Oil prices dropped more than 2% in today’s Asian session, as US President Trump eased market worries for the situation in Iran. U.S. President Donald Trump stated that killings of protesters from the Iranian Government were stopping, which in turn tented to ease worries for a possible US military action in Iran which could disrupt supply of oil. Also weighing on oil prices was a notable easing of the US oil market as both API and EIA reported an increase of US oil inventories signaling that aggregated oil demand in the US was not able to catch up with production levels. In another bearish signal for oil prices, Venezuela has begun increasing oil production as Venezuelan exports of crude oil are expected to resume. US President Trump also stated yesterday that Venezuela should stay in OPEC which may cap production somewhat, yet that seems to be immaterial given the current level of oil production of Venezuela. OPEC also mentioned that demand in the international oil market is expected to remain at the same levels, thus implying that demand and supply are somewhat balanced. Meanwhile, Reuters reported that China’s crude oil imports in December, while total imports in 2025 also rose signaling increased demand.

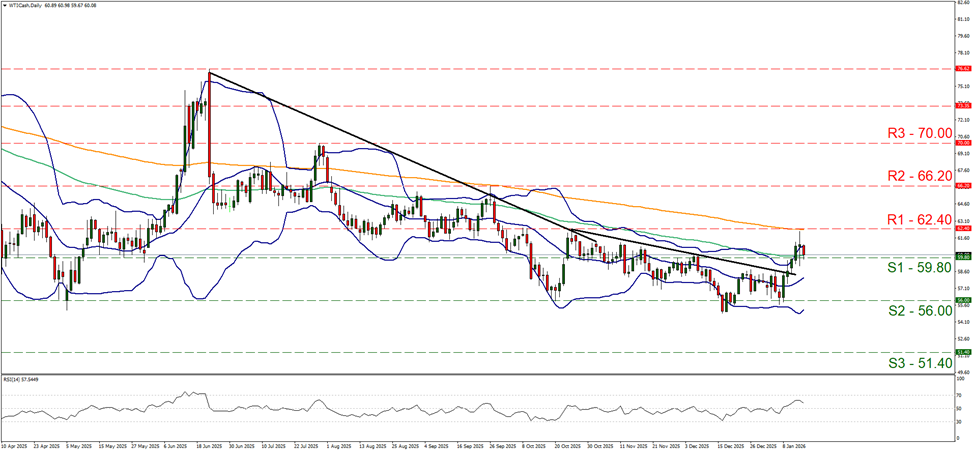

WTI prices corrected lower as expected in today’s Asian session testing the 59.80 (S1) support line. The upward movement of the commodity’s price over the five days has been interrupted while the RSI indicator has dropped yet is still above the reading of 50, implying an easing of the bullish market sentiment for WTI’s price. We still maintain a bullish outlook for the commodity’s price yet we warn for a possible stabilisation of WTI’s price action. Should the bulls remain in the driver’s seat, we may see WTI’s price reversing the losses and aiming for the 62.40 (R1) resistance line and note as the next possible target for the bulls the 66.20 (R2) resistance barrier. Should the bears take over, which we see as a remote scenario currently, we may see WTI’s price breaking the 59.80 (S1) support line and continue lower to break also the 56.00 (S2) support level.

