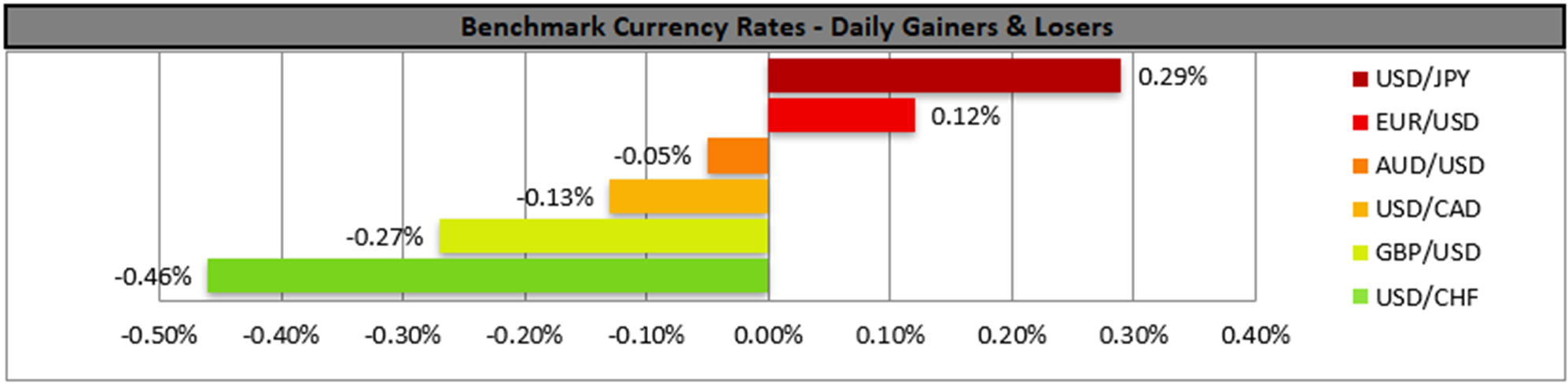

Market worries for the US Macroeconomic outlook seem to persist as the USD tended to edge lower against its counterparts yesterday. The possible lifting of the US Government shutdown is to allow for a slew of US data to be released and market worries tend to revolve around growth and the US employment market. It should be noted that ADP reported an average weekly drop of 11k in the number of private payrolls in the US economy. On the other hand, a number of Fed policymakers do not seem to be convinced about the extent of how soft the US employment market actually is and seem to be reconsidering the case for a rate cut in the December meeting. For the time being Fed Fund Futures imply that the market prices in another rate cut in the December meeting by 64.2% and further easing of the market’s dovish expectations could support the USD, while at the same time could weigh on gold’s price.

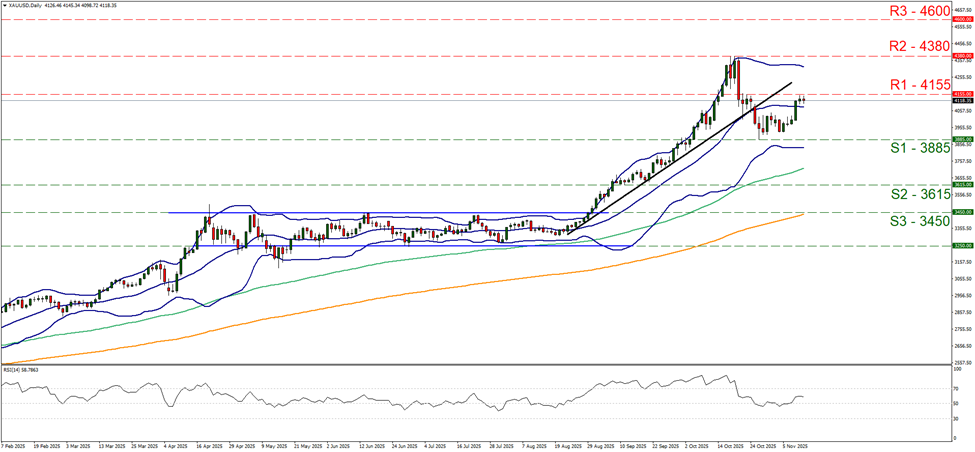

On a technical level, we note that gold’s price fit a ceiling at the 4155 (R1) resistance line. Given the precious metal’s failure to clearly break the prementioned resistance line, our bias for a sideways motion of the precious metal’s price remains while the rise of the RSI indicator to the reading of 60, implies a bullish predisposition of market participants for gold’s price. For the bullish outlook to be adopted, we would require gold’s price to clearly break the 4155 (R1) resistance line and start aiming for the 4380 (R2) resistance level, which marks an All Time High for the precious metal’s price. For a bearish outlook to be adopted we would require gold’s price to break the 3885 (S1) support line and thus pave the way for the 3615 (S2) support level.

In tomorrow’s Asian session we note the release of Australia’s employment data for October. The unemployment rate is expected to tick down to 4.4% and the employment change figure to rise from 14.9k to 20.0k. Should the actual data meet their respective forecasts, implying a tightening of the Australian employment market, or even show an even tighter employment market than expected, we may see the Aussie getting some support as RBA could be encouraged to keep rates unchanged. On the flip side should the data fail to meet the market’s expectations or even show an easing employment market we may see the Aussie being on the retreat. Also, Aussie traders are to keep a close eye on the speech of RBA Assistant Governor Jones and should he allow for a more hawkish tone to prevail we may see the Aussie getting some support while a dovish tone could weigh on AUD.

