黄金 edged higher since our last report and reached its highest levels since mid-June of 2022. The precious is currently consolidating its gains near the $1880 level ahead of today’s highly anticipated Fed Chair Powell’s speech and tomorrow’s crucial CPI print. A softer-than-expected NFP print last Friday, as well as a deterioration in the US services industry, which contracted the most in over two and half years, bolstered speculations that the central bank will be forced to slow down its tightening efforts and helped put a floor under the bullion’s price, aiding to its advance higher. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

Softer-than-expected employment data boosts the bullion

Last week, a paradoxical reaction was observed from the markets as the latest round of employment data showcased, that despite some apparent softening in the NFP figure 和 average weekly earnings, the labour market remains resilient by historical standards. Market participants, appear to be underestimating the resolve of the US central bank, as they progressively bet that the Fed will not raise rates beyond the 5% target level and will be forced to pivot 和 cut rates later this year. Currently, the Fed’s Funds Futures expect the bank to opt for a 25-basis point rate hike in the upcoming February meeting, basing their assessment on improved economic data and decelerating inflationary pressures. Meanwhile, the central bank according to its latest meeting minutes foresees no rate cuts in 2023 and a terminal rate rising above the 5% target. The divergence in what the Fed states it will do and what the market hears and interprets may very well lead to increasingly higher levels of implied volatility, which could pose a detrimental risk to the function of the markets. The conclusion from the reactions could therefore be, that the market is increasingly placing heavier reliance on the effect of incoming data, adjusting their projections accordingly and paying diminishing attention to the broadcasted narrative of the Fed. Nonetheless, the bullion continues to find support from the prospect of less-hawkish interest rate hike expectations, which polish the appeal of the shiny metal, as the greenback creeps lower, failing to gain traction.

Fed Chair Powell speaks today

The head of the Federal Reserve is scheduled to make an appearance at the Riksbank Symposium held in Sweden later today and the market participants will be looking attentively to the comments of the Chair, who may possibly reveal insights to the central banks’ future hike path. Should the contents of the speech contain hawkish undertones calling for more rate hikes, the precious may be subject to short-term downward pressures, easing further from its 8-month peak, ahead of Thursday’s highly anticipated US inflation print. Earlier this week, San Francisco Fed President Daly pointed out that interest rates will need to surpass 5% in order to successfully tackle inflation, but how far beyond 5% is “currently unclear”. She also stated that the pace of hikes depends on incoming information, reiterating the Fed’s stance on assessing the situation in a “data depended” fashion. Atlanta Fed President Bostic also shared similar views, stating that the central bank has more work to do, yet at a more moderate pace, as the bank moves closer to its projected terminal rate. Comments from the aforementioned policymakers for more rate increases to dampen demand, mirror statements of St. Louis Fed President Bullard last week, showcasing once again that the narrative put forth remain unanimous, adding to the credibility of the committee.

Inflation print the main event

On Thursday, the markets’ attention is expected to shift towards the CPI print of December which will give details on where the inflationary problem stands in the US. According to estimates, December’s year-on-year CPI rate is expected to decelerate from 7.1% to 6.5% and likewise, the year-on-year Core CPI rate for the same month is set to ease to 5.7% from the 6.0% recorded in the previous month. Should the actual rates meet their respective expectations, that would imply that inflationary pressures are abiding 和 may intensify speculations that the Fed will consider slowing down its monetary policy tightening efforts. As a result, we may see the dollar facing further downward pressures and on the contrary, the precious’ price receive support.

Technical Analysis of Gold

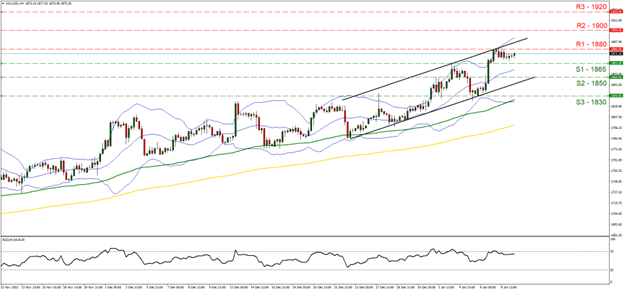

黄金/美元4小时走势图

- Support: 1865 (S1), 1850 (S2), 1830 (S3)

- Resistance: 1880 (R1), 1900 (R2), 1920 (R3)

Looking at XAUUSD 4-hour chart we observe that gold continues to move to the upside as indicated by the ascending channel and it is currently attempting to consolidate its gains at the $1875 level. We hold a bullish outlook bias for the precious and supporting our case is the RSI indicator below our 4-hour chart which registers a value of 68, highlighting the bullish sentiment surrounding the commodity. The fact that the price action trends above the midline of the Bollinger bands and repeatedly attempts to break above the upper bound also adds to our case for an extension of the move to the upside. Should the bulls continue to drive the price action higher, we may see a break above the $1880 (R1) resistance level and the possible challenge of the $1900 (R2) resistance barrier. Should on the other hand the bears take the initiative, we may see the break below the 1865 (S1) support level and move closer to the $1850 (S2) support base.

免责声明:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.