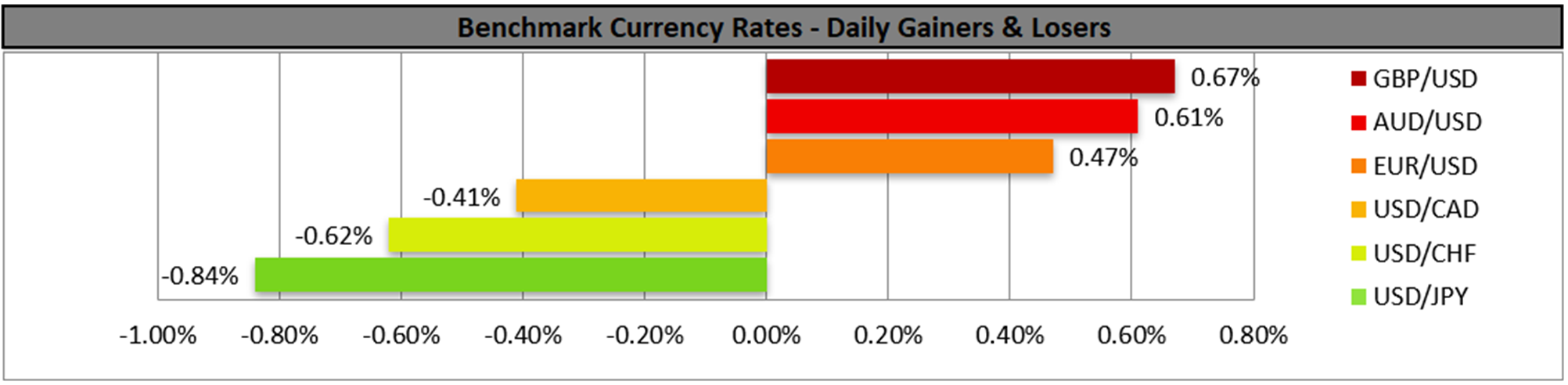

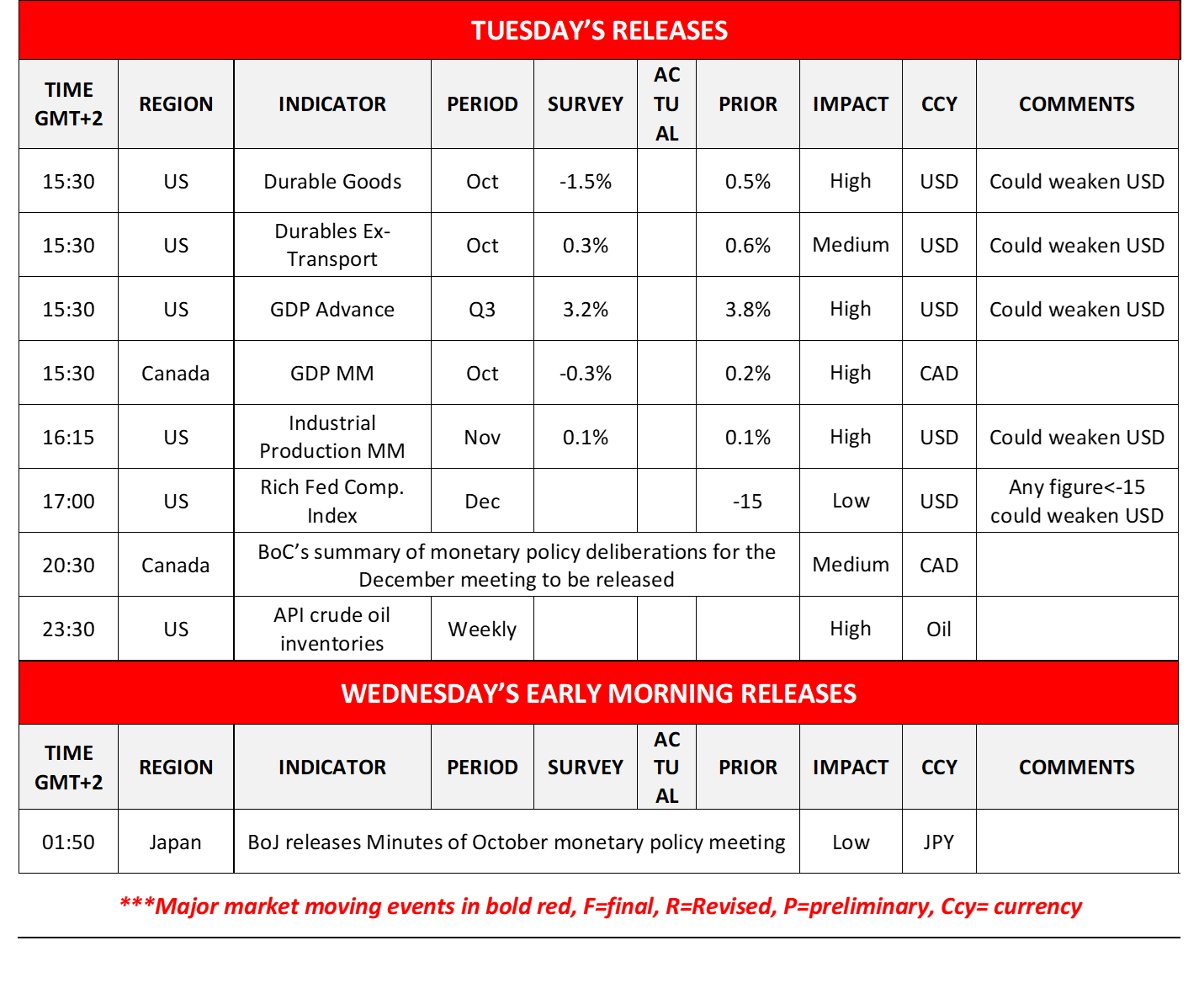

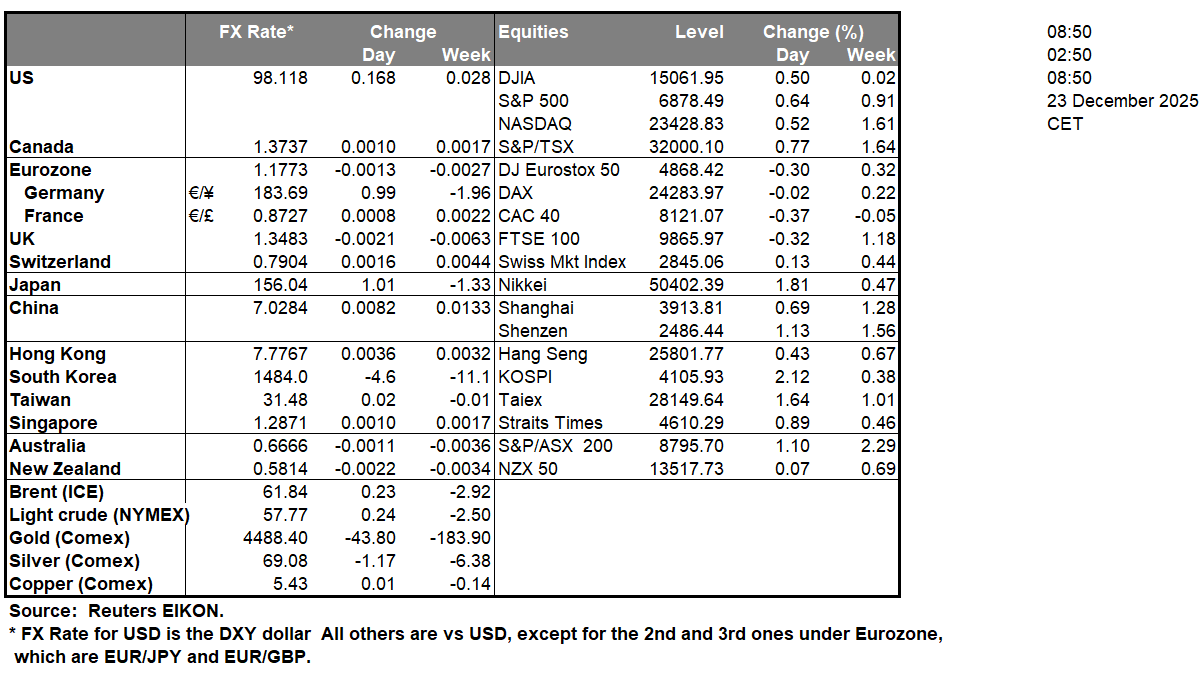

The USD retreated against its counterparts yesterday, as the market maintained its dovish approach in regards to the Fed’s intentions. For the time being, the market continues to expect the bank to cut rates twice in the coming year, once in April and once in July, yet there are also market participants who suspect that the bank may proceed with the rate cuts at an earlier date. As long as the market’s dovish expectations remain or even intensify, they keep the USD under pressure on a monetary level. On a macroeconomic level, we highlight the release of the US GDP advance rate for Q3 in today’s early American session and the rate is expected to slow down to 3.3% qoq on an annualised basis if compared to Q2’s 3.8% qoq, signaling a moderated easing of the expansion of growth of the US economy. Should the rate slow down more than expected, we may see the release weighing on the USD, while at the same time could provide support for gold’s price as market uncertainty for the US macroeconomic outlook may rise. On the flip side, a possible unexpected acceleration of the rate could take the markets off guard and allow for the USD to get asymmetric support and at the same time possibly weighing on gold’s price. Please note that from the US we also get today the Durable goods orders growth rates for October, the industrial production for November, the Richmond Fed Composite Index for December and the consumer confidence indicator for December. Despite the releases possibly being overshadowed by the release of the GDP rate, they still provide valuable information on the level of economic activity and robustness of the demand side of the US economy, as the fog created by the lack of data due to the US Government shutdown is slowly lifted. Furthermore, we note that the holiday season is approaching, and thus may create thin trading conditions in the markets.

