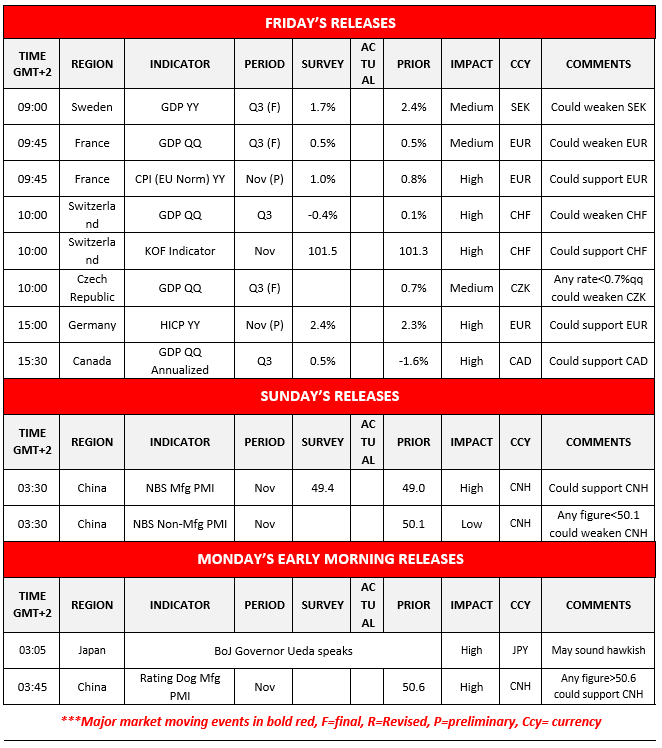

Today we are to keep a close eye on the common currency as financial releases could move the EUR. We make a start with the preliminary HICP rates for November of France and Germany and could act as a prelude for the Euro Zone as a whole. The rates are expected to accelerate on a year-on-year level, for both economies, which may imply a wider resilience of inflationary pressures in the Euro Zone. Should the rates accelerate beyond market expectations, we may see the single currency getting some support as it could further solidify the market’s expectations for the ECB to keep rates steady. Please note that the account of the October monetary policy meeting, released yesterday, seemed to underscore the scenario of the bank remaining on hold. Also, we note the market’s worries for the low growth rates in the Euro Zone, hence some interest may also be expressed for the release of France’s final GDP rate for Q3.

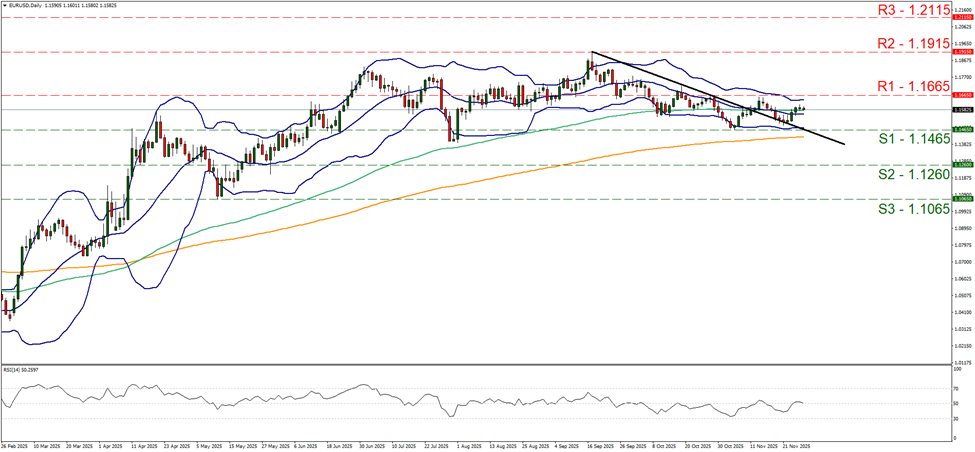

EUR/USD remained relatively steady yesterday well between the 1.1665 (R1) resistance line and the 1.1465 (S1) support level. We maintain the pair’s price action to remain in a rangebound motion within the corridor described above given the pair’s direction since the early days of October. We also note that the RSI indicator remained at the reading of 50, implying a relative indecisiveness on behalf of market participants, while the Bollinger bands seem to have flattened and slightly narrowed, implying less volatility for the pair’s direction. Should the bulls take over, we may see the pair breaking the 1.1665 (R1) resistance line and start aiming for the 1.1915 (R2) resistance level. Should the bears be in charge, we may see EUR/USD breaking the 1.1465 (S1) support line thus paving the way for the 1.1260 (S2) support level.

