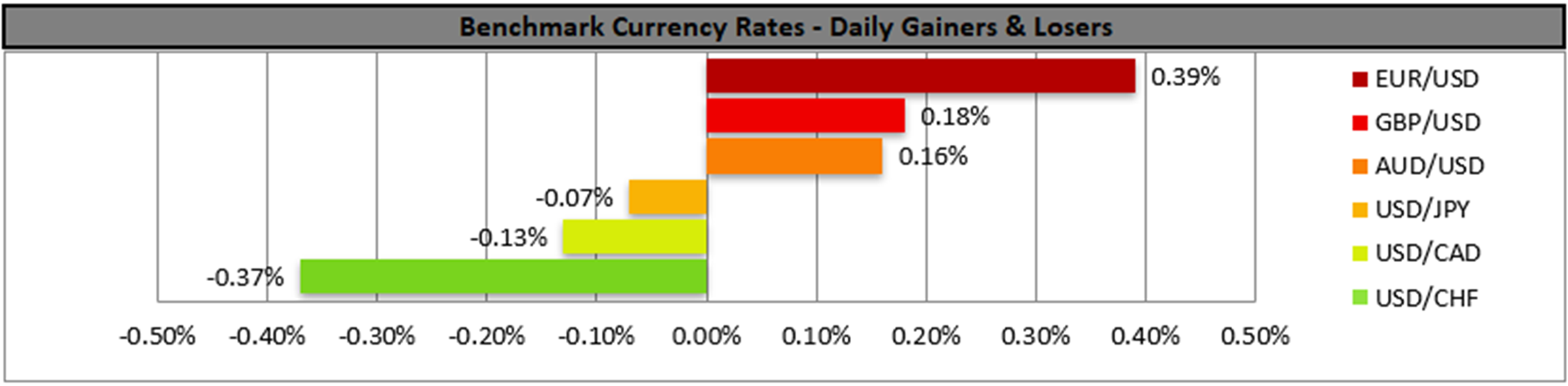

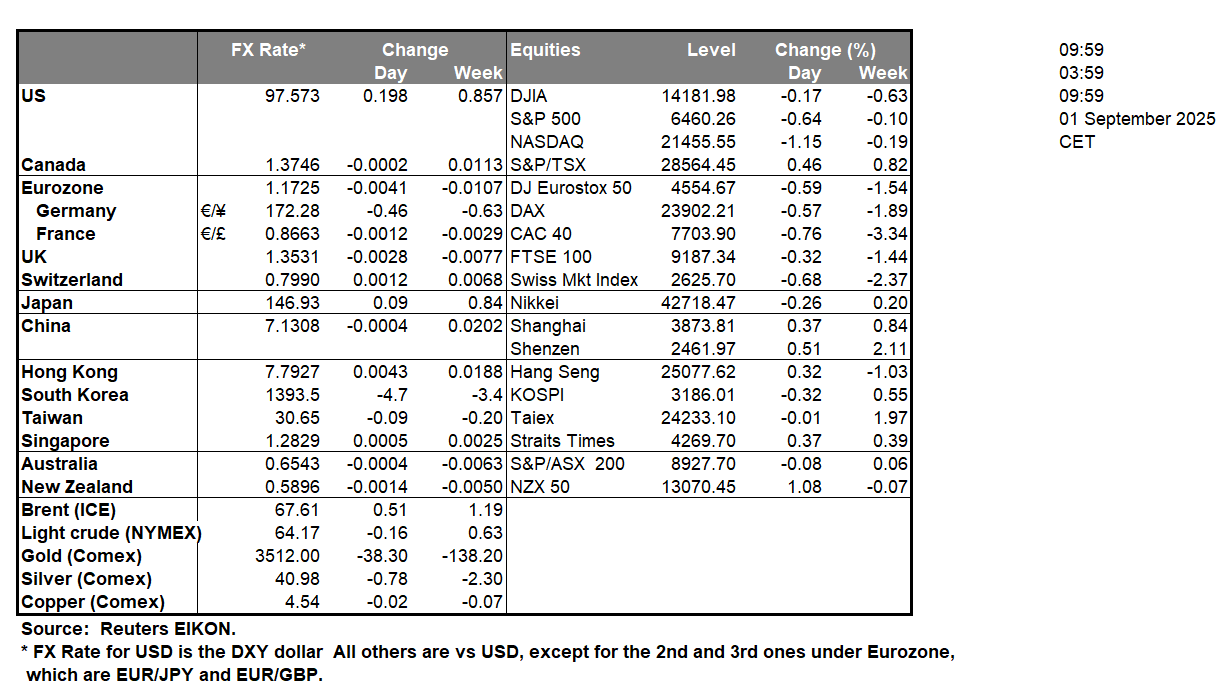

The USD edged lower against its counterparts in today’s Asian session, given that market worries are reignited as September begins. On a monetary level, the pressure of US President Trump on the Fed remains a key issue, especially after he fired Fed Board Governor Cook. Worries for the US labour market are high; thus, we highlight the release of the August US employment report on Friday and the market’s inclination for the Fed remains dovish feeding gold bulls and allowing the precious metal’s price to reach new record highs. Across the Atlantic, the French Government may be forced to step down, signaling political instability ahead, and given France’s fiscal black hole and systemic risk size for the Euro Zone, such events may shake the common currency. On a geopolitical level, the war in Ukraine is still in the market’s focus . Finally, US stock markets are near record highs which on the one hand implies optimism, yet on the other we are still worried that the rise may not be sustainable.

