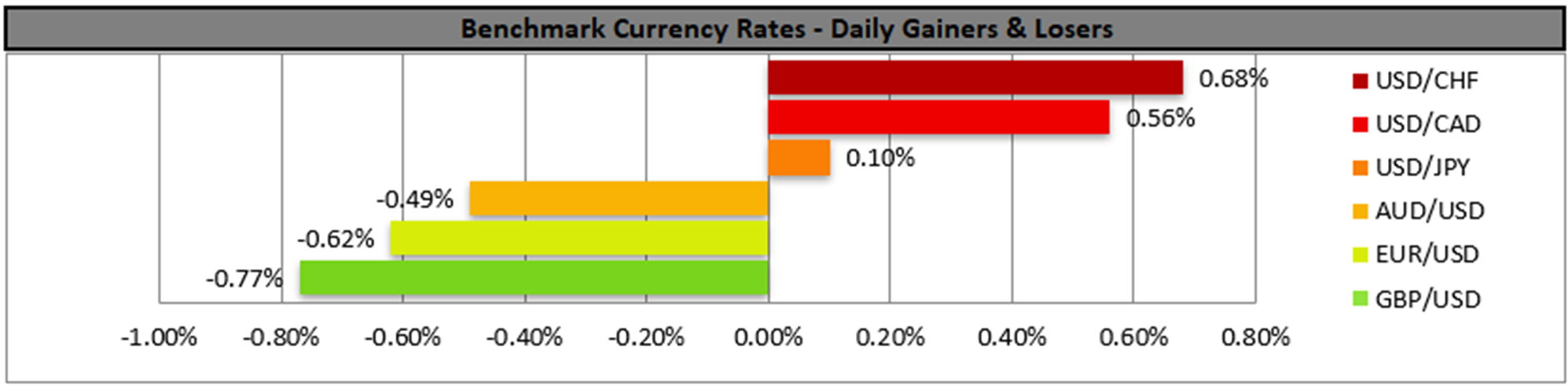

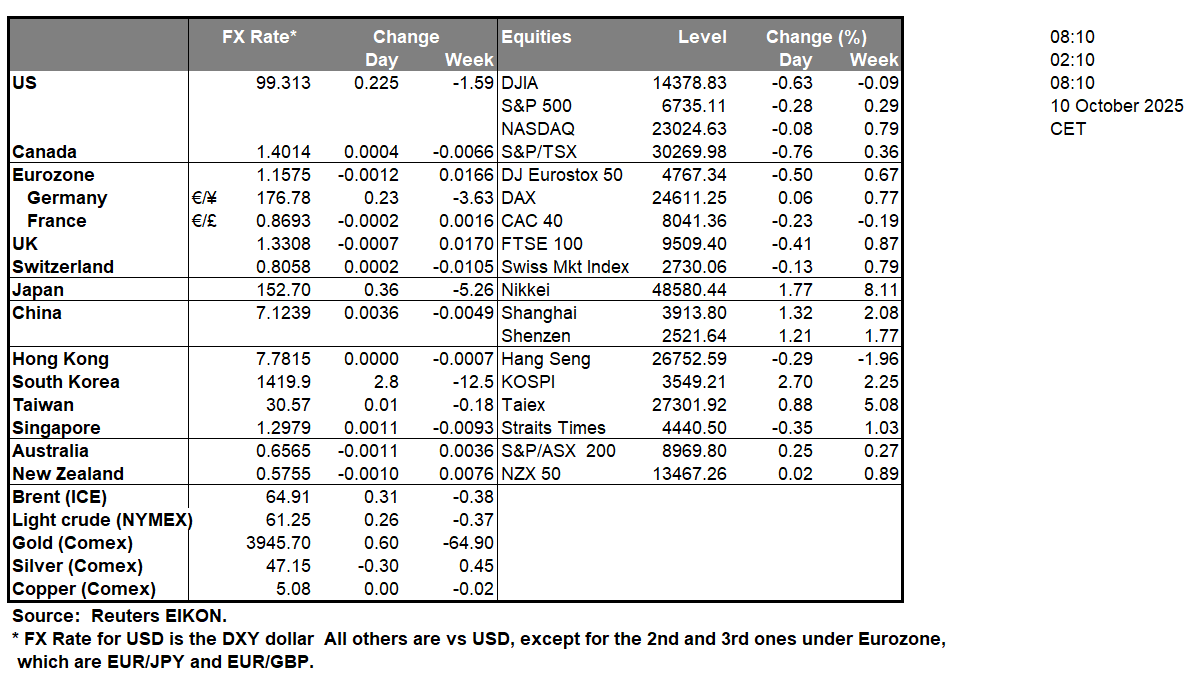

The USD was on the rise yesterday against its counterparts, and on a monetary level, we note that Fed Chairman Powell avoided commenting about the US economic outlook and monetary policy, yet conflicting signals from Fed Policymakers continued to reel in. It’s characteristic that on the one hand, NY Fed President Williams expects more rate cuts to come, while on the other, Fed Board Governor Barr expressed caution for further easing of the bank’s monetary policy. Also, on a fundamental level, the US Government shutdown is ongoing, maintaining a relative degree of uncertainty in the markets. Given the lack of financial data releases from the US, we expect fundamentals to lead the markets. Elsewhere in the FX market, we note the weakening of the EUR as the political uncertainty surrounding France seems to weigh, while also JPY is about to end the week in the reds as market worries for Ms. Takaichi being elected new PM of Japan remain. Also, we note that US stock markets seemed to correct lower yesterday, yet the bullish outlook seems to remain for the time being. Similarly, gold’s price dived below the $4000 per troy ounce threshold as the strengthening of the USD tended to weigh on gold’s price.

