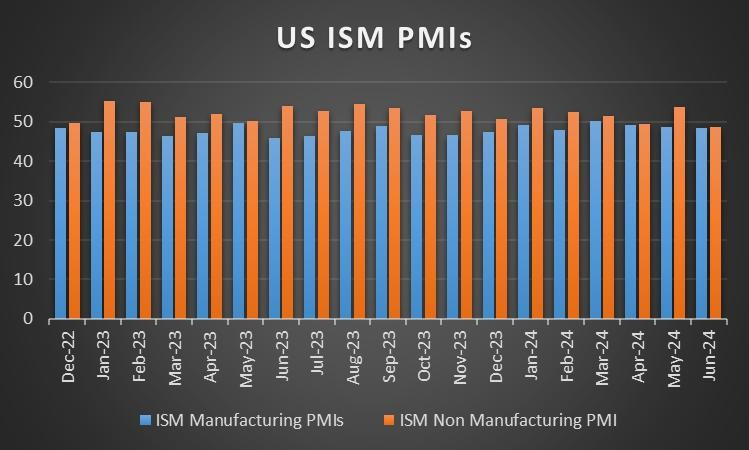

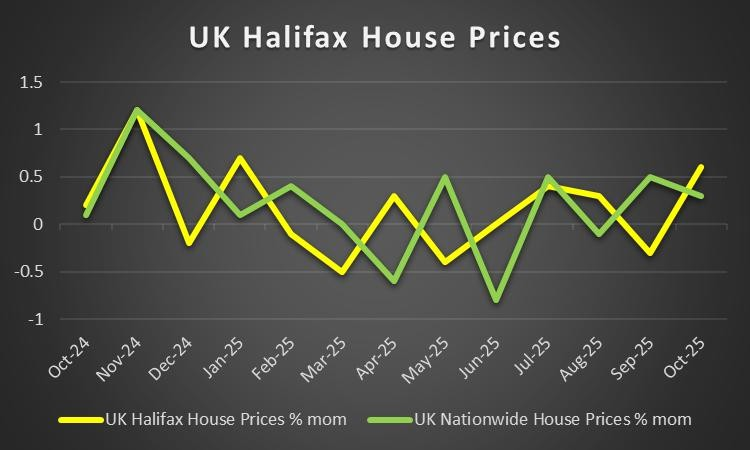

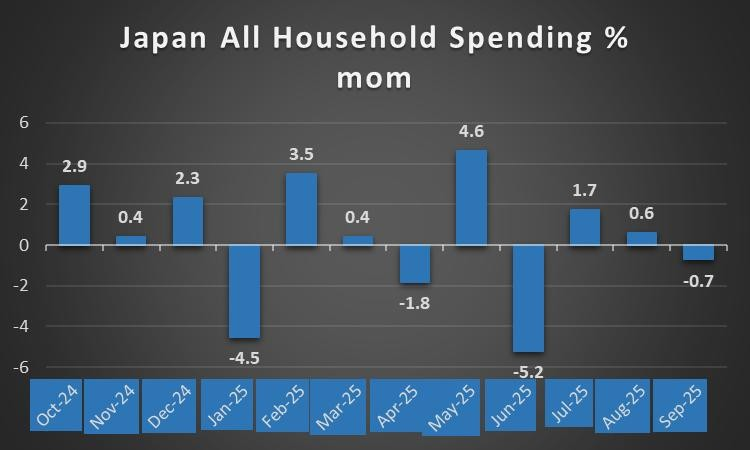

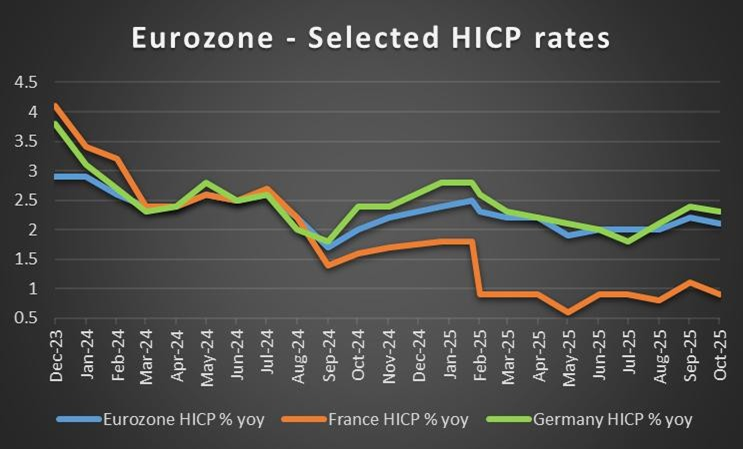

We are nearing the end of the week and have a look at next week’s calendar, but before that we should note the release of China’s NBS manufacturing PMI figure for November. On Monday we get China’s manufacturing PMI figure for November, Turkey’s GDP rate for Q3, Canada’s manufacturing PMI figure and the US ISM manufacturing PMI figure both for November. On Tuesday, we get Australia’s buildings approvals rate for October and trade balance figure for Q3, the UK’s nationwide house prices rate for November and the Eurozone’s preliminary HICP rate for November. On Wednesday, we get Australia’s GDP rate for Q3, Turkey’s and Switzerland’s CPI rates, the US ADP Employment change figure all for November, followed by the US industrial production rate for September and ISM non manufacturing PMI figure for November. On Thursday, we get Australia’s trade balance figure for October, Sweden’s and the Czech Republic’s preliminary CPI rates for November, the US weekly initial jobless claims figure and Canada’s trade balance. On Friday we noe Japan’s household spending rate , Germany’s industrial orders rate for October, the UK’s Halifax house prices rate for November, the Eurozone’s revised GDP rate for Q3, Canada’s employment data for November, the US PCE rates, Factory orders and consumption rate all for September and ending the week is the US UoM preliminary consumer sentiment figure for December. On a monetary level we note the speech by BOJ Governor Ueda on Monday.

USD – US PCE in focus

Our comment for the USD starts with monetary policy as the market appears to be preparing for a new Fed Chair. In particular, we note the recent speculation over the upcoming new Fed Chair has intensified since US Treasury Secretary Bessent’s comments to CNBC that there was a good chance that President Trump could announce his decision for the next Fed Chair within the next month and prior to the 25th of December. Moreover, it has now surfaced that White House National Economic Council Director Kevin Hassett is the current frontrunner for the position.In turn this may have further increased market optimism for rate cuts in the upcoming year, considering how Hassett has aligned himself with Trump’s position on the Fed’s monetary policy path. Hence should Hassett be confirmed in the year term, the dovish implications of his tenure as Fed Chair could weigh on the dollar. On a macroeconomic level, we should note that there was a slight error in last week’s edition of this report based on the economic calendar provided by the LSEG terminal. Specifically, the release of the PCE rates, which have now been confirmed for next week and thus lets revisit our comments