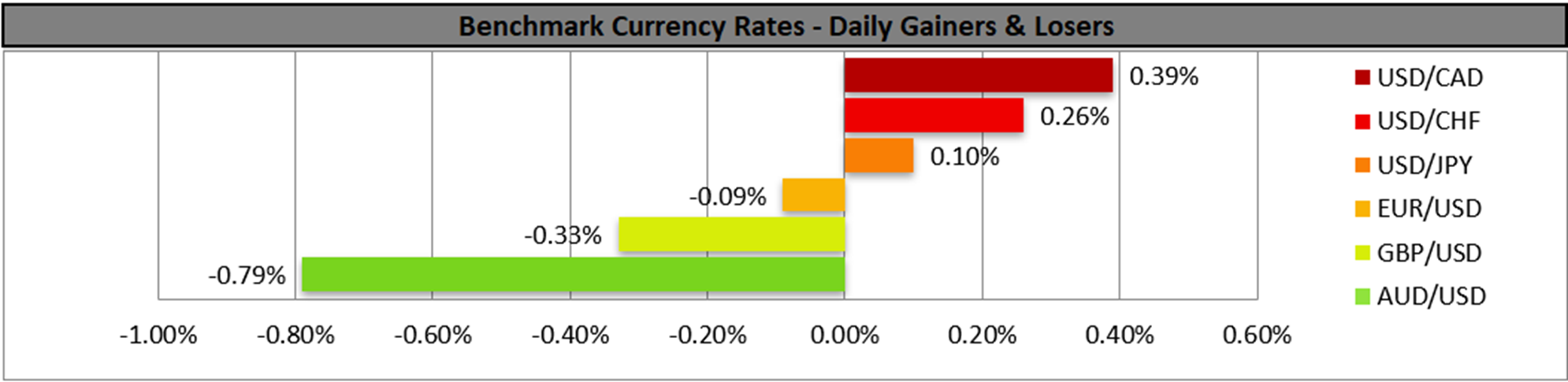

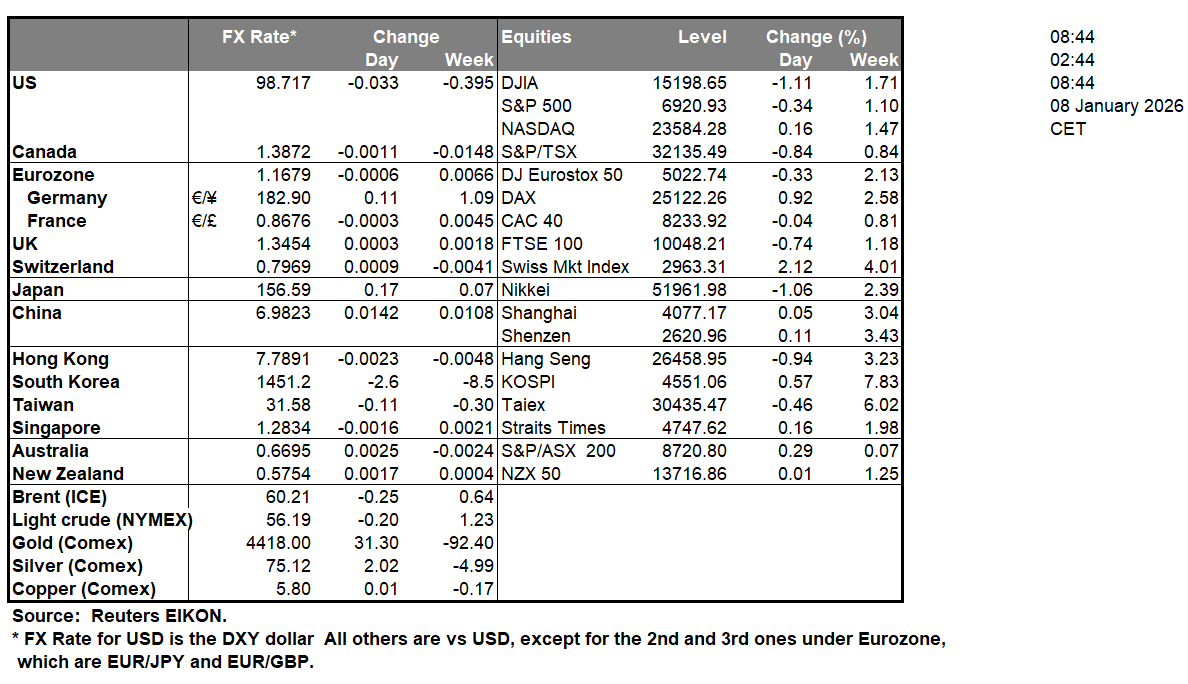

The greenback strengthened in the FX market yesterday and market focus is turning increasingly towards the release of the US employment report for December tomorrow. Financial releases yesterday tended to send mixed signals for the US employment market with the Jolts job openings figure showing that hirings in November dropped, while the ADP national employment figure edged lower, yet the drop may be regarded as immaterial. Also, we note that economic activity in the US services sector picked up, somewhat more than expected in the past month, while factory orders declined. On a monetary level, we note that the market still expects the Fed to cut rates twice in the coming year, in April and July, despite Fed policymakers signaling only one rate cut in their latest dot plot. Hence, we still detect a dovish predisposition of the markets which is weighing on the USD. Please note that the USD has weakened notably in the past year with the market’s expectations for the Fed’s intentions being one of the main catalysts. On a deeper fundamental level, we note that markets were little affected by geopolitical issues, with tensions rising. The US action in Venezuela failed to lower oil prices, as these lines are written, while tensions between China and Japan about Taiwan may intensify safe-haven demand, especially should they escalate further. Another issue that we note is the potential release of the US Supreme Court’s ruling on the legality of US President Trump’s tariffs, possibly on Friday. The uncertainty about the timing of the release as such adds an element of uncertainty, besides what the ruling actually will be. Should we see the US Supreme Court ruling that the tariffs are constitutional, it could provide some moderate support for the USD, as the US dominance on trading would be reinforced.

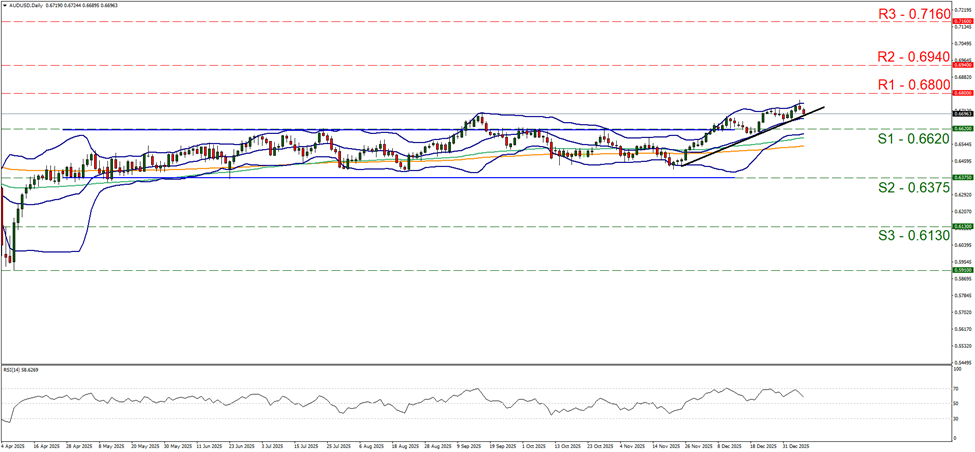

In the FX market AUD/USD dropped yesterday and during today’s Asian session yet is still within the boundaries set by the 0.6800 (R1) resistance level and the 0.6620 (S1) support line. The upward trendline guiding the pair since the 25th of November remains intact hence we maintain our bullish outlook for the pair at the current stage. The RSI indicator has dropped yet is still above the reading of 50, which tends to imply that the bullish market sentiment has eased for the pair. Should the bulls maintain control, we may see AUD/USD breaching the 0.6800 (R1) resistance line and start aiming for the 0.6940 (R2) resistance level. Should the bears take over, we may see the pair reversing course, breaking initially the prementioned upward trendline in a first signal of an interruption of the pair’s upward movement continue to break the 0.6620 (S1) support line clearly and start aiming for the 0.6375 (S2) support level.

