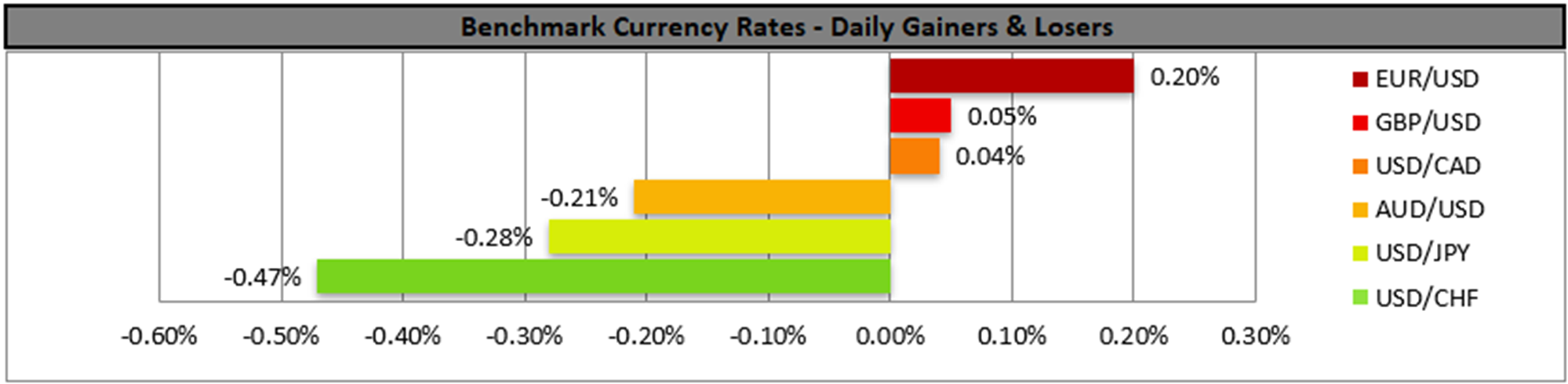

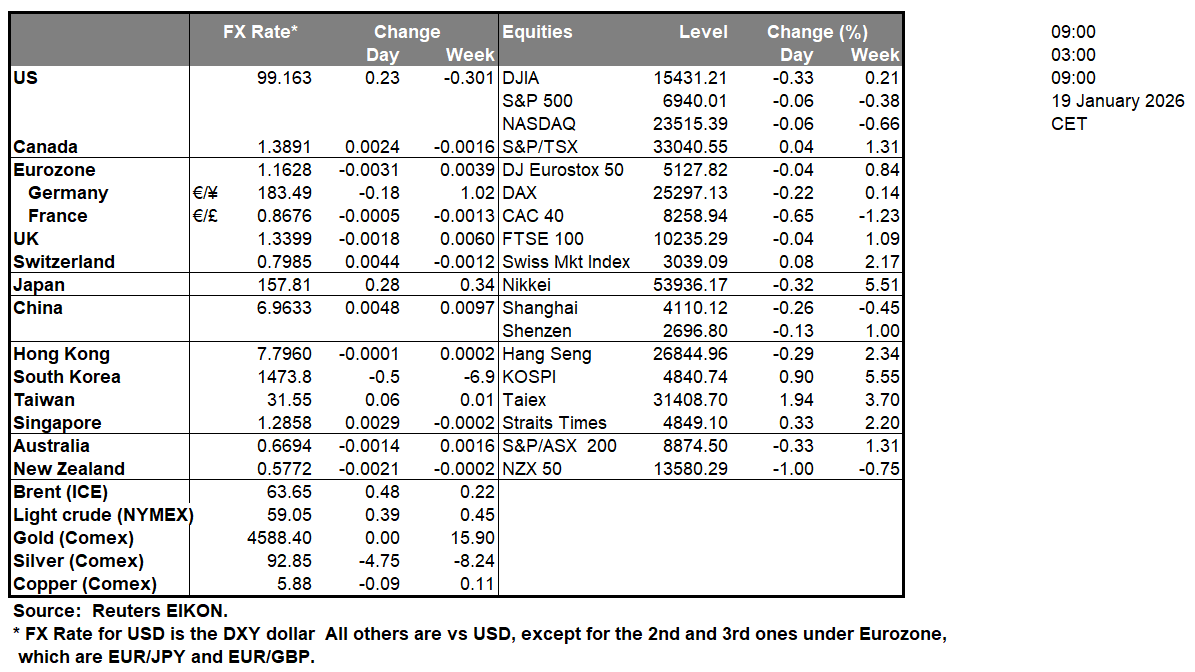

The USD retreated against its counterparts in today’s Asian session, as market jitters were enhanced about US President Trump’s threats to impose tariffs of an additional 10% from the first of coming month to products entering US soil from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and Britain, practically until the US is allowed to buy Greenland. The threats were denounced as blackmail by major EU countries, and a number of countermeasures are being contemplated. The increased uncertainty in the markets has hit on riskier assets such as US stock markets and Bitcoin, while at the same time has enhanced safe-haven trading instruments such as gold, which has reached new record high levels CHF and JPY. Also in the FX market, we highlight the release of Canada’s CPI rates for December and a possible acceleration could provide some support for the CAD as it could harden BoC’s stance to remain on hold.

