January’s US employment report in focus

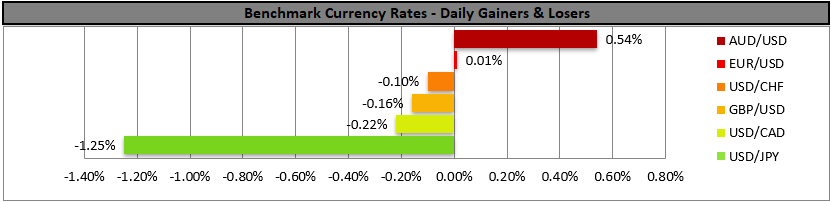

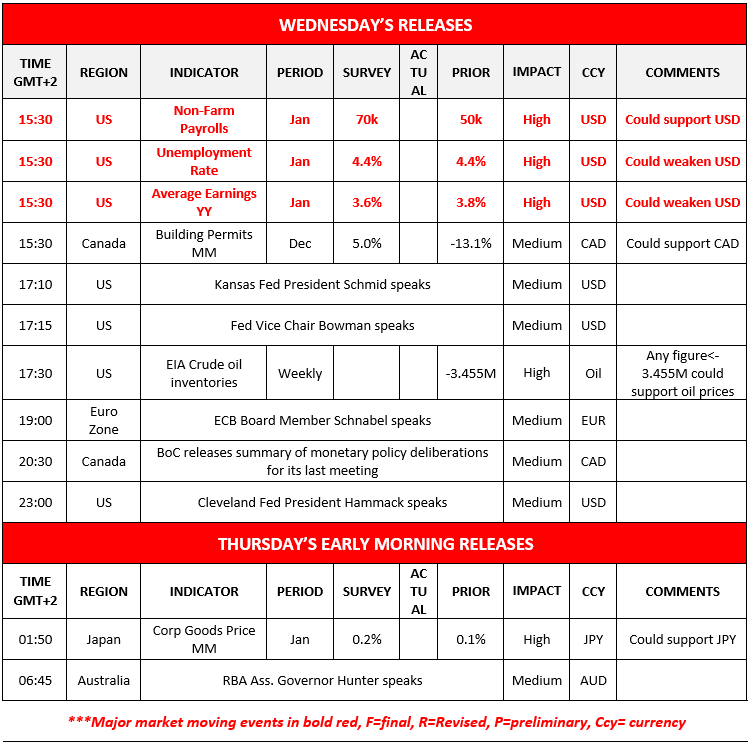

The USD’s retreat in the FX market, continued yesterday and in today’s Asian session. Today, we highlight the release of the US employment report for January, which could shake the markets.

We have some worries for the state of the US employment market, given the US Government’s immigration policies and the end of the Christmas season.

Overall, should the release show a tighter-than-expected US employment market with the Non-Farm Payrolls figure rising more than expected, and a possible tick down of the unemployment rate could halt if not partially reverse, the losses of the greenback in the FX market as expectations for the Fed to remain on hold for longer could intensify.

On the flip side, a possibly looser-than-expected US employment market could weigh further on the USD. Also, the release could have ripple effects beyond the FX market, with a tight US employment market possibly weighing on US stock markets and vice versa.

JPY rallies on fiscal expectations

We note that JPY continued to strengthen yesterday and during today’s Asian session, as the market’s expectations for a possibly expansionary fiscal Government policy are high.

Yet at the same time, the Japanese government is expected to be fiscally responsible and as a kind reminder we note that the XXL-sized national debt of Japan, is hanging like a sword over the Japanese economy.

The Aussie rises on a hawkish monetary outlook

At the same time, AUD got a lift as well as RBA Assistant Governor Hauser stated that inflation is too high, highlighting the hawkish intentions of RBA.

The market is currently expecting the bank to remain on hold in its March meeting and proceed with a rate hike in its May meeting. Also supporting the Aussie we note that mortgage loans and investing loans are on the rise, implying some confidence on the outlook of the Australian economy.

Should we see the market’s hawkish expectations intensify we may see AUD getting more support. Please note that RBA Assistance Governor Hunter is scheduled to speak in tomorrow’s Asian session.

Charts to keep an eye out

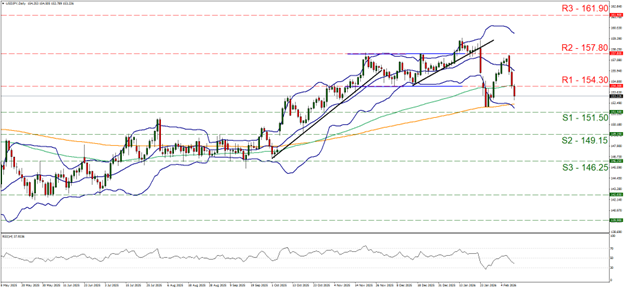

USD/JPY continued to drop yesterday and in today’s Asian session, broke the 154.30 (R1) support line, now turned to resistance. The continuance of the bearish movement forces us to adopt a bearish outlook for the pair as warned in yesterday’s report, which is supported also by the drop of the RSI indicator.

We set as the next possible target for the bears the 151.50 (S1) support line while on the flip side, should the bulls take over, which we currently see as a remote scenario, we may see USD/JPY reversing the losses made since the start of the week and break clearly the 157.80 (R2) resistance level.

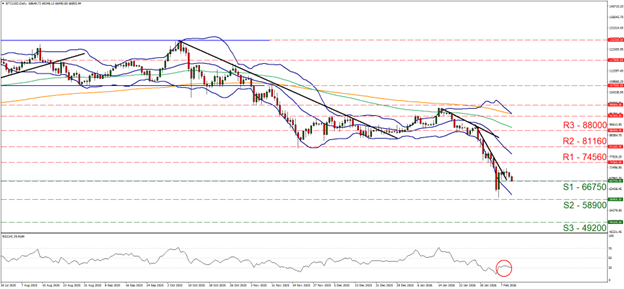

BTC/USD continued to edge lower yesterday and in today’s Asian session, testing the 66750 (S1) support line, highlighting its bearish intentions. Also the RSI indicator remains near the reading of 30, implying a strong bearish market sentiment for the crypto, yet its price action has still some distance until the lower Bollinger Band, allowing for some room for the bears to play.

Should the bears regain control over Bitcoin’s price, it may drop below the 66750 (S1) support line and start aiming for the 58900 (S2) support level. For a bullish outlook to emerge the crypto’s price has to rise and break clearly the 74560 (R1) resistance level.

Other highlights for the day:

Today we get Canada’s building permits for December, and from the US the EIA weekly crude oil inventories, while Kansas Fed President Schmid, Fed Vice Chair Bowman, ECB Board Member Schnabel and Cleveland Fed President Hammack speak and BoC is to release the summary of deliberations for its last meeting.

In tomorrow’s Asian session, we get Japan’s corporate goods price for January.

USD/JPY Daily Chart

- Support: 151.50 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 154.30 (R1), 157.80 (R2), 161.90 (R3)

BTC/USD Daily Chart

- Support: 66750 (S1), 58900 (S2), 49200 (S3)

- Resistance: 74560 (R1), 81160 (R2), 88000 (R3)

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.