The fragile ceasefire agreement between Israel and Iran appears to be holding up for now in spite of yesterday’s drone attacks. In particular, the violation of the ceasefire agreement drew the Ire of the US President and in particular, Israel’s decision to retaliate. Specifically, the US President stated that “ISRAEL. DO NOT DROP THOSE BOMBS. IF YOU DO IT IS A MAJOR VIOLATION. BRING YOUR PILOTS HOME, NOW! DONALD J. TRUMP, PRESIDENT OF THE UNITED STATES”. Nonetheless, the ceasefire agreement appears to be holding for now, which in turn may have alleviated market worries in regards to the vital oil artery of the Hormuz Strait and thus may have weighed on oil prices. Moreover, the easing of geopolitical tensions may have weighed on gold’s price as well. In our view, the easing of tensions is a positive development, but with Iran’s Foreign Minister stating that Iran will not abandon its nuclear program and their decision so suspend cooperation with the IAEA may place the two countries at odds once again in the near future.Over in Japan, BOJ Tamura stated per some sources that the “BOJ should raise rates in several stages with 1% in mind if likelihood of durably achieving 2% inflation heightens”, which may imply that the bank could be preparing to raise rates in the near future. Such a scenario could possibly aid the JPY. Moreover, concern over the inflation outlook appears to have been a matter of concern amongst policymakers according to the bank’s summary of opinions which was released during today’s Asian session.In Europe Germany’s Ifo business climate figure came in slightly better than expected which in turn may have aided the EUR during yesterday’s trading session.

XAU/USD appears to be moving in a predominantly sideways bias. We opt for a sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 which tends to imply a neutral market sentiment. However, the MACD indicator below our chart which tends to imply bearish market tendencies. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and the 3385 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2). Lastly, for a bullish outlook we would require a clear break above the 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

EUR/USD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our charts which currently registers a figure above 60, implying a bullish market sentiment, in addition to our MACD indicator below our chart. For our bullish outlook to be maintained we would require a clear break above the 1.1685 (R1) resistance level, with the next possible target for the bulls being the 1.1885 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between the 1.1445 (S1) support level and the 1.1685 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.1445 (S1) support level, with the next possible target for the bears being the 1.1185 (S2) support line,

今日其他亮点:

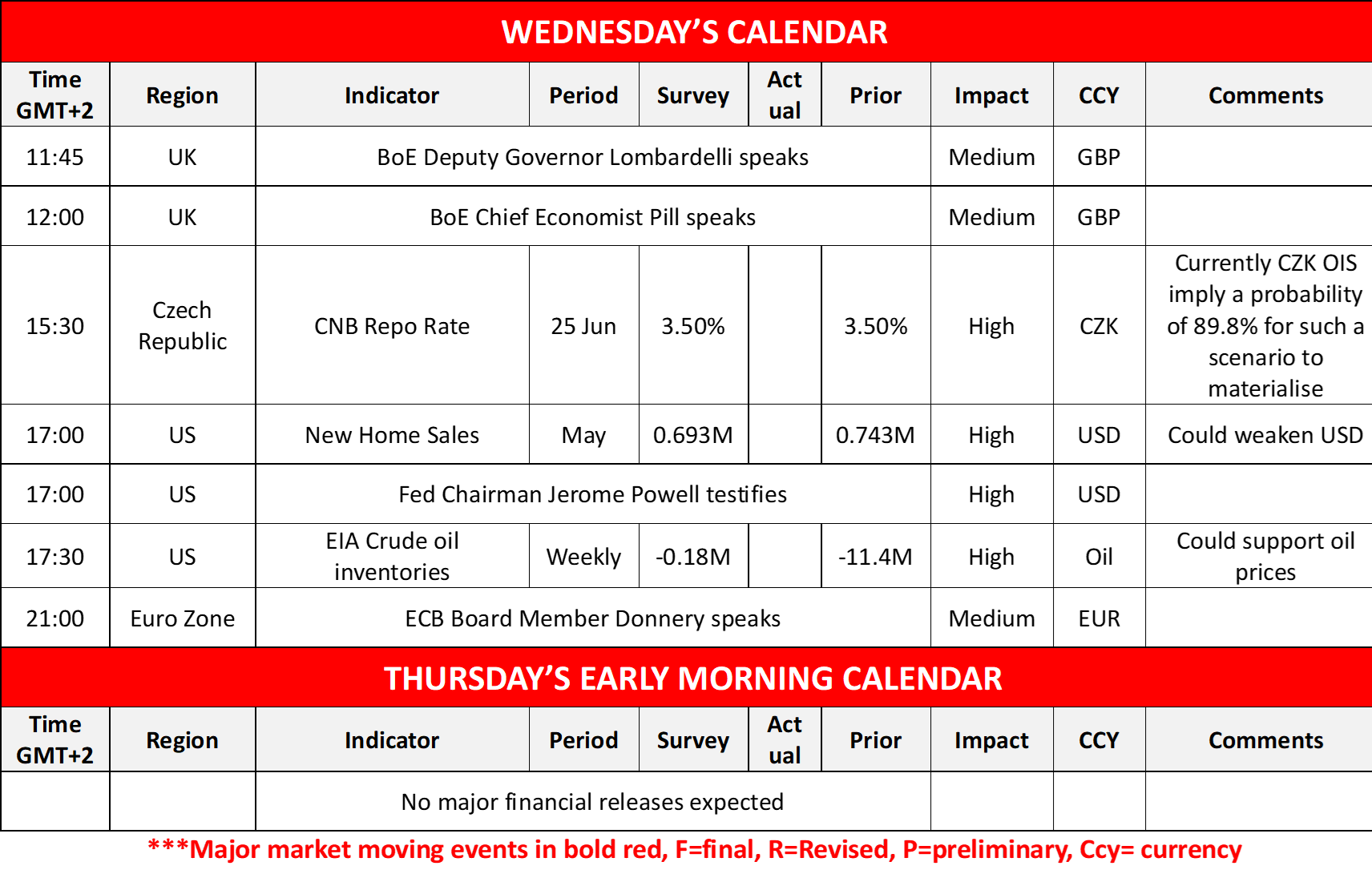

Today we note the release from the Czech Republic, CNB’s interest rate decision, and from the US the new home sales figure for May, while oil traders may be more interested in the release of EIA’s weekly crude oil inventories figure. On a monetary level, we note that BoE’s Lombardelli and Pill, ECB’s Donnery are scheduled to speak, while we highlight the second testimony of Fed Chairman Powell before the US Congress.

黄金/美元 日线图

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

EUR/USD Daily Chart

- Support: 1.1445 (S1), 1.1185 (S2), 1.0950 (S3)

- Resistance: 1.1685 (R1), 1.1885 (R2), 1.2070 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.