should the bulls take over ,we may see the pair breaking the 149.15 (R1) resistance line and start aiming for the 151.20 (S2) support level. On the flip side should the bears be in charge of the pairs’ direction, we may see USD/JPY reversing course, relenting any gains made yesterday and during today’s Asian session, breaking the 146.25 (S1) support line and start aiming for the 142.20 (S2) support level.

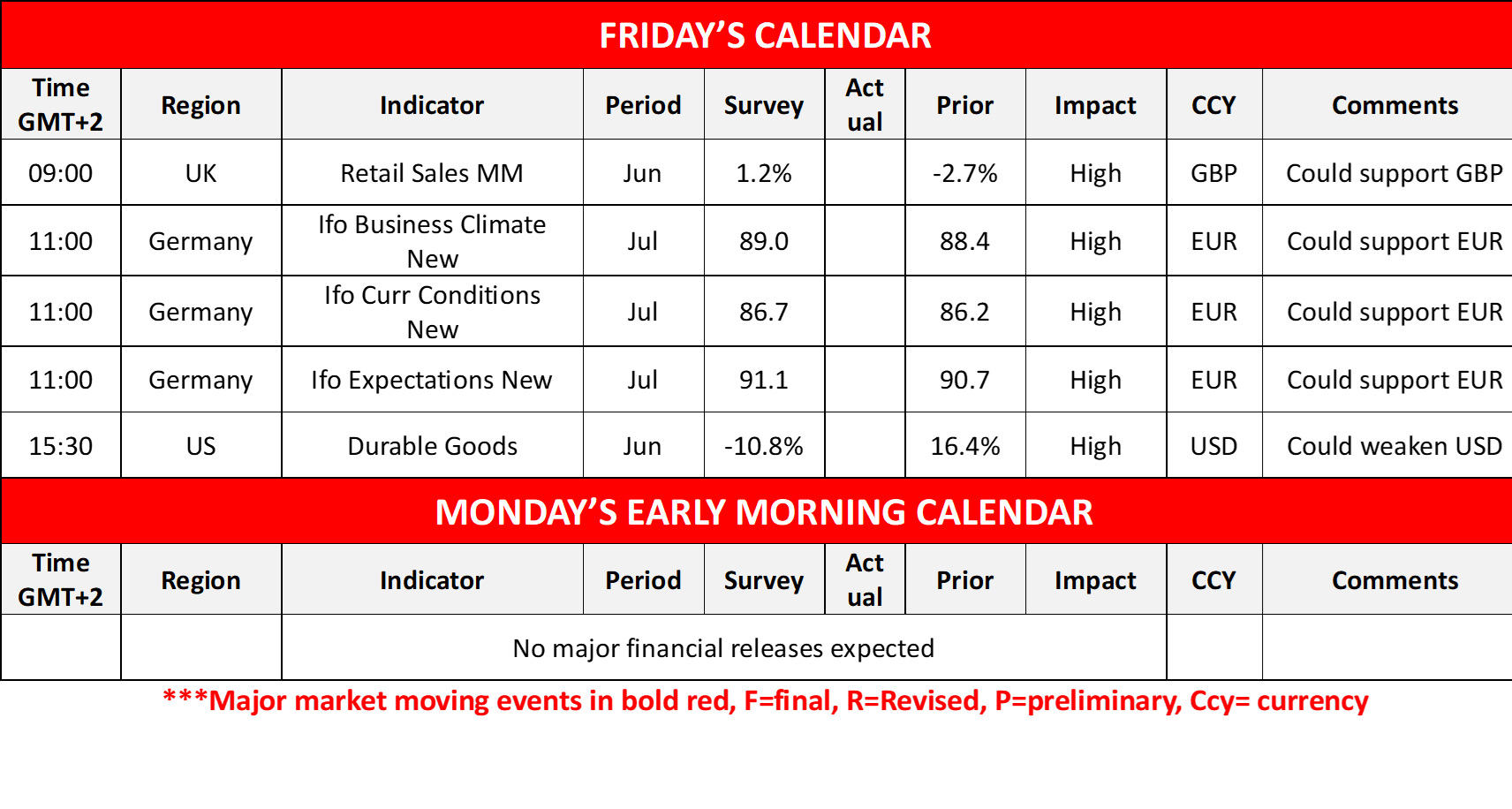

In Europe, ECB’s decision to remain on hold was no surprise for the markets as it was widely expected and mentioned in yesterday’s report. In its accompanying statement the bank mentioned that the economy is resilient and that inflation is currently at the 2% medium target, while also highlighted the international trade risks, expressing its worries for international trading risks. We see the case for the bank to maintain a wait and see position and despite the bank highlighting the inflation outlook, we also see the international trade risks as a possible issue that could tip the bank’s stance to either direction. Should we see the trade war of the EU and the US intensifying, we may see the ECB maintaining a more dovish stance, while a possible US-EU trade deal could encourage the bank to keep rates unchanged for longer. Today we note the release of Germany’s Ifo