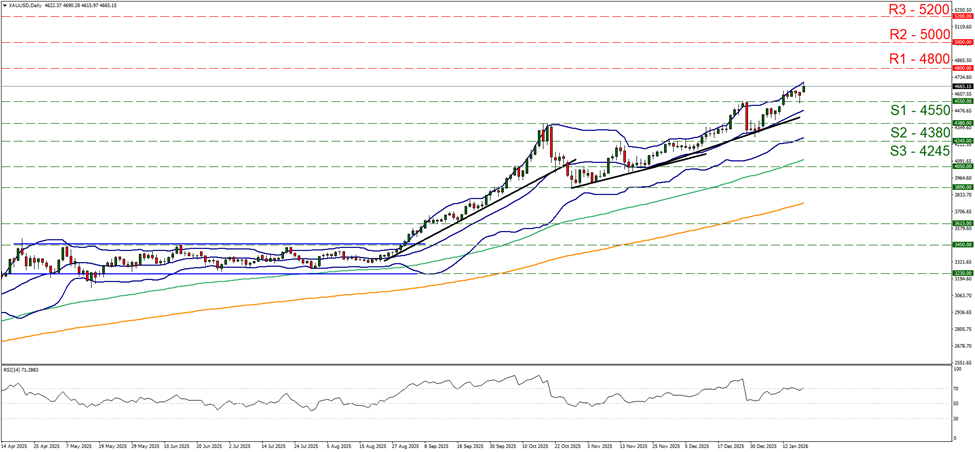

Gold’s price continued to rise reaching new record high levels at $4668/ troy ounce in today’s Asian session. We have a bullish outlook for gold’s price and intend to keep it as long as the upward trendline guiding it since the 28th of October remains intact. Please note that the RSI indicator has reached the reading of 70, implying a strong bullish market sentiment on the one hand yet on the flip side may also imply that the precious metal’s price is near overbought levels and a correction lower could be in the cards for gold’s price. For the bullish outlook to be maintained we would require the precious metal’s price to start actively aiming for the 4800 (R1) line. A bearish outlook currently seems remote and for it to be adopted we would require gold’s price to break the 4550 (S1) line and continue to break also the prementioned upward trendline in a first signal of an interruption of the upward movement and continue even lower to break the 4380 (S2) level.

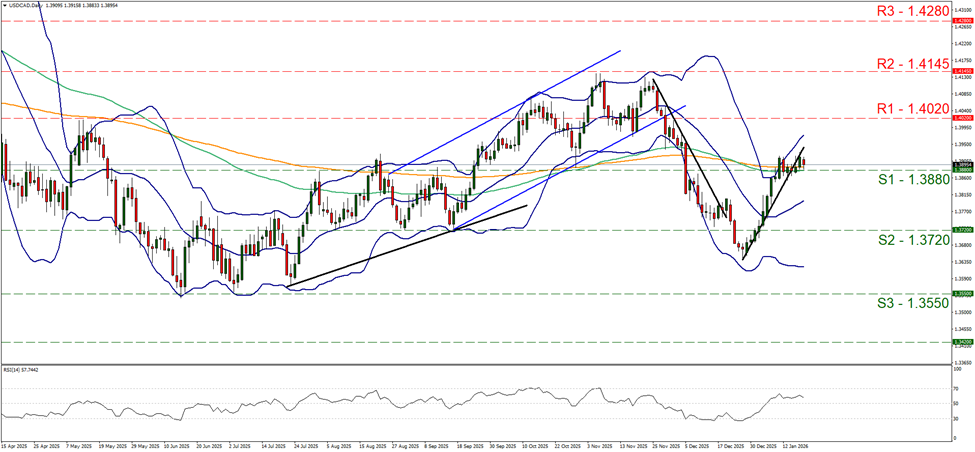

USD/CAD remained relatively edged lower in today’s Asian and early European sessions, testing the 1.3880 (S1) support line. The pair’s price action was rather stable just above the S1 over the past week, breaking on Thursday the upward trendline guiding it since the 26th of December, hence we switched our bullish outlook in favour of a sideways motion bias. Yet the RSI indicator remains currently between the readings of 50 and 70, implying a bullish predisposition of the market for the pair. Should the bulls gain control, we may see the pair start breaking the 1.4020 (R1) resistance line. On the flip side, should the bears take over, we may see USD/JPY breaking the 1.3880 (S1) support line and continue to break also the 1.3720 (S2) support level.