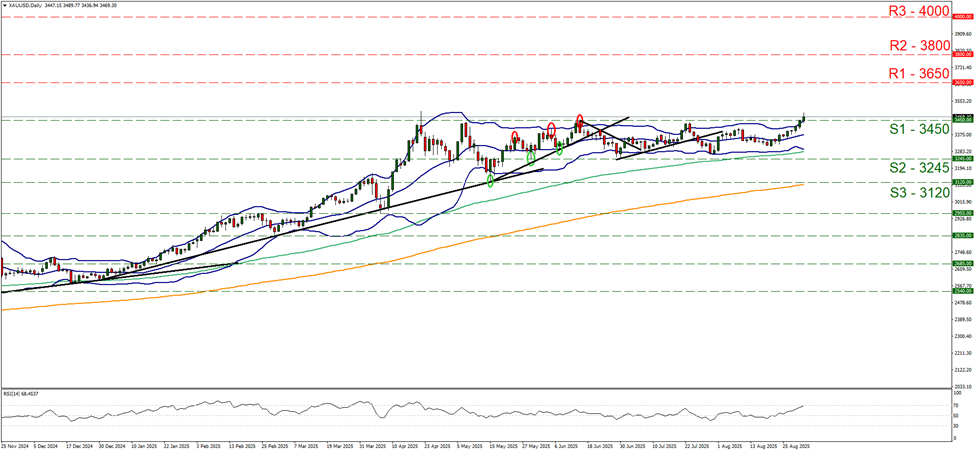

Gold’s upward motion has been maintained and during today’s Asian session broke the 3450 (S1) resistance line now turned to support. We maintain a bullish outlook for the precious metal’s price given also that the RSI indicator has reached the reading of 70, implying a strong bullish sentiment for gold’s price. Yet at the same time it could imply that the bullion may have neared overbought conditions and be ripe for a possible correction lower. Similar signals are being sent by the fact that gold’s price action is flirting with the upper Bollinger band. Should the bulls maintain control we may see gold’s price surpassing $3500, which was a prior record high level, and start aiming for the 3650 (R1) line. Should the bears take over, we may see gold’s price reversing direction, breaking the 3450 (S1) line and continue to aim if not reach the 3245 (S2) level.

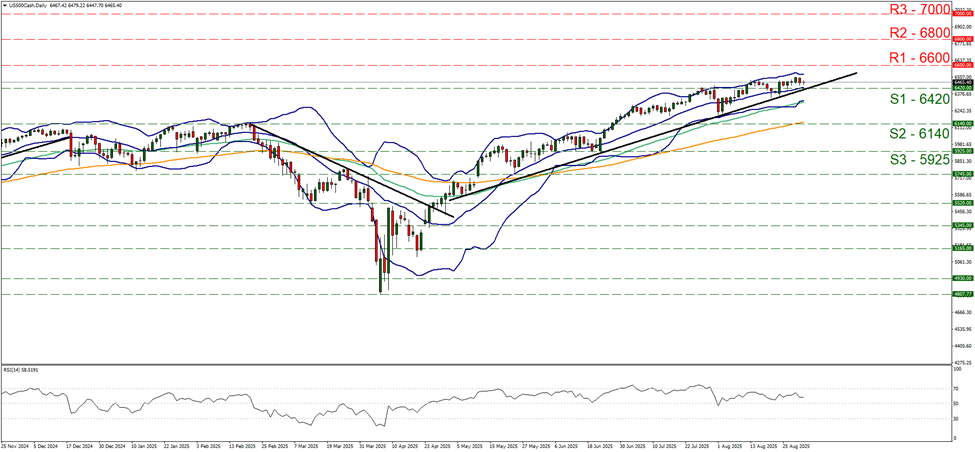

S&P 500 remained relatively stable just over the 6420 (S1) support line. We intend to maintain our bullish outlook for the index as long as the upward trendline guiding it since the 1str of May remains intact. Should the bulls remain in control of the index’s price action we may see it reaching new record high levels and set the next possible target for the bulls at the 6600 (R1) resistance level. Should the bears take over, we may see S&P 500 reversing course, breaking the prementioned upward trendline, breaking the 6420 (S1) support line and starting to aim for the 6140 (S2) support base.