on that issue. The US PCE rates for September are due out next Friday and considering the FOMC’s last meeting for the year will occur in two weeks’ time the particular release may lead to more volatility in the markets than usual. The current expectations for the PCE rates are for a slight acceleration on a headline level from 2.7% to 2.8%, whereas the Core PCE rate is expected to remain steady at 2.9%. Hence, should the PCE rates come in as expected, implying a slight acceleration of inflationary pressures in the US economy on a headline level, it may provide support for the dollar as the Fed may face pressure to remain on hold in their final meeting of the year. On the other hand, should the PCE rates come in lower than expected it may have the opposite effect.

Analyst’s opinion (USD)

“The PCE rates are due out next Friday and we wouldn’t be surprised if they showcased inflation remaining relatively steady around 2.8% in the US economy. From the Fed’s perspective should they acceleration or show signs of stubbornness it may influence the narrative in the bank’s accompanying statement, which could be perceived as hawkish. Yet, seeing the uptick in the unemployment rate based on the latest release of the US Employment data, a rate cut may still prevail, albeit with some caveats set in place to possibly ease the market’s expectations of further rate cuts with the new year.”

GBP – Autumn budget comes in

The main event for the GBP in the past week may have been the release of the UK government’s autumn budget. The autumn budget in our opinion, is still being digested by the markets but some interesting numbers have emerged from the OBR which may cast some light into how the UK economy may be influenced by the budget. Although before we get into the details, we should note that numerous announcements were made in the report which we will not dive into, and thus will just focus on the overall picture. According to the OBR, economic growth for the UK economy is expected to be 1.4% in 2026, which would be lower than the previously anticipated 1.9% and will be at 1.5% for the rest of the decade. Moreover, the OBR forecasts that “CPI inflation returns to the Bank’s 2 per cent target in 2027, a year later than in our March forecast” which may tend to cast doubt that the BoE may begin aggressively easing interest rates and could thus opt for a more restrictive stance in light of higher inflation forecasts. Hence, should the BoE’s stance adopt a more restrictive aka hawkish, approach, it may aid the sterling. For next week, it’s set to be a relatively quiet week for the UK as of interest are the nationwide and Halifax house prices which could lead to some movement in the sterling. Although based on the financial releases expected from the US, the sterling may find itself in the passenger seat.

