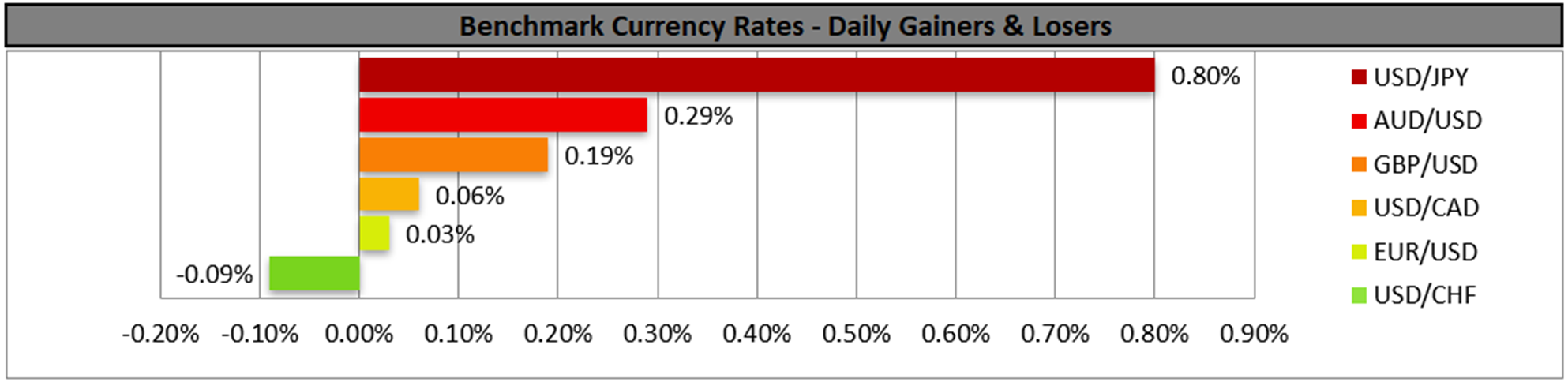

JPY weakened across the board on Friday. Given the release of BoJ’s interest rate decision as the bank, despite hiking rates as expected, failed to provide clear hawkish signals in its forward guidance. It should also be noted that the Japanese officials seemed to intensify their warnings for a possible market intervention to the JPY’s rescue. In today’s Asian session, JPY officials highlighted their concerns for a “one-sided and sharp” JPY moves in the FX market and warned that they are ready to “take appropriate actions“, a clear innuendo for a possible market intervention. Yet the market seems to bypass such comments, possibly estimating that any market intervention may provide only temporary support for JPY. We highlight the planned speech of BoJ Governor Ueda on Christmas Day, and a verbal market intervention is possible yet we also intend to focus on any further clues regarding the bank’s intentions.

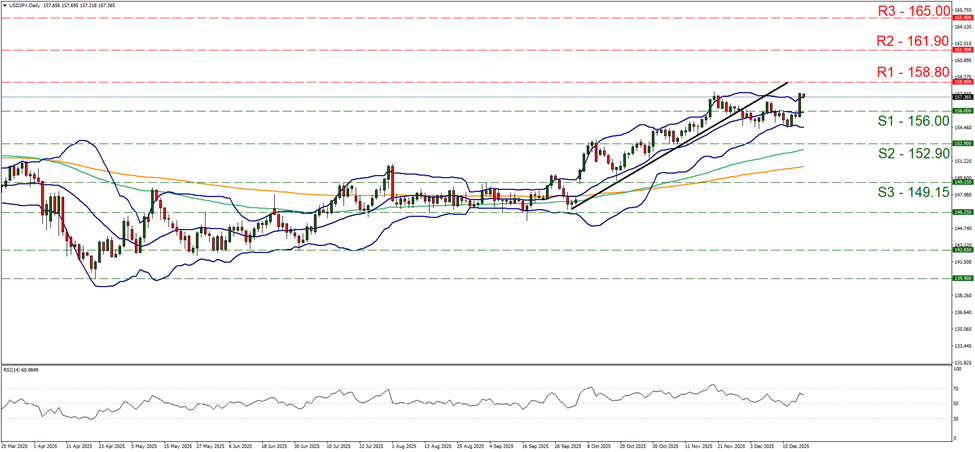

USD/JPY rose on Friday breaking the 156.00 (S1) resistance line, now turned to support. The pair’s price action seems to have stabilised, as it hit the upper Bollinger band, while the RSI indicator escaped the boundaries of the reading of 50 and rose signaling a strengthening bullish market sentiment for the pair. We adopt a bullish outlook for the pair, yet warn for the stabilisation of the pair to be extended. Should the bulls maintain control, we may see the pair breaking the 158.80 (R1) resistance line and thus pave the way for the 161.90 (R2) resistance hurdle. Should the bears take over, we may see the pair reversing direction, breaking the 156.00 (S1) support line and start aiming if not breaching the 152.90 (S2) support barrier.

