USD down the drain, gold lifted to new highs

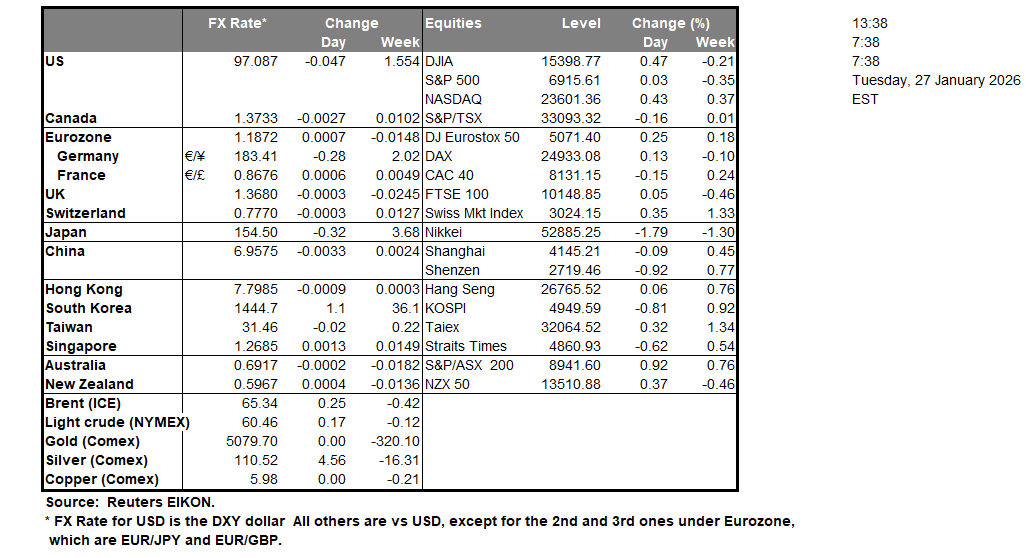

The USD is experiencing a sell-off today which in turn allowed gold’s price to rally beyond $5000/per ounce. The domestic tensions with protests in Minnesota, the possibility of US President Trump naming a replacement of Fed Chairman Powell who would be willing to lower the bank’s rates substantially and further sanctions on Iran have pushed investors to a safe haven flight. The market seems to be sending a message; the question is if the Trump government is getting it.

Market intervention intentions lift the Yen

JPY got some substantial support in today’s Asian session as the possibility of a joint market intervention of the BoJ and the Fed to the Yen’s rescue appears on the horizon. We expect that as long as the possibility for such a scenario to materialise intensifies, we may see JPY getting further support.

Charts to keep an eye out

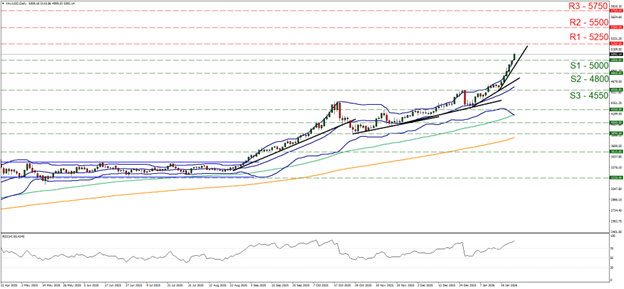

Goud’s price continued to rise in today’s Asian session breaking the $5000 (R1) resistance line, like a hot knife through butter. We maintain our bullish outlook for the precious metal’s price as long as the upward trendline guiding it remains intact. Should the bulls maintain control, we may see gold’s price breaking the 5250 (R1) resistance line and we set as the next possible target for the bulls the 5500 (R2) resistance level. At the same time we intensify our warning for a possible correction lower as gold’s price is at overbought levels, given that the RSI indicator is substantially above the reading of 70 and the precious metal’s price action is above the upper Bollinger band. Should the bears take over, which we consider as a remote scenario currently, we may see gold’s price action breaking the 5000 (S1) support line, the prementioned upward trendline and continue even lower to break also the 4800 (S2) support base.