Also, we highlight the release of Canada’s GDP rate for Q3. The rate is expected to get out of the negatives, showing growth once again by reaching 0.5%. Please note that the Looney got some slight support yesterday against the USD, as the release of the Current Account balance showed that the deficit narrowed more than expected for Q3, in a sign of the Canadian economy having made less net outward payments. Should we see the GDP rate actually accelerating beyond market expectations, we may see the CAD getting some support, yet the rate fail to rise above zero, the release could weigh on the Loonie as market worries for possible recessionary tendencies in the Canadian economy may emerge.

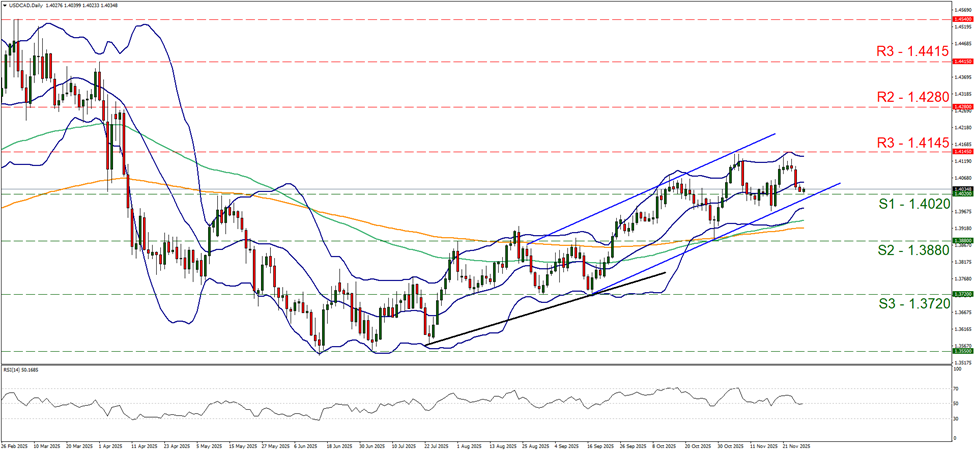

USD/CAD edged lower yesterday, teasing the 1.4020 (S1) support line. The pair’s price action since the start of September was within an upward channel, allowing for a bullish outlook to be adopted. Yet we note the pair’s weakness in forming a new higher high after hitting a ceiling last Monday at the 1.4145 (R1) resistance line, which may imply some stabilisation of the pair. Also the RSI indicator has dropped as low as the reading of 50, implying an erasing of the bullish market sentiment for the pair. Should the bulls maintain control we may see USD, reversing the losses of the past three days and breaking the 1.4145 (R1) resistance hurdle, thus paving the way for the 1.4280 (R2) level. Should the bears take over, we may see USD/CAD breaking the 1.4020 (S1) support line, continuing lower by breaking the lower boundary of the prementioned upward channel in a first of an interruption of the upward movement and start aiming for the 1.3880 (S2) base.

In Monday’s Asian session, we note the speech of BoJ Governor Ueda. Please bear in mind that BoJ’s hawkish intentions are key for JPY’s direction at the current stage and the political pressure exercised by the Japanese government on the bank opposing its intentions tends to weigh on the Yen. Should BoJ Governor Ueda try to defend the bank’s intentions by sounding more hawkish, we may see the JPY getting some support.

Other highlights for the day:

Today we get Sweden’s, Switzerland’s, the Czech Republic’s, Switzerland’s KOF indicator for November. On Sunday, we get China’s NBS PMI figures for November and on Monday’s Asian session, China’s Caixin manufacturing PMI figure for November.

EUR/USD Daily Chart

- Support: 1.1465 (S1), 1.1260 (S2), 1.1065 (S3)

- Resistance: 1.1665 (R1), 1.1915 (R2), 1.2115 (R3)

USD/CAD Daily Chart

- Support: 1.4020 (S1), 1.3880 (S2), 1.3720 (S3)

- Resistance: 1.4145 (R1), 1.4280 (R2), 1.4415 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.