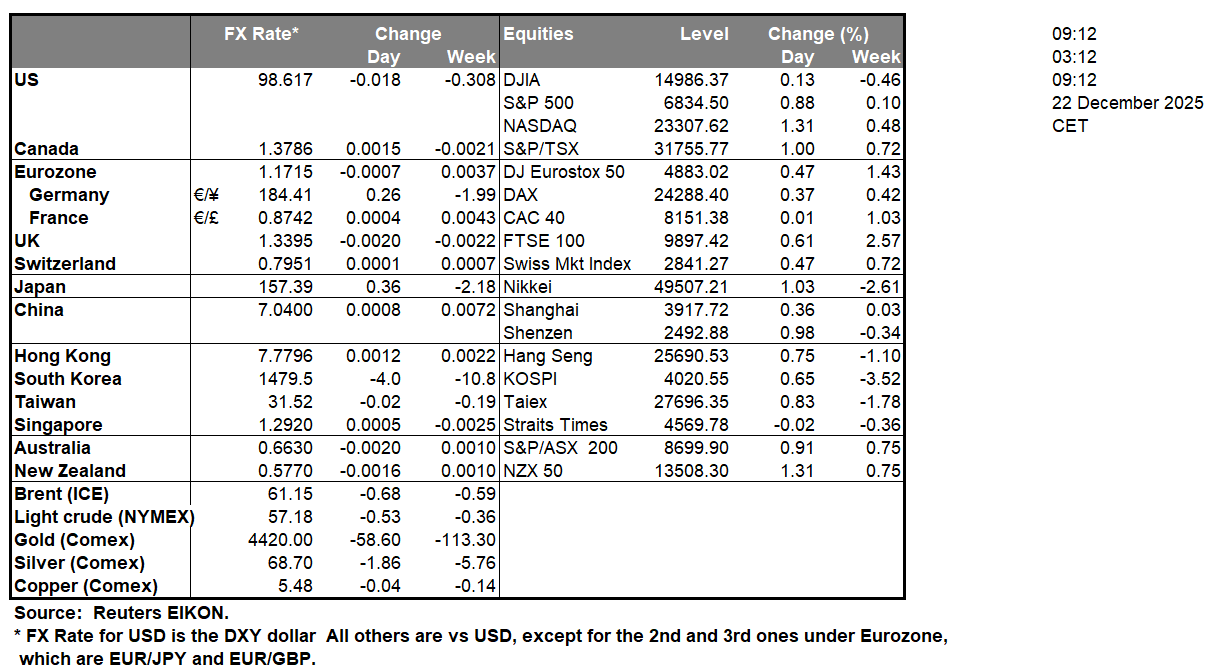

Also, we highlight the rise of gold’s price reaching new record highs. The precious metal’s price seems to be supported by increased market expectations for the Fed to cut rates further but also geopolitical uncertainty seems to be driving safe haven inflows for gold. On a monetary level, we note that the market is currently expecting the bank to proceed with two more rate cuts in the coming year, despite Fed policymakers signaling only one rate cut to come. We also highlight the rally of silver’s price which in new record highs, but we also note the strengthening of copper’s price.

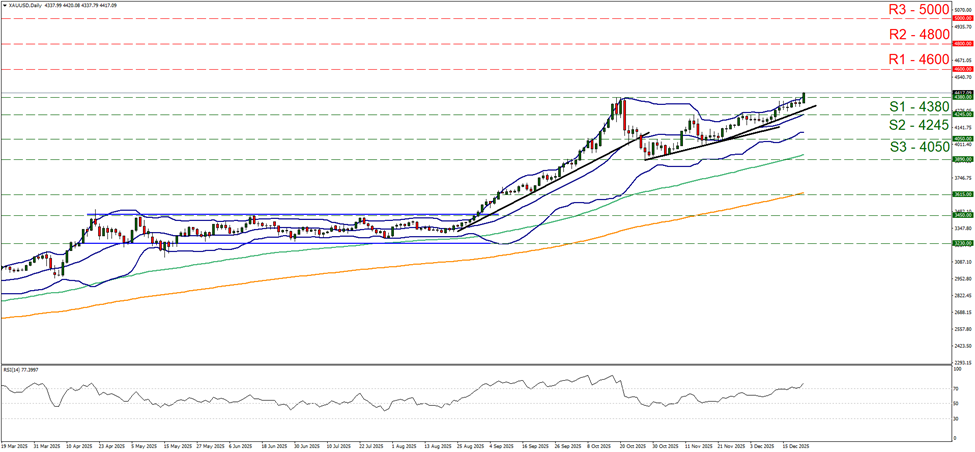

Gold’s price also rose in today’s Asian session, breaking the 4380 (S1) resistance line now turned to support, reaching new All Time High (ATH) levels. We intend to maintain a bullish outlook for the precious metal’s price as long as the upward trendline guiding it remains intact. The RSI indicator remains above the reading of 70, signaling a strong market sentiment for gold’s price, while at the same time may imply that gold’s price has reached over bought levels and may be ripe for a correction lower. Similar signals are coming from the price action reaching the upper Bollinger band. Should the bulls maintain control over gold’s price we may see it aiming for the 4600 (R1) line. Should the bears take over we may see gold’s price reversing course, breaking initially the 4380 (S1) line and continue to break the prementioned upward trendline in a first signal of an interruption of the upward movement and continue to break the 4245 (S2) support level.