今日其他亮点:

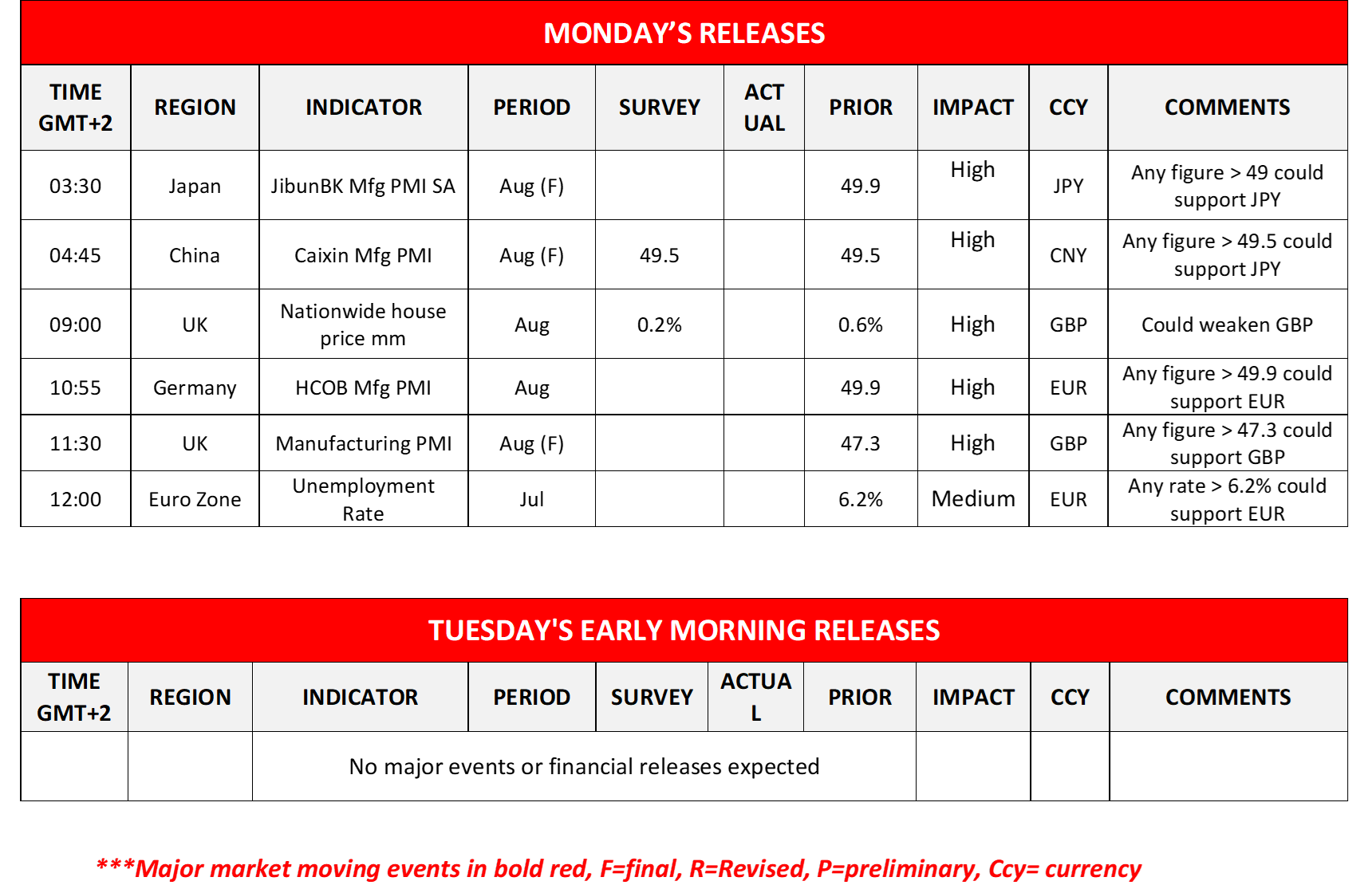

Today we get Japan’s final Jibun manufacturing PMI figure for August and China’s final Caixin manufacturing PMI figure for August, the UK’s Nationwide house prices rate for August, Germany’s HCOB manufacturing PMI figure and the UK’s manufacturing PMI figure both for August and ending the day is the Eurozone’s unemployment rate for July.

本周

On Tuesday, we get the Eurozone’s preliminary HICP rate, Canada’s manufacturing PMI figure and the US ISM manufacturing PMI figure all for the month of August. On Wednesday, we get Australia’s GDP rate for Q2, China’s Caixin services PMI figure, Turkey’s CPI rate and France’s services PMI figure all for August, followed by the US’s factory orders rate and JOLTS Job openings figure both for July. On Thursday, we get Australia’s trade balance figure for July, Sweden’s, Switzerland’s and the Czech Republic’s CPI rates and the US ADP national employment figure all for the month of August, Canada’s trade balance figure for July and the US ISM non-manufacturing PMI figure for August. On Friday, we get Germany’s industrial orders rate for July, the UK’s Halifax house prices rate for August, the UK’s retail sales rate for July, the Eurozone’s revised GDP rate for Q2, the US Employment data for August, Canada’s employment data for August and Canada’s Ivey PMI figure for August.

黄金/美元 日线图

- Support: 3450 (S1), 3245 (S2), 3120 (S3)

- Resistance: 3650 (R1), 3800 (R2), 4000 (R3)

S&P 500 Daily Chart

- Support: 6420 (S1), 6140 (S2), 5925 (S3)

- Resistance: 6600 (R1), 6800 (R2), 7000 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.