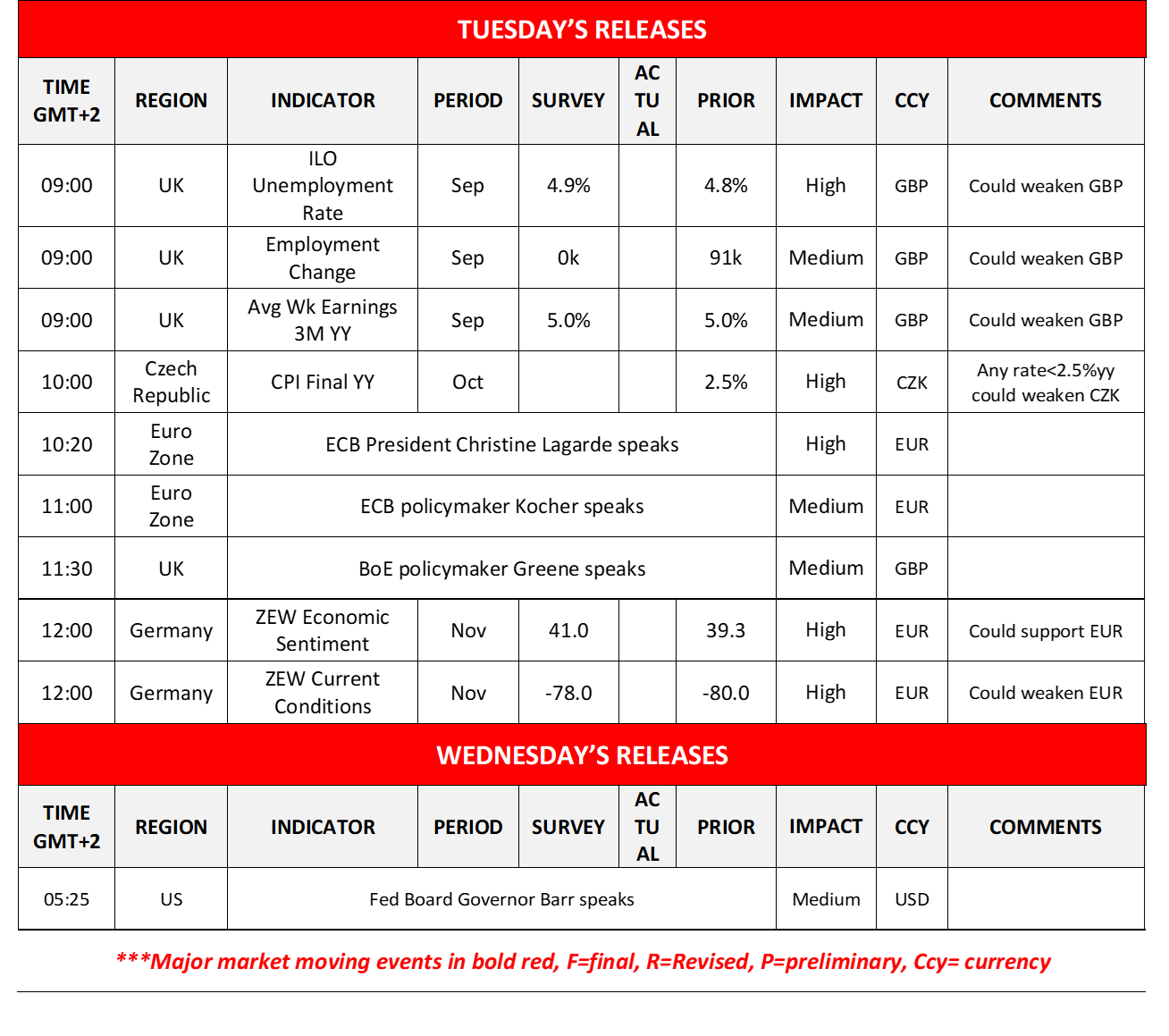

The US Senate has voted and passed the bill required to end the ongoing US government shutdown. The vote passed with 60 Senators voting in favour of the bill and 40 voting to reject the proposal. The bill will now head to the US House of Representatives which is controlled by the Republicans and thus in our view the bill is expected to be passed. However, per Reuters “The deal would extend funding through January 30, leaving the federal government for now on a path to keep adding about $1.8 trillion a year to its $38 trillion in debt”, which could lead to heightened uncertainty with the start of the new year, as they will need to agree on another deal to prevent another Government shutdown post January 30th.Nonetheless, the passing of the bill and the anticipated favourable outcome from the House of Representatives may aid the US Equities markets as some form of normality returns.In the UK, the nation’s employment data for September came in lower than expected with the unemployment rate increased from 4.8% to 5.0% which is also higher than the anticipated increase to 4.9%. Hence the data from the UK tends to imply a loosening labour market which could further weigh on the economic picture for the UK, as the nation’s November budget which is due out on the 26th of this month is anticipated by economists to include tax hikes and a possible violation of the Labour Government’s manifesto. Yet, the recent financial release may raise the possibility of a rate cut by the BoE, which could aid the UK Equities markets temporarily. In the US Equities markets, we would like to note the recent report by the FT which notes that GoldmanSachs (#GS) is set to earn a $110m fee for advising EA on its record $55bn take-private deal. The announcement could possibly provide support for GoldmanSach’s stock price during today’s trading session. Per Bloomberg, SoftBank Group has sold its entire stake in Nvidia (#NVDA) which could weigh on the company’s stock price.

XAU/USD appears to be moving in a predominantly upwards fashion after reaching our 4145 (R1) resistance line. We opt for a predominantly bullish outlook for the commodity’s price and supporting our case are all three indicators below our chart which tend to imply a bullish market sentiment. Although we would not be surprised to see a temporary retracement from the commodity’s price. Nonetheless, for our bullish outlook to continue we would require a clear break above our 4145 (R1) resistance line, with the next possible target for the bulls being our 4240 (R2) resistance level. On the other hand, for a sideways bias we would require the commodity’s price to remain confined between our 4045 (S1) support level and our 4145 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4045 (S1) support level with the next possible target for the bears being our 3980 (S2) support line.

GBP/USD appears to be moving in a downwards fashion, after failing to clear our 1.3195 (R1) resistance line. We opt for a bearish outlook for the pair and supporting our case are all three indicators below our chart which tend to imply a bearish market sentiment. For our bearish outlook to continue we would require a clear break below our 1.3015 (S1) support level with the next possible target for the bears being our 1.2875 (S2) support line. On the other hand for a sideways bias we would require the pair to remain confined between our 1.3015 (S1) support level and our 1.3195 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 1.3195 (R1) resistance level with the next possible target for the bulls being our 1.3335 (R2) resistance line.

금일 주요 경제뉴스

Today we highlight the release of UK’s employment data for September, the Czech Republic’s CPI rates for October and Germany’s ZEW indicators for November. On a monetary level, we note that ECB President Lagarde and policymaker Kocher as well as BoE policymaker Greene are scheduled to speak, while in tomorrow’s Asian session, Fed Board Governor Barr speaks.

XAU/USD Four Hour Chart

- Support: 4045 (S1), 3980 (S2), 3902 (S3)

- Resistance: 4145 (R1), 4240 (R2), 4340 (R3)

GBP/USD Daily Chart

- Support: 1.3015 (S1), 1.2875 (S2), 1.2720 (S3)

- Resistance: 1.3195 (R1), 1.3335 (R2), 1.3480 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.