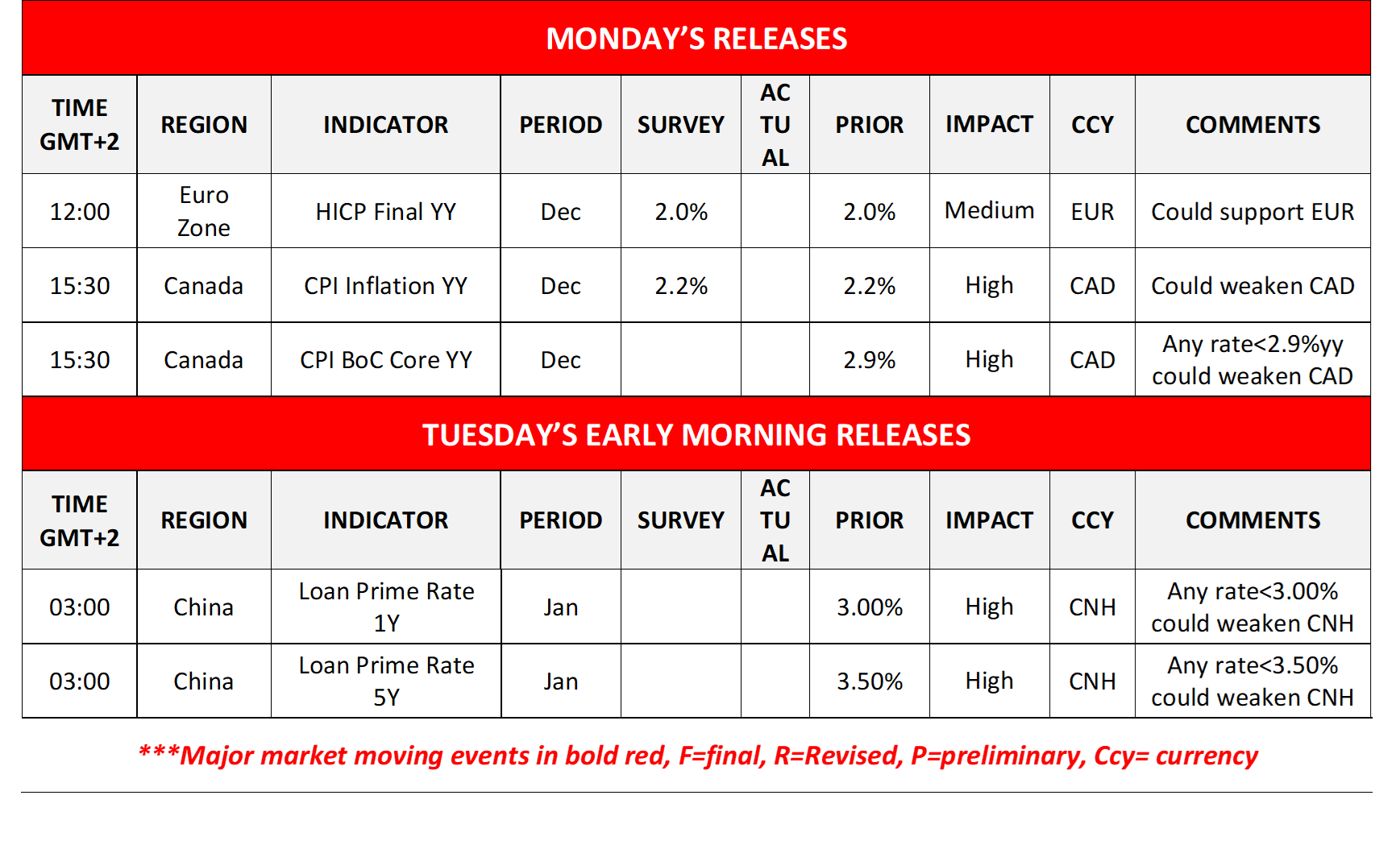

Other highlights for the day:

Today we note the release of Euro Zone’s final HICP rate for December and in tomorrow’s Asian session we get from China, PBOC’s interest rate decision.

As for the rest of the week:

On a fundamental level, we note the World Economic Forum, throughout the week. On Tuesday, we get UK’s employment data for November and Germany’s ZEW indicators for January. On Wednesday, we get UK’s CPI rates for December and Canada’s CPI rates for the same month. On Thursday we get Japan’s trade data for December, Australia’s employment data also for December, in Norway and in Turkey, Norgesbank and CBT are to release their interest rate decisions, from the US we note the release of the weekly initial jobless claims figure, the final GDP rate for Q4 and Core PCE rates for November, while from New Zealand we get Q4’s CPI rates. Finally on Friday, we get Japan’s CPI rates for December, the preliminary PMI figures for January and BoJ is to release its interest rate decision, in the UK December’s retail sales growth rate is to be released and we also get Germany’s, France’s, the Euro Zone’s, the UK’s and the US preliminary PMI figure for January, Canada’s retail sales for November and the final US University of Michigan consumer sentiment for January.

XAU/USD Daily Chart

- Support: 4550 (S1), 4380 (S2), 4245 (S3)

- Resistance: 4800 (R1), 5000 (R2), 5200 (R3)

USD/CAD Daily Chart

- Support: 1.3880 (S1), 1.3720 (S2), 1.3550 (S3)

- Resistance: 1.4020 (R1), 1.4145 (R2), 1.4280 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.