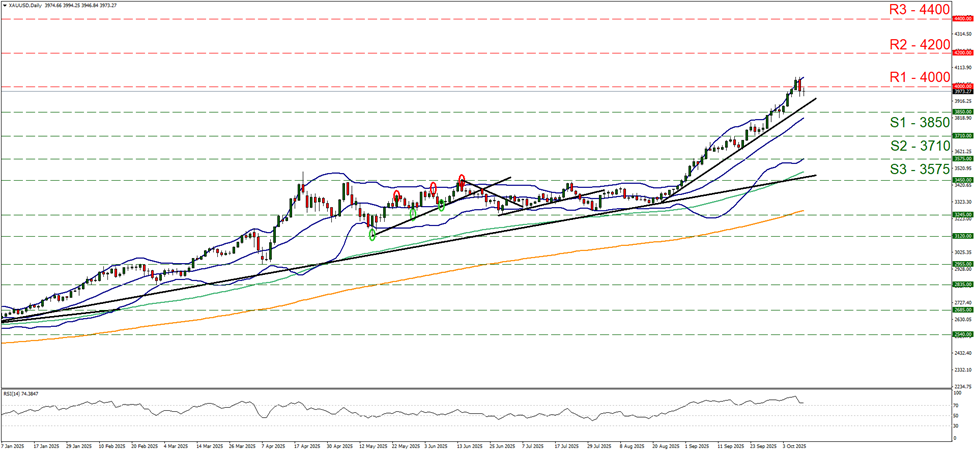

Gold’s price corrected lower breaking the 4000 (R1) support line, now turned to resistance. Despite the correction of gold’s price lower we maintain our bullish outlook for gold. The upward trendline guiding gold’s price since the 22nd of August, remains intact, the RSI indicator continues to remain above the reading of 70, continuing to imply a strong bullish market sentiment for gold’s price but also that gold is at overbought levels and the correction lower may be extended. On the contrary, the retreat of gold’s price created some room for the bulls until the upper Bollinger band. Should the bulls remain in charge, we may see gold’s price breaking the 4000 (R1) line and set as the next possible target for the bulls the 4200 (R2) resistance level. Should the bears take over, we may see gold’s price breaking the prementioned upward trendline, in a first signal of an interruption of the upward motion and continue to also break the 3850 (S1) level.