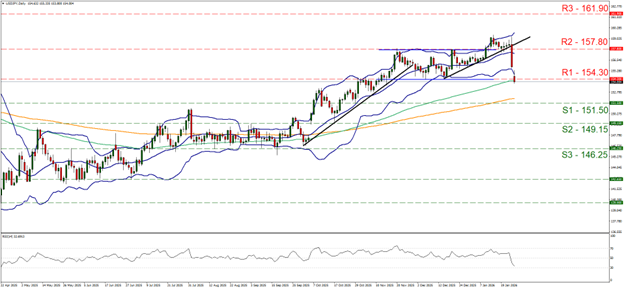

USD/JPY tumbled on Friday breaking the 157.80 (R2) support line now turned to resistance. The freefall continued in today’s Asian session as the pair’s price broke also the 154.30 (R1) support barrier. At the same time the RSI indicator sunk to the reading of 30 signaling an intense bearish market sentiment for the pair, which in combination with the breaking of the upward trendline guiding it, allows us to switch our bullish outlook, directly in favour of a bearish one. We also note that the pair’s price action has dropped below the lower Bollinger band which may slow down the bears, possibly even cause a correction higher for USD/JPY. Should the bears continue to dominate the pair’s direction, we may see USD/JPY breaking the 151.50 (S1) support line and in this way pave the way for the 149.15 (S2) support base. For a bullish outlook to re-emerge, we would require USD/JPY to reverse direction by breaking the 154.30 (R1) resistance line and continuing higher to also break the 157.80 (R2) resistance level.

Other highlights for the day:

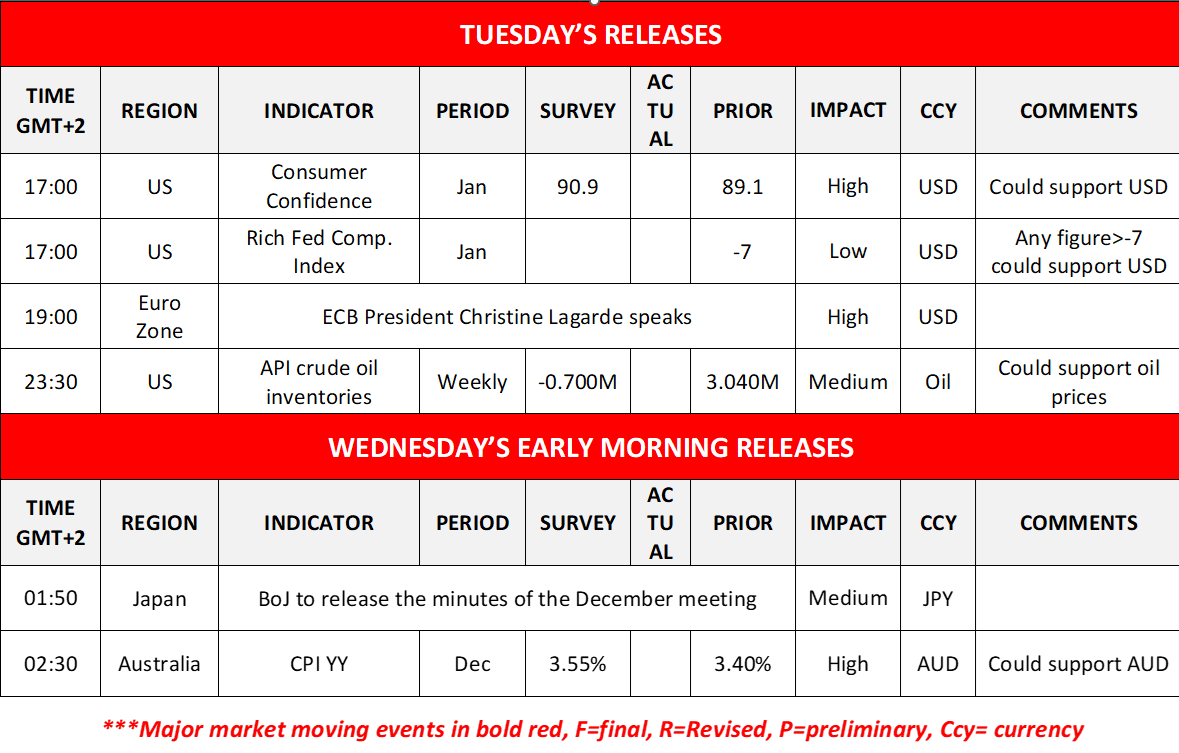

Today we get Germany’s Ifo indicators for January, the US Durable Goods Orders for November and the US January Dallas Fed Manufacturing Business Index. In tomorrow’s Asian session, we get Australia’s December NAB indicators for business confidence and conditions.

As for the rest of the week:

In the current week the highlight is expected to be the Fed’s interest rate decision on Wednesday. The bank is widely expected to remain on hold, keeping rates at 3.50%-3.75% range. Hence we expect the market to shift its attention to the bank’s forward guidance and should the bank signal that it intends to remain on hold for longer, we may see the USD getting some support while gold’s price could lose ground. Also on Wednesday we get from Canada, BoC’s interest decision, while on Friday EUR traders may be more interested in the release of Germany’s, France’s and the Euro Zone’s preliminary GDP rates for Q4 25. Calendar follows

XAU/USD Daily Chart

- Support: 5000 (S1), 4800 (S2), 4550 (S3)

- Resistance: 5250 (R1), 5500 (R2), 5750 (R3)

USD/JPY Daily Chart

- Support: 151.50 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 154.30 (R1), 157.80 (R2), 161.90 (R3)

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.