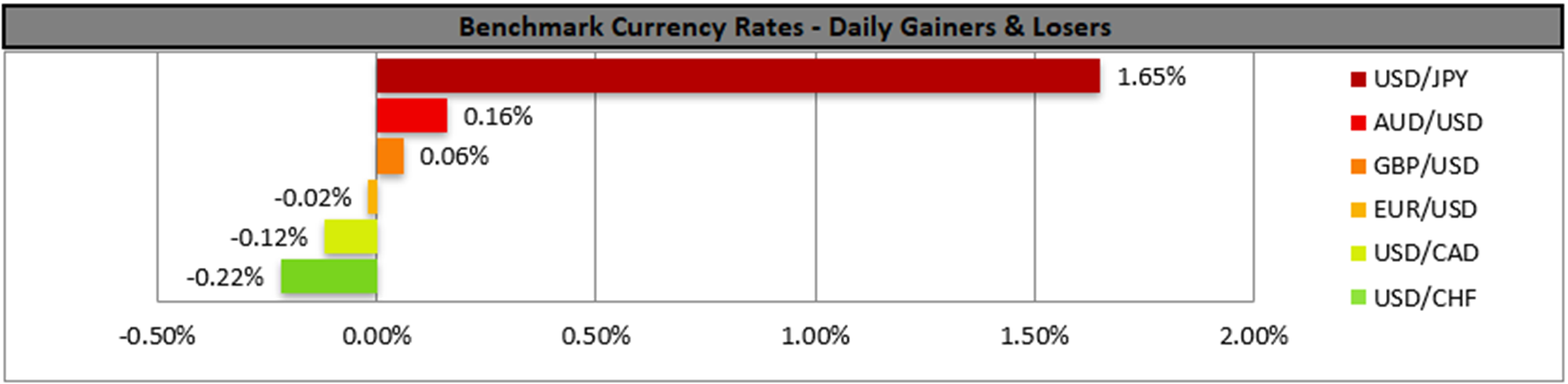

Japan’s ruling party elected a new leader last Saturday. Sanae Takaichi has been elected as the party’s new leader and is on course in becoming Japan’s. Ms. Takaichi is considered as a hardline conservative and is expected to follow an expansionary fiscal policy while at the same time seems to be opposing BoJ’s intentions to tighten its monetary policy further. The issue becomes critical in the sense that an expansionary fiscal policy could cause Japan’s XLarge national Debt to balloon even further, while should BoJ stall in tightening its monetary policy, we may see inflationary pressures in the Japanese economy being revived. The vote for her to become PM is scheduled for the 15th of October and Ms. Takaichi will have to gain also the votes of junior member parties of the coalition. JPY was on the retreat since the start of today’s Asian session, as was expected in Friday’s report, across the board and should the market’s hawkish expectations for BoJ ease further we may see JPY continuing to slip lower.