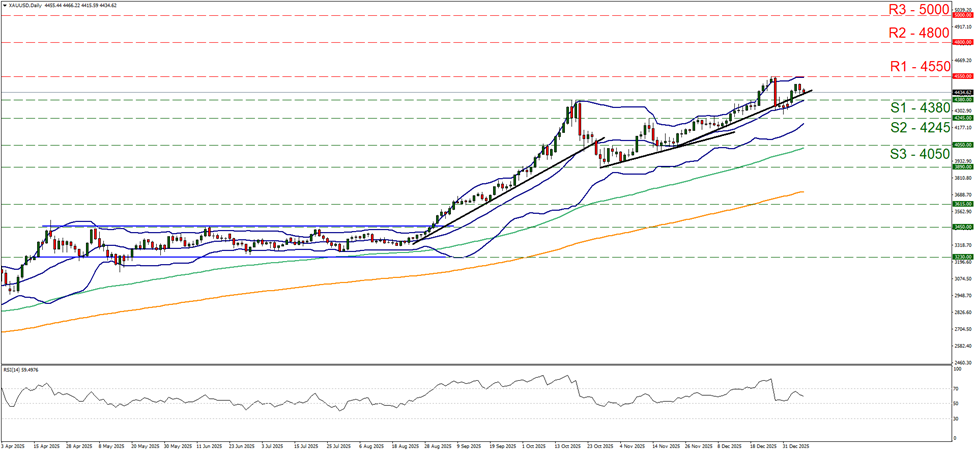

Gold’s price edged lower yesterday and during today’s Asian session remaining well between the 4380 (S1) support line and the 4550 (R1) resistance level. The RSI indicator remains between the reading of 50 and 70, implying a bullish predisposition of the market for the precious metal’s price. For the time being we maintain our bias for a sideways motion of the precious metal’s price and for the adoption of a bullish outlook we would require gold’s price to break the 4550 (R1) resistance line, and we set as the next possible target for gold’s bulls the 4800 (R2) resistance level. For a bearish outlook to emerge for gold’s price we would require gold’s price to break the 4380 (S1) support line and start aiming if not reaching the 4245 (S2) support barrier.

今日其他亮点:

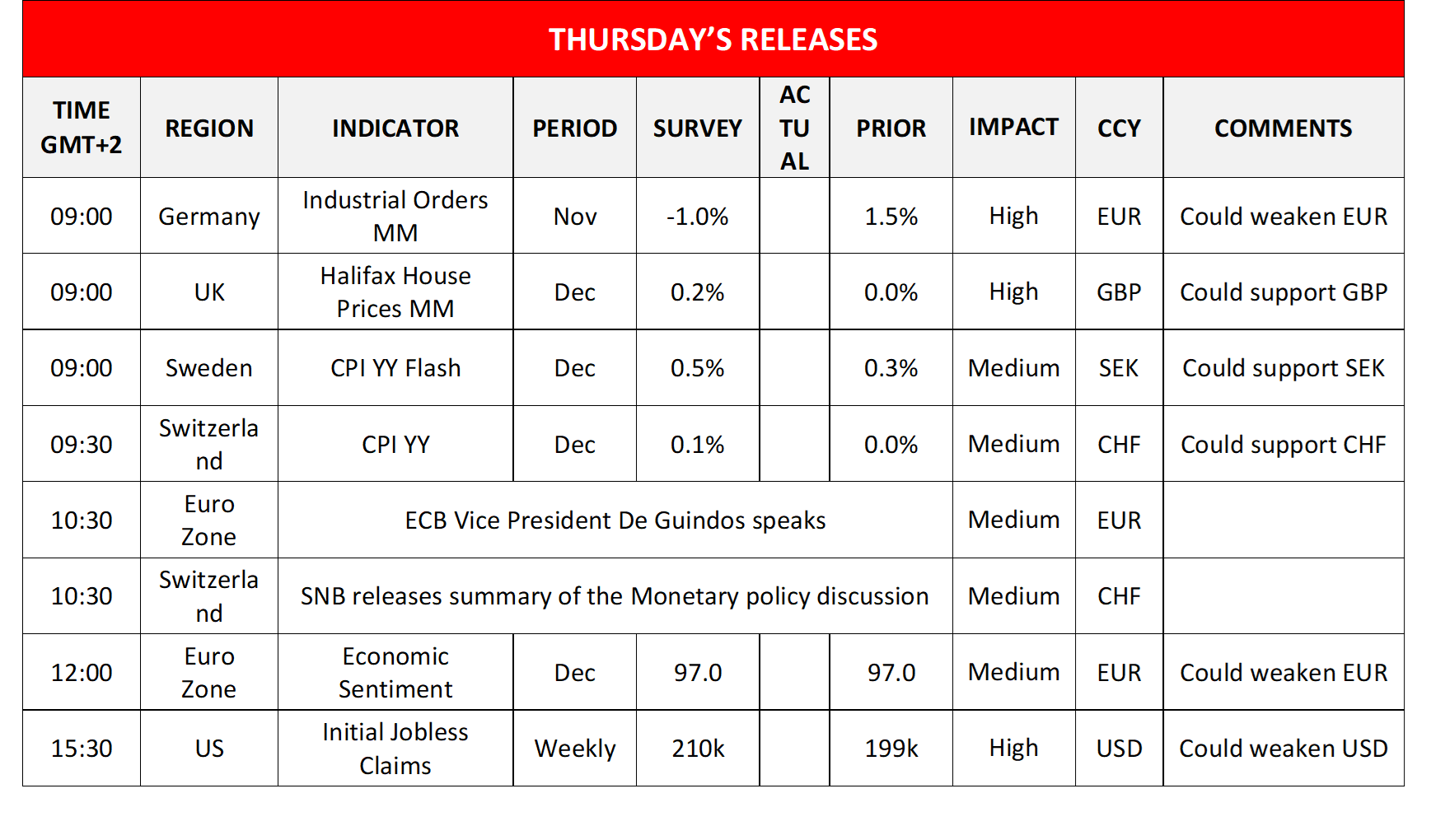

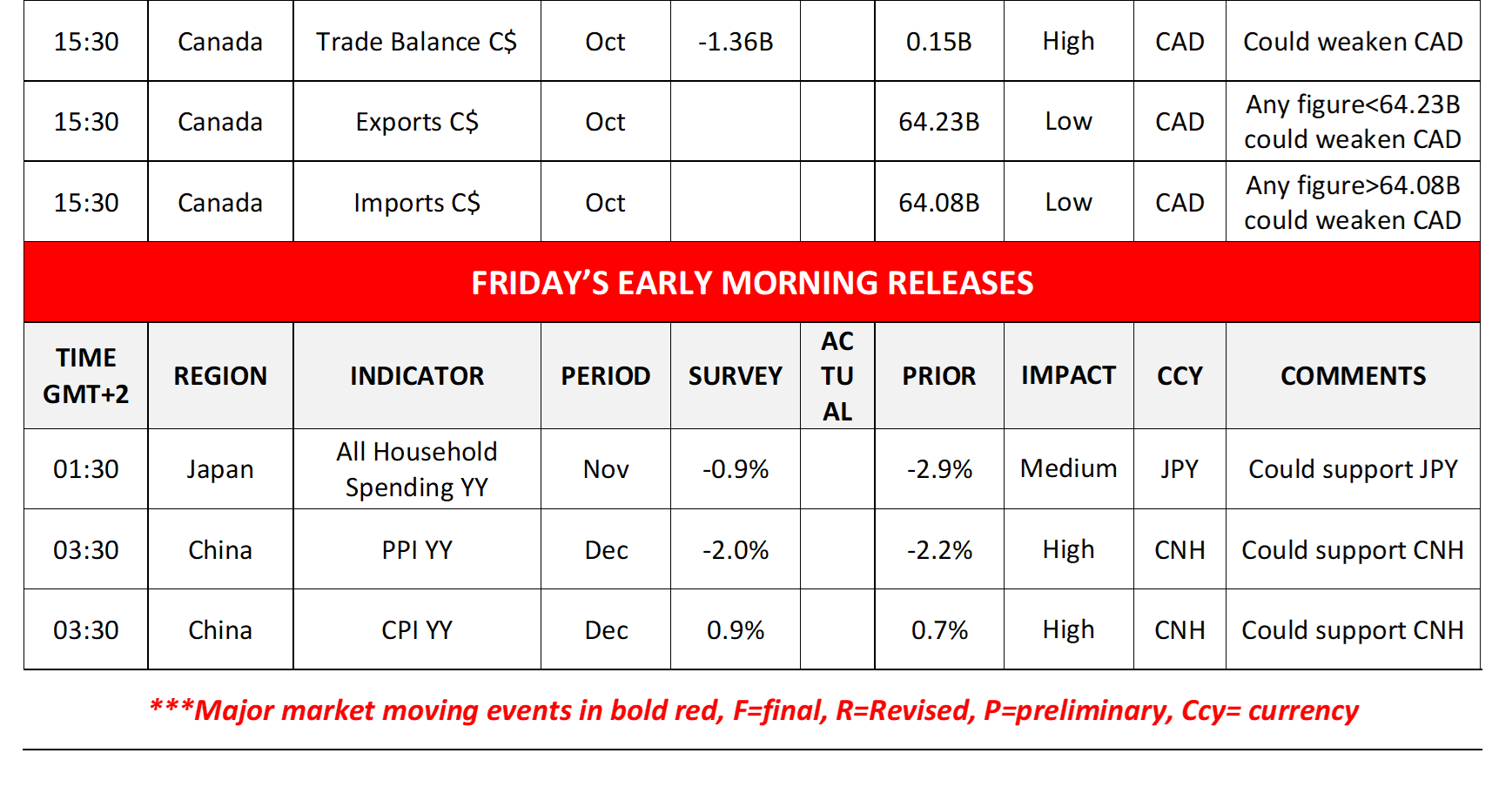

Today we get Germany’s industrial orders for November, UK’s Halifax House prices for December, Sweden’s and Switzerland’s CPI rates for December, Euro Zone’s economic sentiment for December, the US weekly initial jobless claims figure and Canada’s October trade data. On a monetary level, ECB’s Vice President De Guindos speaks, while SNB releases the summary of the Monetary policy discussion. In tomorrow’s Asian session, Japan’s All Household spending for November and China’s inflation metrics for December.

AUD/USD Daily Chart

- Support: 0.6620 (S1), 0.6375 (S2), 0.6130 (S3)

- Resistance: 0.6800 (R1), 0.6940 (R2), 0.7160 (R3)

黄金/美元 日线图

- Support: 4380 (S1), 4245 (S2), 4050 (S3)

- Resistance: 4550 (R1), 4800 (R2), 5000 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.