USD loses ground despite favorable data

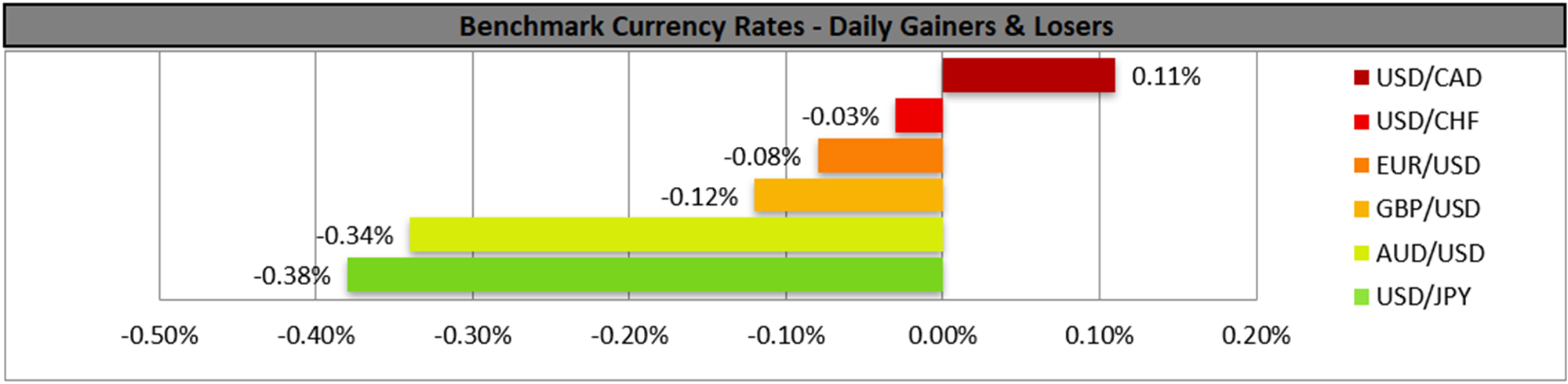

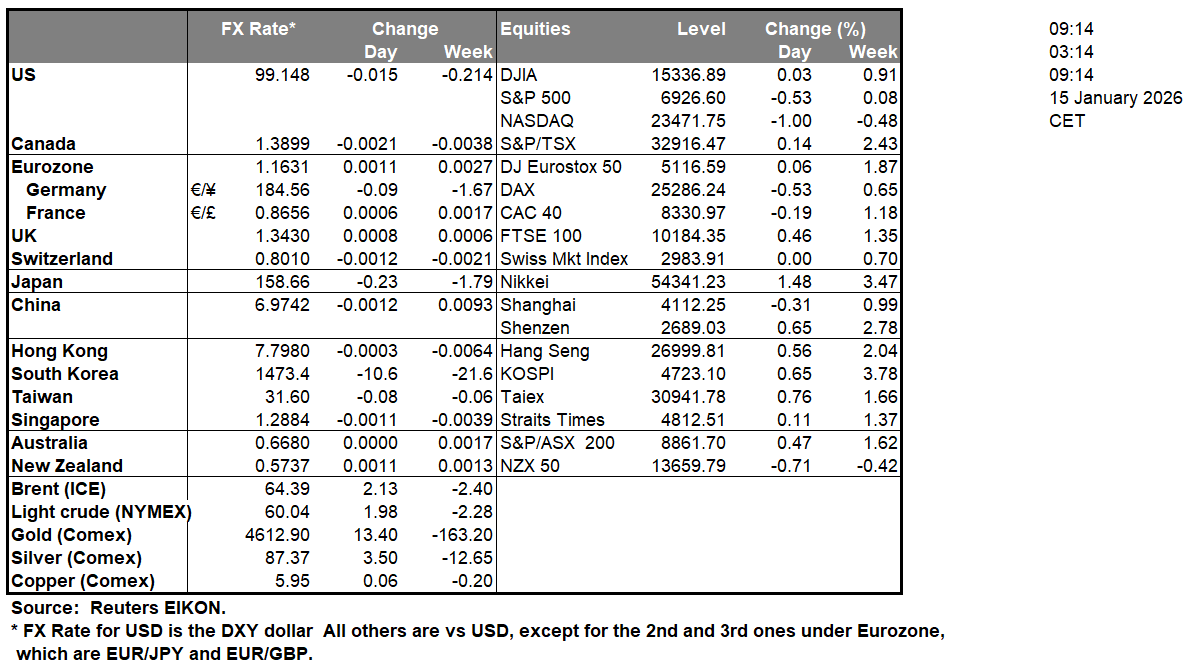

In the FX market the USD weakened against its counterparts yesterday, despite the US PPI rates slowing down less than expected for October and actually accelerating in November, implying the existence of inflationary pressures at a producer’s level. Also, the retail sales rate for November accelerated more than expected signaling a robust demand side for the US economy.

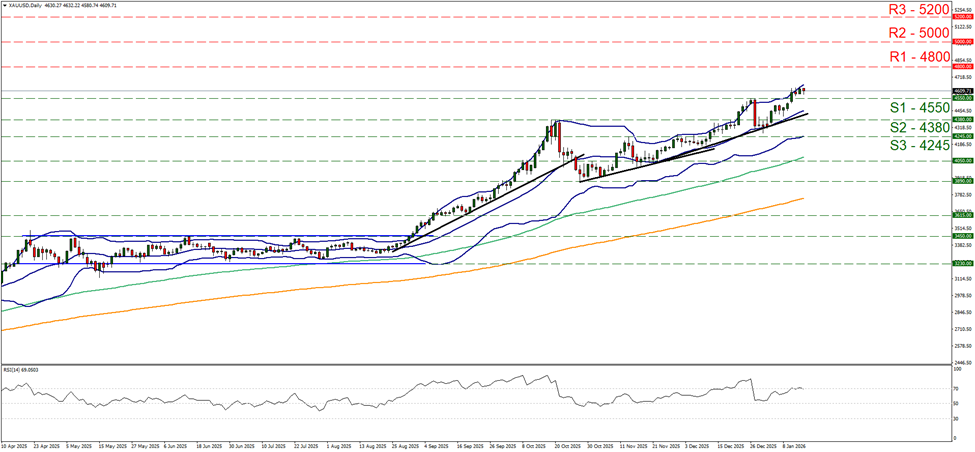

Gold’s price remained relatively stable yesterday edging lower in today’s Asian session. We maintain our bullish outlook for gold’s price given that the upward trendline guiding it remains intact, while the RSI indicator remained at the reading of 70, implying a continuance of the bullish market sentiment for the precious metal. The price action seems to have edged a bit lower than the upper Bollinger band which may provide some room for the bulls to play. Should the bulls maintain control, we set as the next possible target for the bulls the 4800 (R1) line. Should the bears take over we may see gold’s price breaking the 4550 (S1) line, breaking also the prementioned upward trendline and continue even lower to break the 4380 (S2) level.