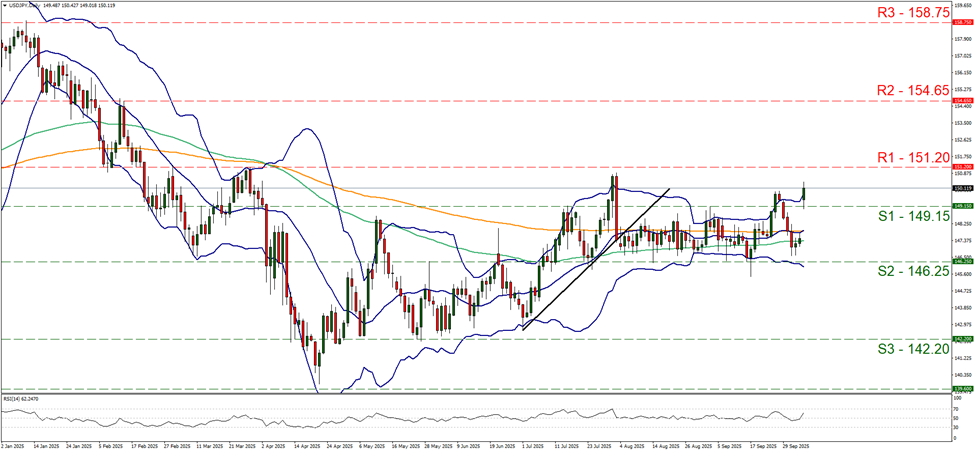

USD/JPY rallied at today’s opening breaking the 149.15 (S1) resistance line, now turned to support. We see the case for a bullish outlook to emerge given also that the RSI indicator has risen sharply above the reading of 50, implying the build up of a bullish market sentiment for the pair, yet on the flip side we also note that he pair’s price action has breached the upper Bollinger band which may slow down the bulls if not cause a correction lower. Should the bullish momentum be maintained we may see the pair breaking the 151.20 (R1) resistance line and start aiming for the 154.65 (R2) resistance level. Should the bears find a chance and lead the pair lower we may see USD/JPY breaking the 149.15 (S1) support line and start aiming for the 146.25 (S2) support level.

Further down the week we highlight on Wednesday the release of the Fed’s September meeting minutes and expect the document to be scrutinised, by investors for any clues regarding the Fed’s intentions. Should the bank signal extensive easing up until H126, we may see the greenback losing ground as the market’s dovish expectations could be enhanced.

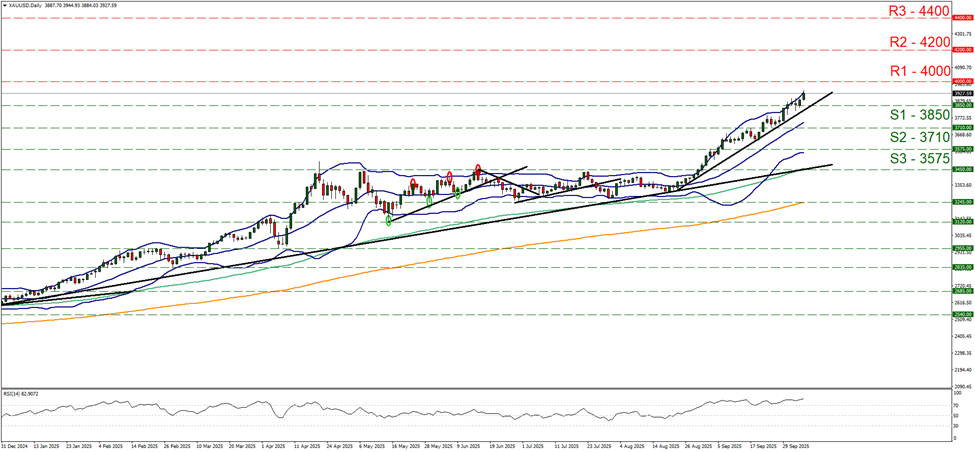

Gold’s price continued to rally in today’s Asian and early session, aiming for the 4000 (R1) resistance line. The RSI indicator remains well above the reading of 70, implying a strong bullish market sentiment for gold, yet at the same time reminding traders that gold is at overbought levels and is ripe for a correction lower. Similar signals are being sent by the price action reaching the upper Bollinger band. We maintain our bullish outlook as long as the upward trendline guiding gold’s price remains intact. Should the bulls continue leading gold’s price, we may see it breaking the 4000 (R1) line and start aiming for the 4200 (R2) level. Should the bears take over, we may see gold’s price the 3850 (S1) support line and start aiming for the 3710 (S2) support level.