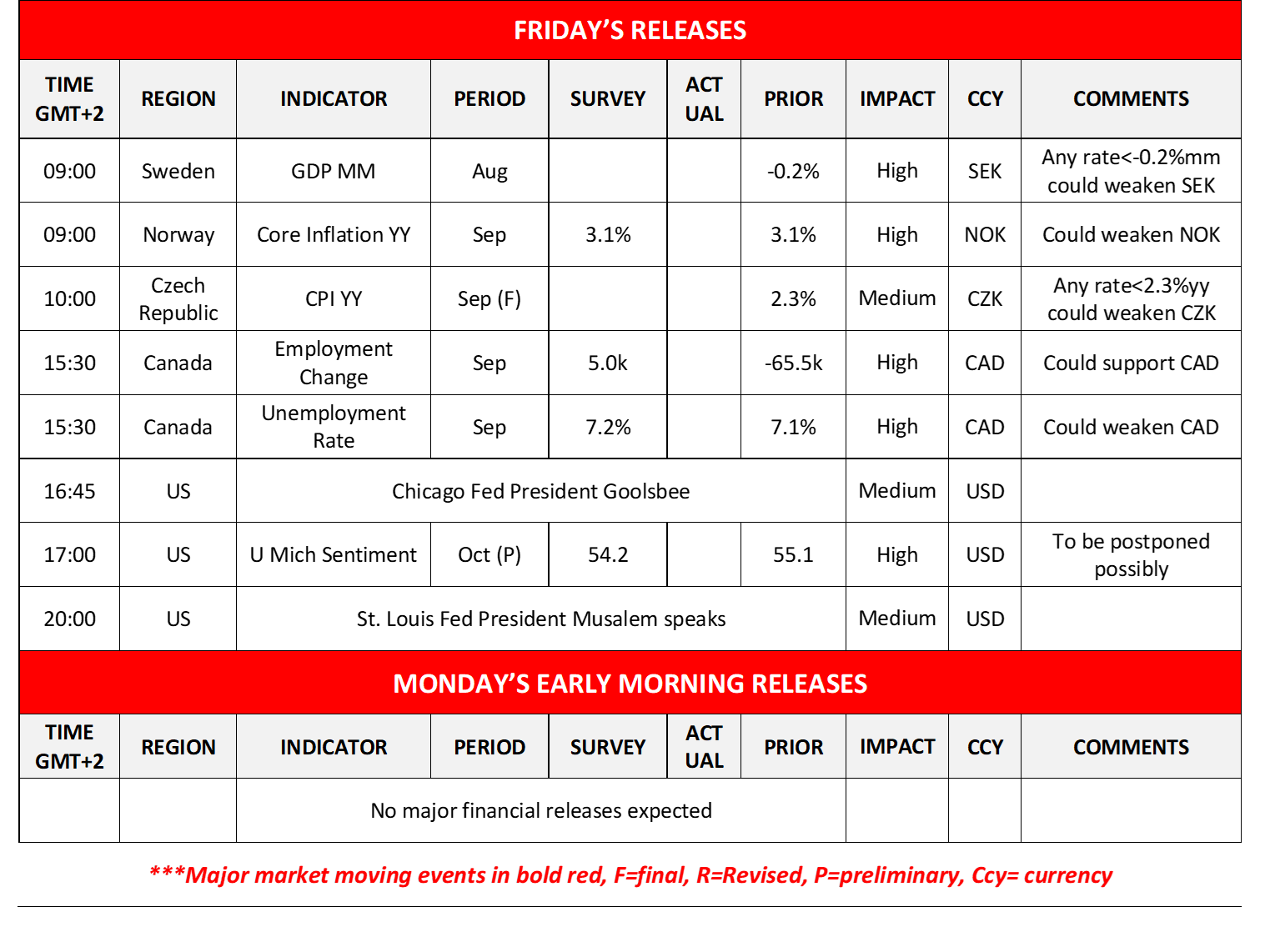

Today, we highlight the release of Canada’s September employment data. The employment change figure is expected to rise, reaching 5k from August’s shocking -65k, yet the unemployment rate is expected to tick up to 7.2%. Despite the conflicting signals provided from the forecasts, and should the rates and figures meet their respective forecasts, we still view the Canadian employment market as loose, which in turn may add more pressure on BoC to ease its monetary policy further thus we see the risks from today’s releases as tilted to the bearish side for the Loonie. Yet should the actual data fail to meet their forecasts and show clearly a tightening Canadian employment market, we may see the Loonie getting asymmetric support.

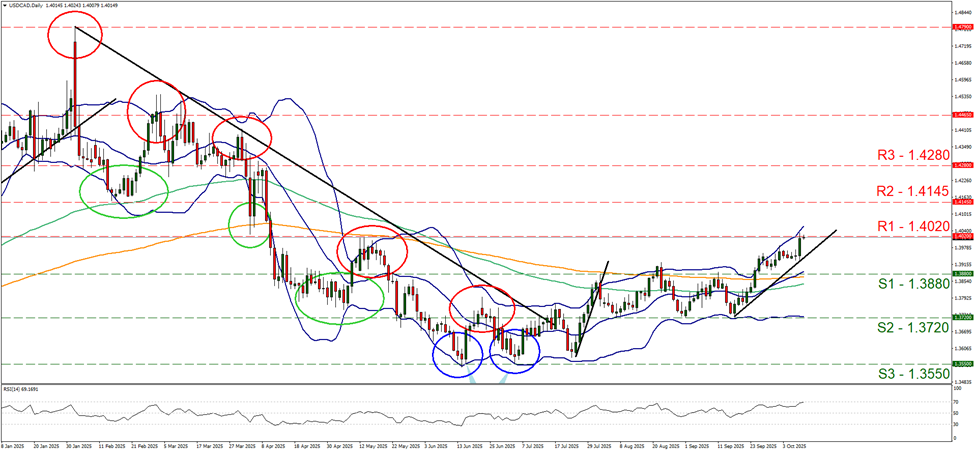

USD/CAD continued to be on the rise yesterday testing the 1.4020 (R1) resistance line. We maintain a bullish outlook for the pair and intend to keep is as long as the upward trendline guiding the pair since the 17th of September remains intact. The RSI indicator is near the reading of 70, implying a strong bullish sentiment and is currently supporting our case. Should the bulls continue to drive the pair we may see USD/CAD breaking the 1.4020 (R1) resistance line and start aiming for the 1.4145 (R2) resistance level. Should the bears take over we may see USD/CAD breaking the prementioned upward trendline in a first signal of an interruption of the upward trendline and continue to break the 1.3880 (S1) support level.

Other highlights for the day:

Today we get Sweden’s GDP rates for August, Norway’s CPI rates for September, the Czech Republic’s final CPI rates also for September, Canada’s employment data for the same month and from the US the release of the University of Michigan consumer sentiment for October was scheduled yet will be postponed probably given the US Government shutdown. On a monetary level we note the speeches of Chicago Fed President Goolsbee and St. Louis Fed President Musalem.

XAU/USD Daily Chart

- Support: 3850 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4000 (R1), 4200 (R2), 4400 (R3)

USD/CAD Daily Chart

- Support: 1.3880 (S1), 1.3720 (S2), 1.3550 (S3)

- Resistance: 1.4020 (R1), 1.4145 (R2), 1.4280 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.