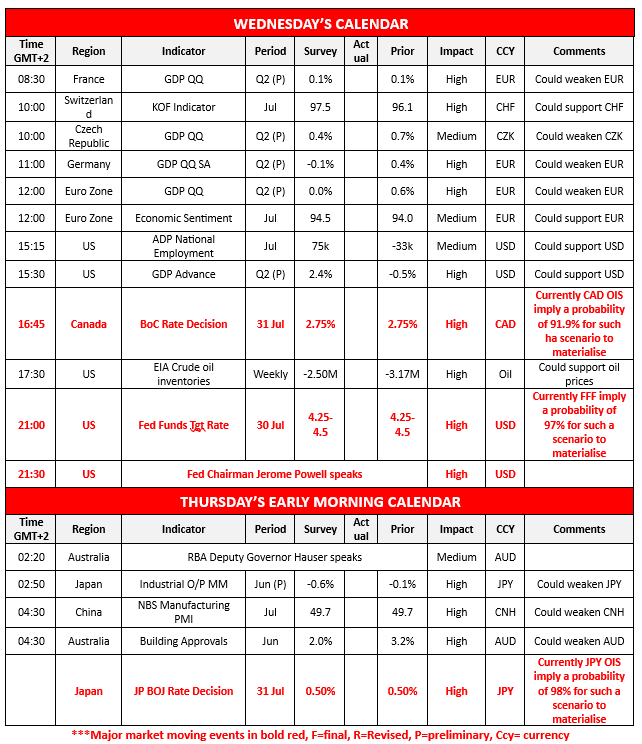

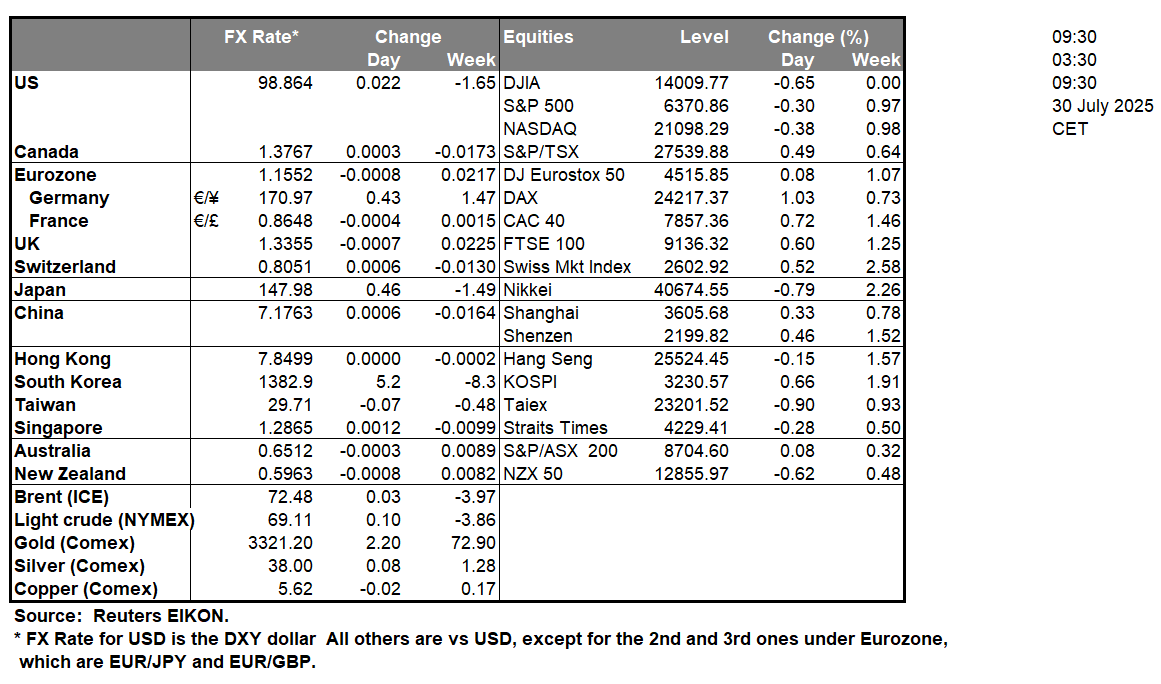

The USD continued to rise yesterday and today we highlight the release of the Fed’s interest rate decision. The bank is widely expected to remain on hold, yet Fed Fund Futures also suggest that the market expects the bank to cut rates in September and once more in December underscoring its dovish inclination. Should the bank remain on hold as expected, which is also our base scenario, we expect market attention to shift to the bank’s forward guidance, which is to be included in the bank’s accompanying statement and Fed Chairman Powell’s press conference. Should the bank sound ready to keep rates unchanged for longer, it may contradict the market’s expectations thus forcing it to reposition and such a scenario could provide considerable support for the USD while at the same time weigh on gold’s price and US stock markets. On the flip side, should the Fed sound dovish and ready for a rate cut in its next meeting, it could solidify the market’s dovish expectations thus weighing on the greenback and supporting gold’s price and the US equities markets. As for US stock markets we note that the earnings season is in full swing with attention being shifted to the tech sector, as today we get the releases of Microsoft and Meta, while tomorrow we get the earnings reports of Apple and Amazon.