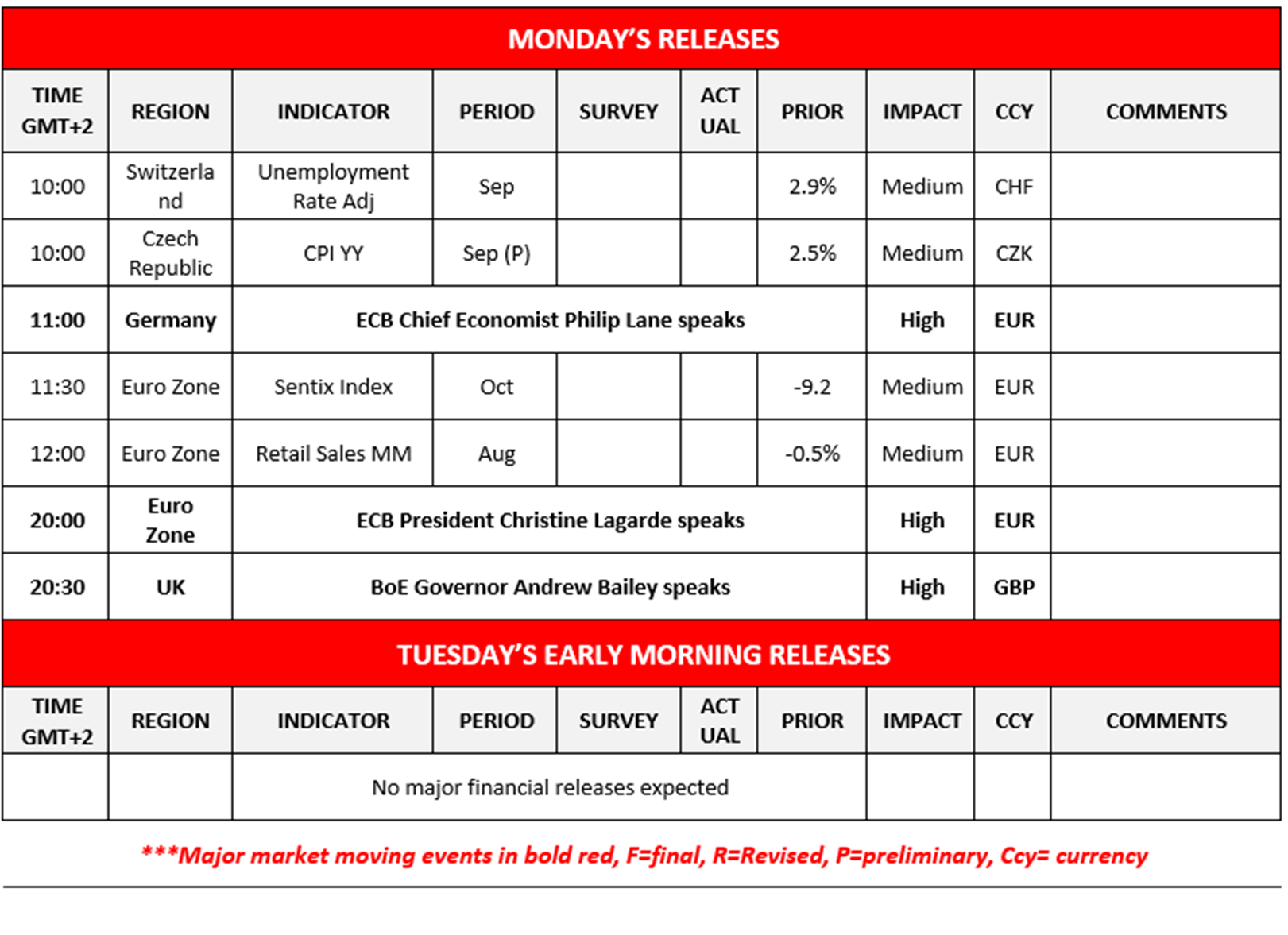

Other highlights for the day:

In today’s European session, we get the Euro Zone’s Sentix figure for October and retail sales rate for August. On a monetary level we note the speeches by ECB Chief Economist Lane, ECB President Lagarde and BoE Governor Bailey

As for the rest of the week:

On Tuesday we get August’s industrial orders of Germany, the UK’s Halifax House Prices for September and Canada’s trade data for August. On Wednesday, we get Japan’s current account balance for August, from New Zealand RBNZ’s interest rate decision, Germany’s industrial output for August, Sweden’s September preliminary CPI rates and the Fed is to release the minutes of its September meeting. On Thursday we get the weekly US initial jobless claims figure and on Friday we note the release of Sweden’s GDP rate for August, Norway’s CPI rates for September, Canada’s employment data for the same month and the preliminary US University of Michigan consumer sentiment for October.

USD/JPY Daily Chart

- Support: 149.15 (S1), 146.25 (S2), 142.20 (S3)

- Resistance: 151.20 (R1), 154.65 (R2), 158.75 (R3)

XAU/USD Daily Chart

- Support: 3850 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4000 (R1), 4200 (R2), 4400 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.