今日其他亮点:

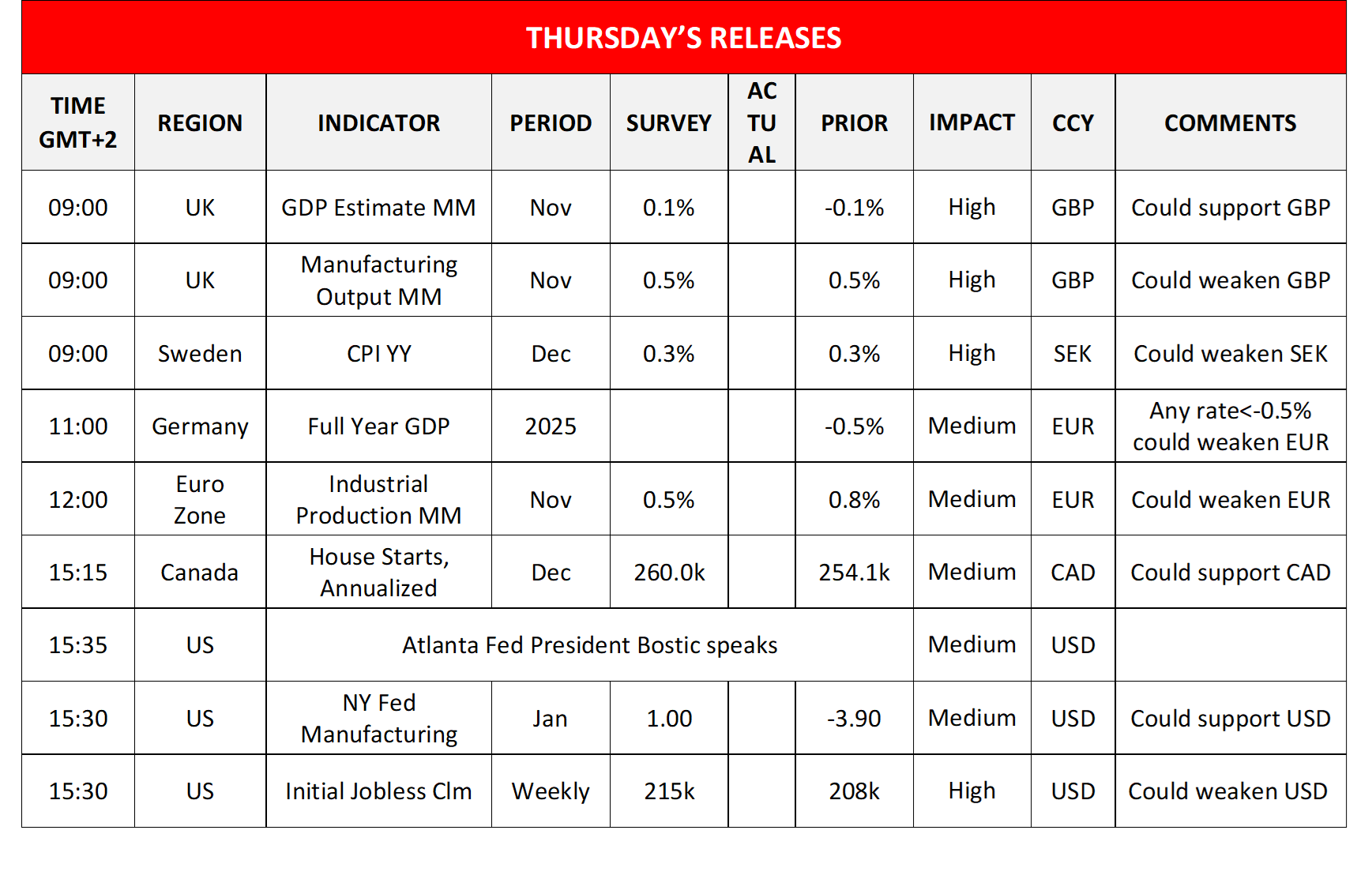

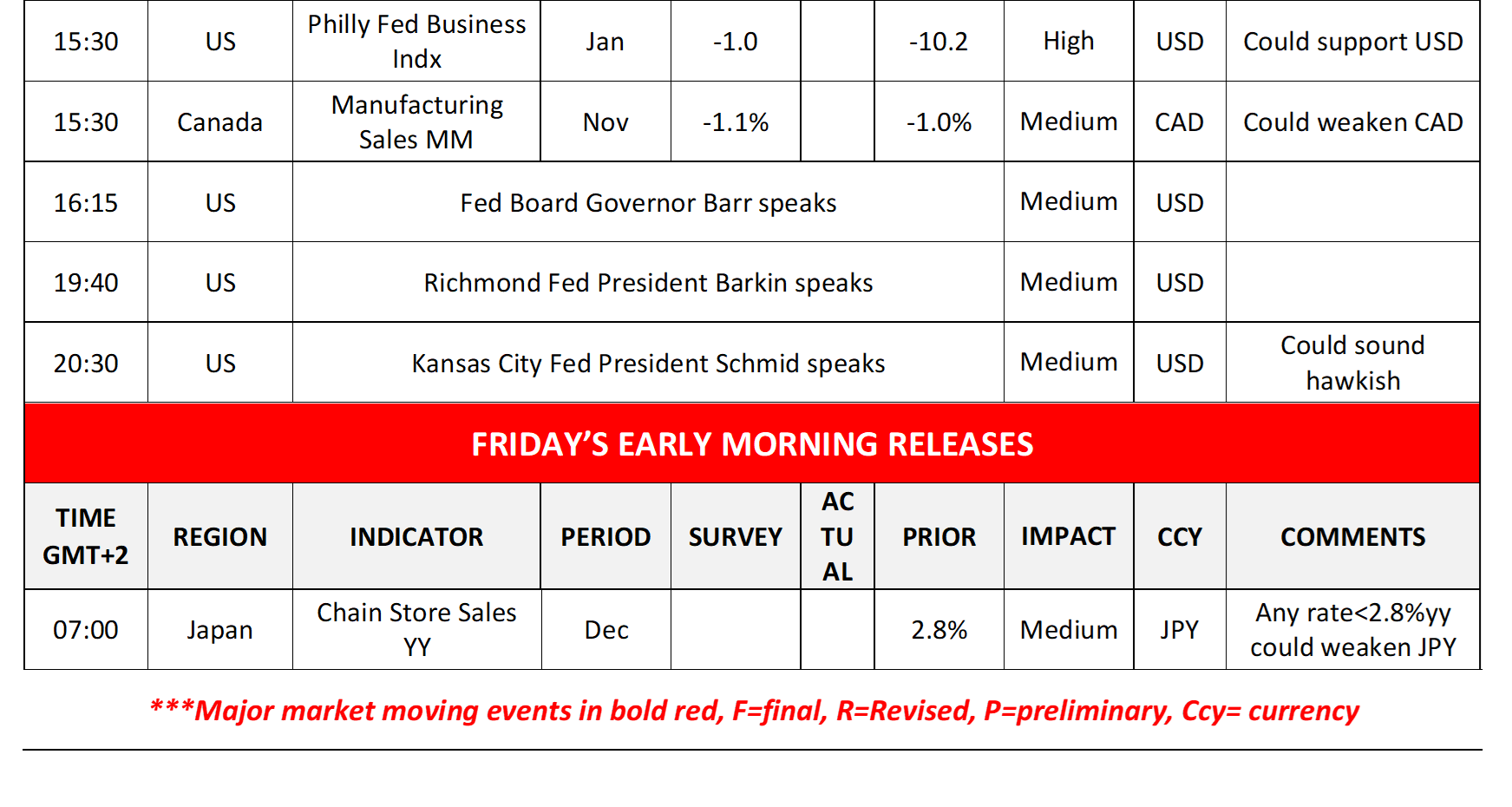

Today we get the UK GDP and manufacturing output growth rates for November, Sweden’s CPI rates for December, Germanys’ full year GDP rate for 2025, Euro Zone’s industrial output for November, Canada’s House Starts for December and Manufacturing sales for November, while from the USD we note the release of the NY Fed Manufacturing index for January, the weekly initial jobless claims figure and the Philly Fed Business index for January. On a monetary level, we note that Atlanta Fed President Bostic, Fed Board Governor Barr, Richmond Fed President Barkin and Kansas City Fed President Schmid are scheduled to speak. In tomorrow’s Asian session, we get Japan’s Chain Store Sales for December.

WTI Daily Chart

- Support: 59.80 (S1), 56.00 (S2), 51.40 (S3)

- Resistance: 62.40 (R1), 66.20 (R2), 70.00 (R3)

黄金/美元 日线图

- Support: 4550 (S1), 4380 (S2), 4245 (S3)

- Resistance: 4800 (R1), 5000 (R2), 5200 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.