Analyst’s opinion (GBP)

“We’ve seen the budget and our main worry is the reduction in economic growth and the OBR’s projections of inflation returning to the bank’s 2% inflation target a year later than what was projected in March this year. Hence, as we gear to up to head in 2026 we would opt for a pessimistic view of the UK economy as a whole which in turn could weigh on the UK Equities markets.”

JPY – Japan-China relationship sours

Japan’s Tokyo CPI rates for October were released during today’s Asian session and tended to showcase an persistent inflationary pressures in the Japanese economy. In particular, the core CPI rate on a year-on-year level did not ease to 2.7% as was expected by economists but instead remained at 2.8%. Moreover, Japan’s preliminary industrial production rate for October also exceeded expectations by economists by coming in at 1.4% versus -0.5%. In turn both financial releases may have provided support for the JPY during today’s Asian session. Moving on to a monetary level, the Tokyo CPI rates may increase pressure for BOJ policymakers to adopt a more hawkish stance which in turn could further aid the JPY down the line. Furthermore, considering the comments made by BOJ Governor Ueda last week that the bank will discuss the ”feasibility and timing” of a rate hike in the banks next meeting, could further intensify market expectations of a more hawkish stance for the BOJ and could thus further aid the JPY in the coming week. For next week, continuing from our previous comment all eyes may be on the speech of BOJ Governor Ueda on Monday, where we would not be surprised to see the door for a rate hike in the banks’ next meeting being “opened” which could in turn aid the JPY. On a political level, the relationship between the Japanese and Chinese governments has soured following comments made by Japan in regards to Taiwan. Specifically, the Japanese Prime Minister “told parliament this month that a hypothetical Chinese attack on Taiwan that threatened Japan could justify a military response”, which obviously was bound to cause diplomatic tensions.

Analyst’s opinion (JPY)

“The Tokyo CPI rates which remained at 2.8% showcase that the BOJ may need to adopt a more restrictive approach and thus we wouldn’t be surprised see BOJ Governor Ueda’s comments on Monday being perceived as hawkish in nature. Therefore, based on our assumption that they may be hawkish, we would not be surprised to see some strengthening for the JPY in the coming week.”

EUR – Eurozone’s HICP rates and GDP rate next week

Making a start for the Eurozone on a monetary policy level. Starting off with the comments made by ECB Vice President De Guindos in appears that the bank is not concerned with their “read” on inflation, as the policymaker stated to Bloomberg that he’s comfortable with how inflation is developing and being quoted as having said that “The risk of undershooting is limited, in my view”. Moreover, ECB Chief Economist Lane also noted that “To have 2% inflation, we need European wages to be growing at — depending on your view of productivity — let’s say 2.5% or 3%” which appears to be where the wage growth is going next year per his own comments. Hence, looking at the comments made by these two policymakers it appears that the bank is in no rush to cut rates as their monetary policy path appears to be bearing fruit. In turn these comments may increase market expectations that the bank may remain on hold in their final meeting in December, which in turn could provide support for the common currency. On a macroeconomic level, we should note today’s financial releases, starting with France’s preliminary HICP rates for November which came in lower than expected and tended to imply easing inflationary pressures in the Zone, which may have weighed on the EUR. Yet we should note that Germany’s preliminary HICP rates for November are due out this afternoon and based on the expectations by economists could showcase an acceleration of inflationary pressures in turn this may aid the EUR whereas should they showcase easing inflationary pressures it may weigh on the common currency. For next week we would like to note that we are set to receive the Eurozone’s revised GDP rate for Q3 as well and the Zone’s preliminary HICP rate for November. Depending on the releases the EUR may react accordingly.

Analyst’s opinion (EUR)

“On a macroeconomic level we note that the preliminary HICP rates may influence the EUR. At the time of this report Germany’s HICP rates have not been released and thus we lack an overall picture for the inflation picture in Europe’s two largest economies. However, on a general note we wouldn’t be surprised to see the ECB remaining on hold for the prolonged period of time.”