North of the US border, the Bank of Canada is also to release its interest rate decision and is expected to remain on hold. In BoC’s case though, the market’s expectations are for the bank to remain on hold tomorrow and until the end of the year. Should the bank imply that it’s to keep rates steady, we may see the Loonie getting some slight support as such a scenario is already expected, while any hints for easing its monetary policy could weigh asymmetrically on the CAD.

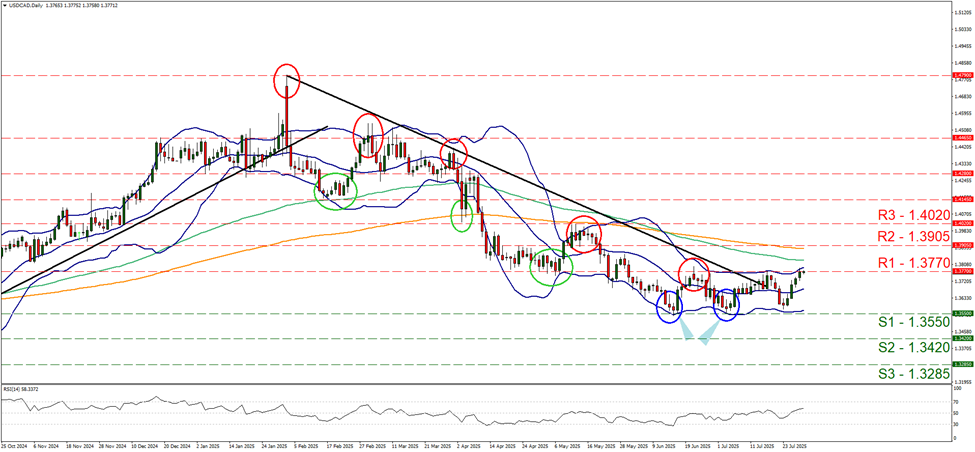

On a technical level, we note that USD/CAD continued to rise over the past few days testing the 1.3770 (R1) resistance line. For the time being we intend to maintain our bias for a sideways motion of the pair as long as its price action remains within the boundaries set by the 1.3770 (R1) resistance line and the 1.3550 (S1) support level. However, we also note that the RSI indicator has started to rise above the reading of 50 implying a possible bullish predisposition of the market for the pair. Yet for a bullish outlook we would require the pair to break the 1.3770 (R1) clearly and start aiming if not breaking the 1.3905 (S2) support level. A bearish outlook seems currently remote and for its adoption we would require the pair to retreat, break the 1.3550 (S1) support line and start aiming for the 1.3420 (S2) support base.

Also, we note in tomorrow’s Asian session the release from Japan of BoJ’s interest rate decision and the bank is expected to remain on hold tomorrow and proceed with a rate hike in its October meeting, hence the market is leaning on the hawkish side. We expect the bank to continue expect a rise of inflation which could imply a resumption of its rate hiking path and if so could provide some support for JPY.

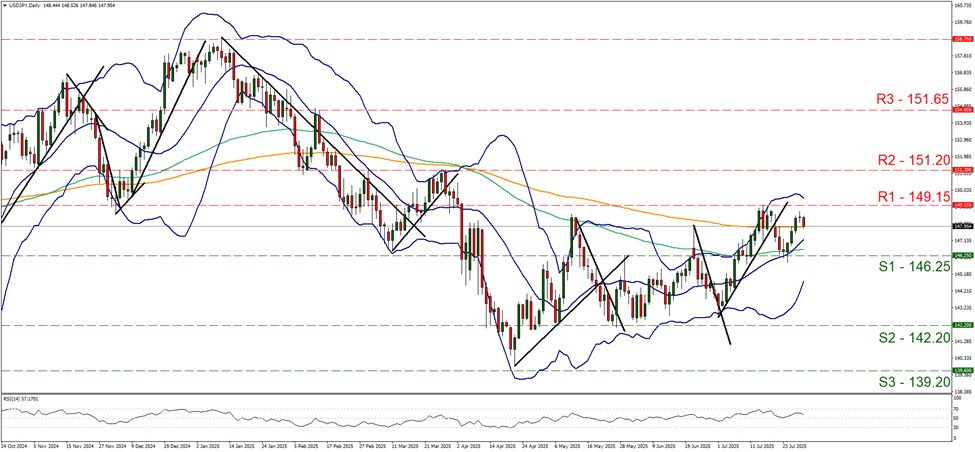

USD/JPY remained relatively stable yesterday and during today’s Asian session corrected lower, with its price action remaining well between the 149.15 (R1) resistance line and the 146.25 (S1) support line. We maintain our bias for the pair’s sideways motion to continue at the current stage and note the narrowing of the Bollinger bands which may imply lower volatility for the pair’s price action. Should the bulls take over we may see USD/JPY breaking the 149.15 (R1) resistance line and pave the way for the 151.20 (R2) resistance level. Should the bears take over, we may see the pair breaking the 146.25 (S1) support line and start aiming for the 142.20 (S2) support barrier.

今日其他亮点:

Today we get France’s, Germany’s, the Euro Zone’s, the Czech Republic’s and the US preliminary GDP rates for Q2, Euro Zone’s Sentiment for July, and the US ADP national employment figure for July.

USD/CAD Daily Chart

- Support: 1.3550 (S1), 1.3420 (S2), 1.3285 (S3)

- Resistance: 1.3770 (R1), 1.3905 (R2), 1.4020 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 142.20 (S2), 139.20 (S3)

- Resistance: 149.15 (R1), 151.20 (R2), 151.65 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.