今日其他亮点:

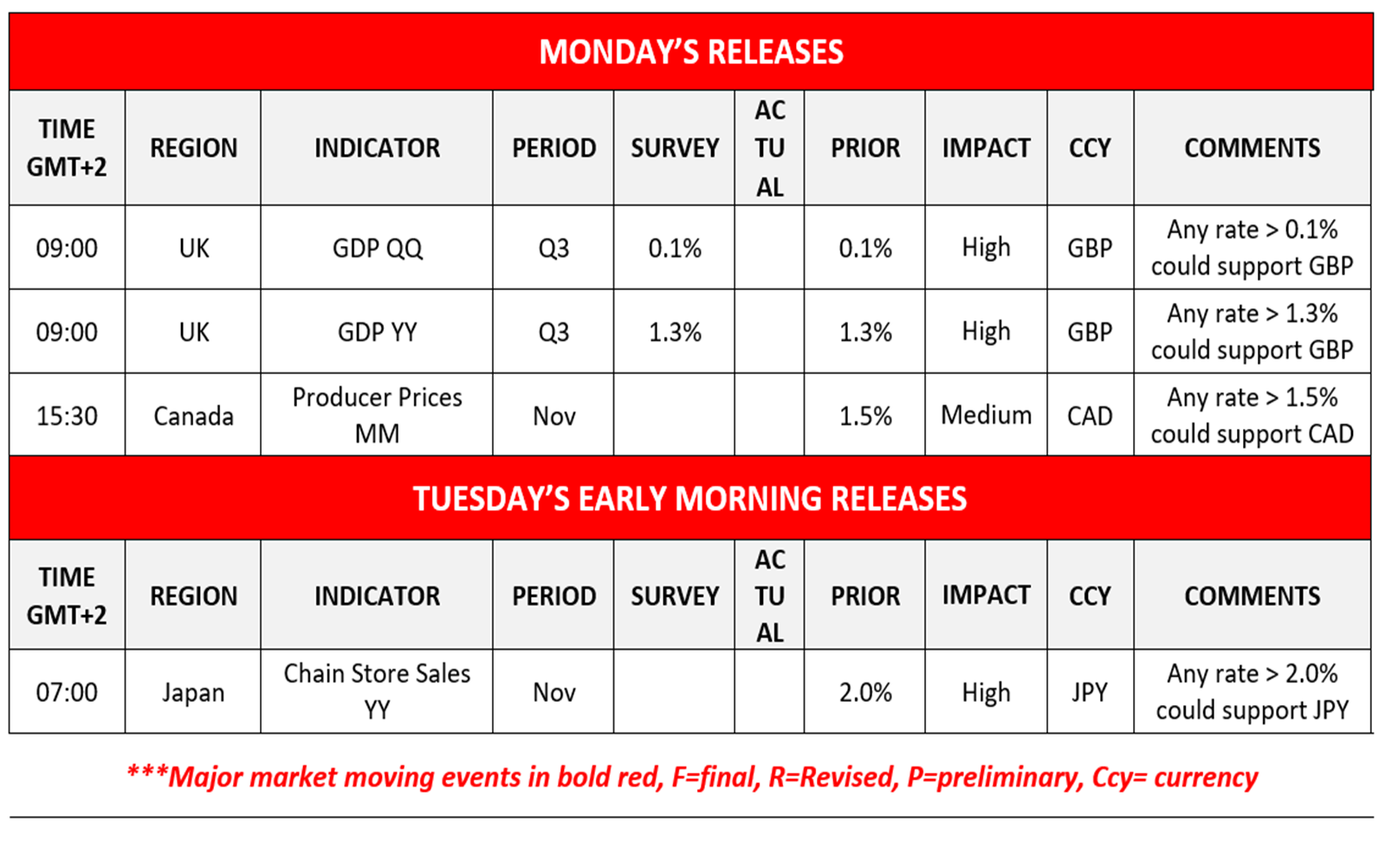

Today, we get the UK’s GDP rates for Q3 and Canada’s producer prices rate for November during today’s American trading session. In tomorrow’s Asian session, we note Japan’s November chain stores sales rate.

本周

On Tuesday, the 23rd of December we get the US preliminary GDP advance rate for Q3, Canada’s GDP Rate for October, the US industrial output for the same month and the US consumer confidence for December. On Wednesday, the 24th of December we get from Japan BoJ’s October meeting minutes and from the US the weekly initial jobless claims figure, while the following day BoJ Governor Ueda is scheduled to speak and on Friday we get from Japan the December CPI rates of Tokyo and the preliminary industrial output rate for November.

USD/JPY Daily Chart

- Support: 156.00 (S1), 152.90 (S2), 149.15 (S3)

- Resistance: 158.80 (R1), 158.80 (R2), 161.90 (R3)

黄金/美元 日线图

- Support: 4380 (S1), 4245 (S2), 4050 (S3)

- Resistance: 4600 (R1), 4800 (R2), 5000 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.