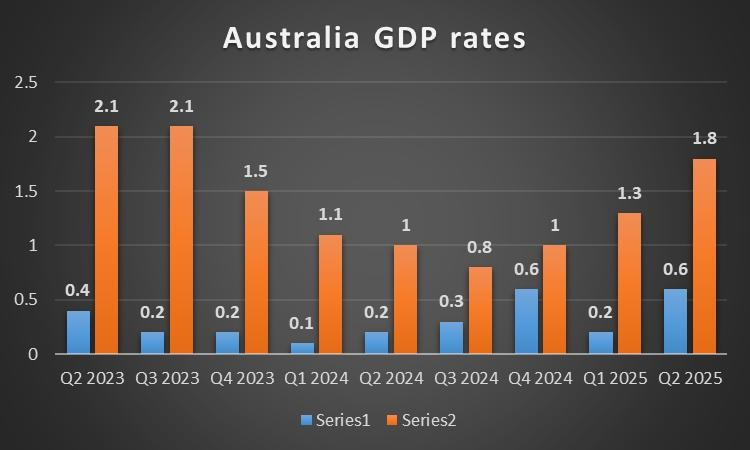

AUD – Australia’s GDP rate for Q3 due out next week

The Aussie seems about to end the week deep in the greens against the USD and appearing to have recovered the losses made last week against the dollar. On a macroeconomic level, we would like to note that Australia’s CPI rates for October were released earlier this week. Specifically, inflation accelerated from 3.5% to 3.8% showcasing that inflation in Australia’s economy remains prevalent and thus may have provided support for the AUD during the week. On a monetary level, the hotter-than- expected inflation print may increase pressure on the RBA to adopt a more hawkish stance in order to combat the rising inflationary pressures in Australia, which could further aid the AUD in the coming week should policymakers adopt a more hawkish tone. For next week, Australia’s GDP rates for Q3 are set to garner attention as the release should showcase economic growth, the Aussie may further strengthen.

Analyst’s opinion (AUD)

“The hotter-than-expected inflation print may further increase pressure on the RBA to be more restrictive in their monetary policy decisions going forward and thus we wouldn’t be surprised to see the AUD gaining in the long term .”

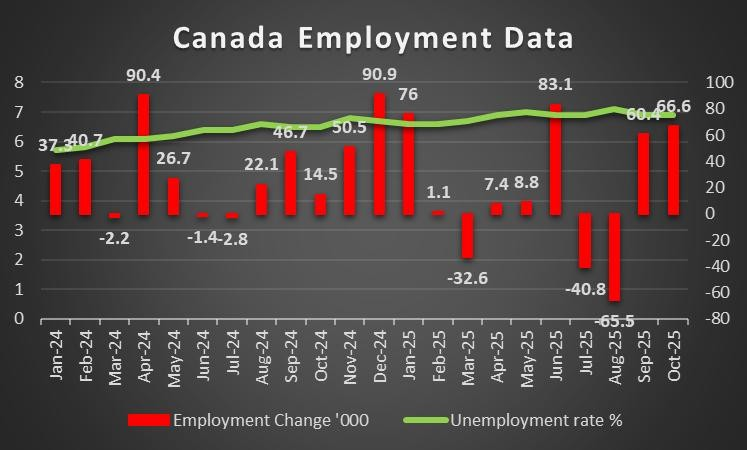

CAD – Canada’s Employment data due out next week

Also the Loonie seems about to end the week in the greens against the USD. Before we note next week’s events, we should note the release of Canada’s GDP rates for Q3 later on today. The rate is currently in the negatives, and should it remain below zero, we may see market worries for a recession in the Canadian economy, intensifying and possibly weighing on the Loonie. However expectations by economists are for the rate to improve to 0.2% which could increase optimism surrounding the Canadian economy and could thus provide support for the Loonie. On a macro level for next week we would like to note the release of Canada’s employment data for November next Friday. Should the employment data showcase a resilient labour market it may provide support for the Loonie and vice versa.

Analyst’s opinion (CAD)

“The GDP rates for Q3 today could influence the Loonie as the week comes to an end but based on predictions by economists, the rate of 0.2% would be a positive note for Canada and could thus aid the Loonie. Next week we are set to receive the Canadian employment data on the same day as the US PCE rates which could lead to some volatile swings in the USD/CAD.”

General Comment

In the big picture, we expect the USD to maintain the initiative over other currencies, considering the upcoming release of the US PCE rates. We note that the US stock markets appear to have recovered since last week. We should note that trading on the Chicago Mercantile Exchange (CME) was halted for several hours on Friday following a cooling issue at a CyrusOne data centre that supports its operations. The outage disrupted some of the world’s most active futures and options markets, including major contracts for commodities such as crude oil, gold, and palm oil, as well as derivatives tied to U.S. equities, Treasuries, and foreign exchange instruments. On a political level, we remain cautious to the US’s actions in Venezuela as an attempt to overthrow the regime could influence the oil markets.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.