indicators for July and should the actual figures surpass market expectations we may see the EUR getting some support as it would imply more optimism for Germany’s outlook but also an improvement for the conditions on the ground of the largest economy in the Euro Zone.

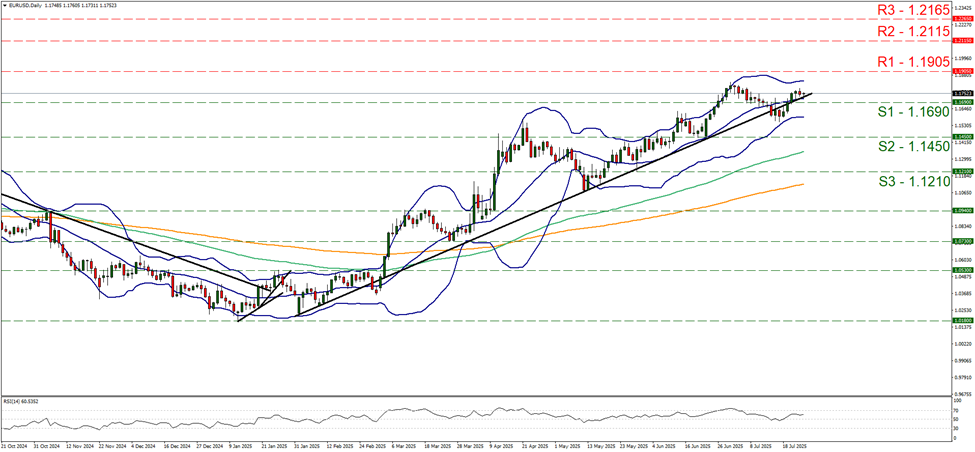

EUR/USD appears to be continuing its sideways movement, revolving around the 1.1690 (S1) support line. Hence we maintain our bias for a sideways motion yet note that the RSI indicator remains above the reading of 50 implying possibly a bullish predisposition of the market for the pair. For a bullish outlook we would require the pair to break the 1.1905 (R1) resistance line and thus pave the way for the 1.2115 (R2) resistance level. On the flip side for a bearish outlook we would require a clear break below the 1.1690 (S1) support level with the next possible target for the bears being the 1.1450 (S2) support line.

금일 주요 경제뉴스

Today we get UK’s retail sales for June, and the US durable goods orders also for June.

USD/JPY Daily Chart

- Support: 146.25 (S1), 142.20 (S2), 139.20 (S3)

- Resistance: 149.15 (R1), 151.20 (R2), 151.65 (R3)

EUR/USD Daily Chart

- Support: 1.1690 (S1), 1.1450 (S2), 1.1210 (S3)

- Resistance: 1.1905 (R1), 1.2115 (R2), 1.2165 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.