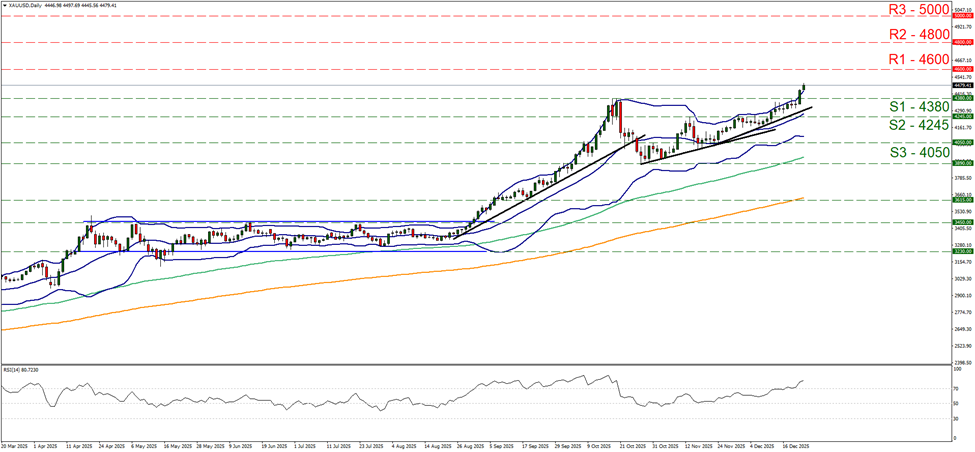

Gold’s price continued to rise, placing more distance between its price action and the 4380 (S1) support line. We maintain a bullish outlook for the precious metal’s price as long as the upward trendline guiding it remains intact. Yet at the same time, we intensify our warning for a possible correction lower of the precious metal’s price. The RSI indicator remains above the reading of 70, actually reaching 81, signaling a strong bullish market sentiment for gold’s price, while at the same time highlights that gold’s price has reached overbought levels and is ripe for a correction lower. Similar signals are coming from the price action well surpassing the upper Bollinger band. Should the bulls maintain control over gold’s price we may see it aiming for the 4600 (R1) line. Should the bears take over we may see gold’s price dropping, breaking initially the 4380 (S1) line and continue to break the prementioned upward trendline in a first signal of an interruption of the upward movement and continue to break the 4245 (S2) level, thus paving the way for the 4050 (S3) level.

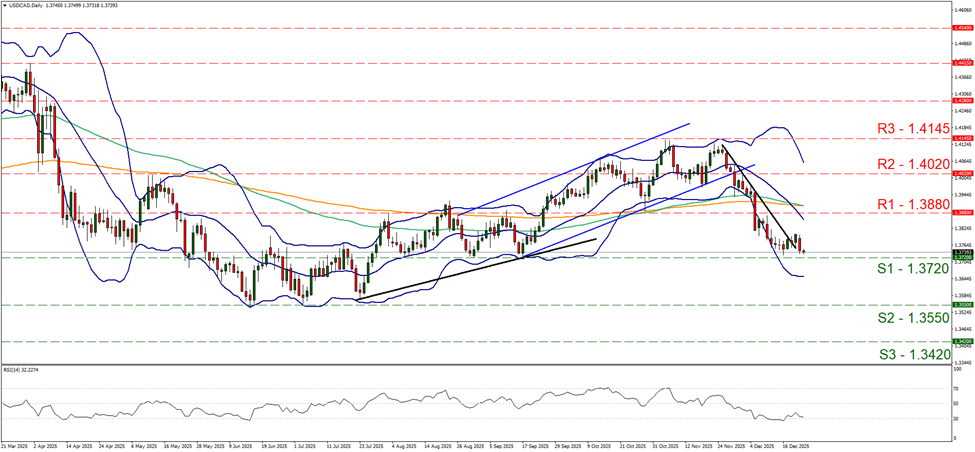

In the FX market USD/CAD edged lower yesterday and in today’s Asian session, and is currently flirting with the 1.3720 (S1) support line. We note the pair’s bearish tendencies given also the RSI indicator which remains near the reading of 30, implying a strong bearish market sentiment for the pair. Also the distance between the pair’s price action and the lower Bollinger band allows for some room to play for the bears. For the adoption of a bearish outlook, we would require the pair to clearly break the 1.3720 (S1) line and start aiming for the 1.3550 (S2) support level. For a bullish outlook to emerge, which we consider currently as a remote scenario, we would require the pair’s price to rise and break the 1.3880 (R1) resistance line aiming for the 1.4020 (R2) resistance levels.

今日其他亮点:

Today, we get from the US the weekly API crude oil inventories figure, while from Canada we get the GDP rate for October and BoC’s summary of monetary policy deliberations for the December meeting is to be released. In tomorrow’s Asian session, in Japan, BoJ releases the Minutes of the October monetary policy meeting.

黄金/美元 日线图

- Support: 4380 (S1), 4245 (S2), 4050 (S3)

- Resistance: 4600 (R1), 4800 (R2), 5000 (R3)

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.