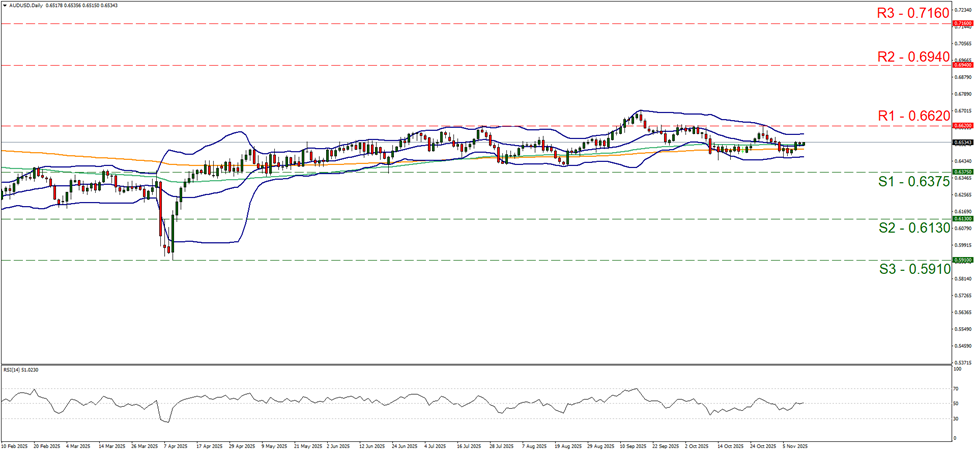

AUD/USD remained relatively stable yesterday, well between the 0.6620 (R1) resistance line and the 0.6375 (S1) support level. We maintain a bias for the pair’s sideways motion within the corridor set by the prementioned levels to be continued. Supporting our opinion are the Bollinger bands which are narrow and converging slightly implying lower volatility for the pair and the RSI indicator which runs along the reading of 50 implying a rather indecisive market for the pair’s direction. Should the bulls take over, AUD/USD may break the 0.6620 (R1) line and start aiming for the 0.6940 (R2) level. Should the bears be in charge, we may see the pair breaking the 0.6375 (S1) line and start aiming for the 0.6130 (S2) base.

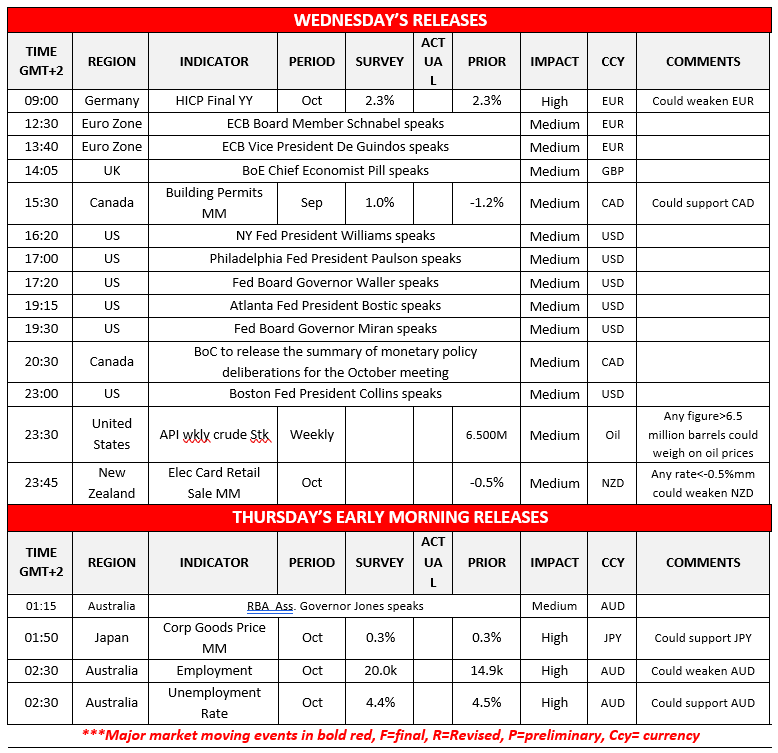

Other highlights for the day:

Today we Get Germany’s final HICP rate for October, Canada’s building permits for September, from the US the API weekly crude oil inventories figure and from New Zealand the electronic card retail sales for October. On a monetary level we note that ECB Board Member Schnabel, ECB Vice President De Guindos, BoE Chief Economist Pill, NY Fed President Williams, Philadelphia Fed President Paulson, Fed Board Governor Waller, Fed Board Governor Miran and Boston Fed President Collins are scheduled to speak while BoC is to release the summary of monetary policy deliberations for the October meeting. In tomorrow’s Asian session. We note the release of Japan’s Corporate Goods Prices for October in tomorrow’s Asian session.

AUD/USD Daily Chart

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

XAU/USD Daily Chart

- Support: 3885 (S1), 3615 (S2), 3450 (S3)

- Resistance: 4155 (R1), 4380 (R2), 4600 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.