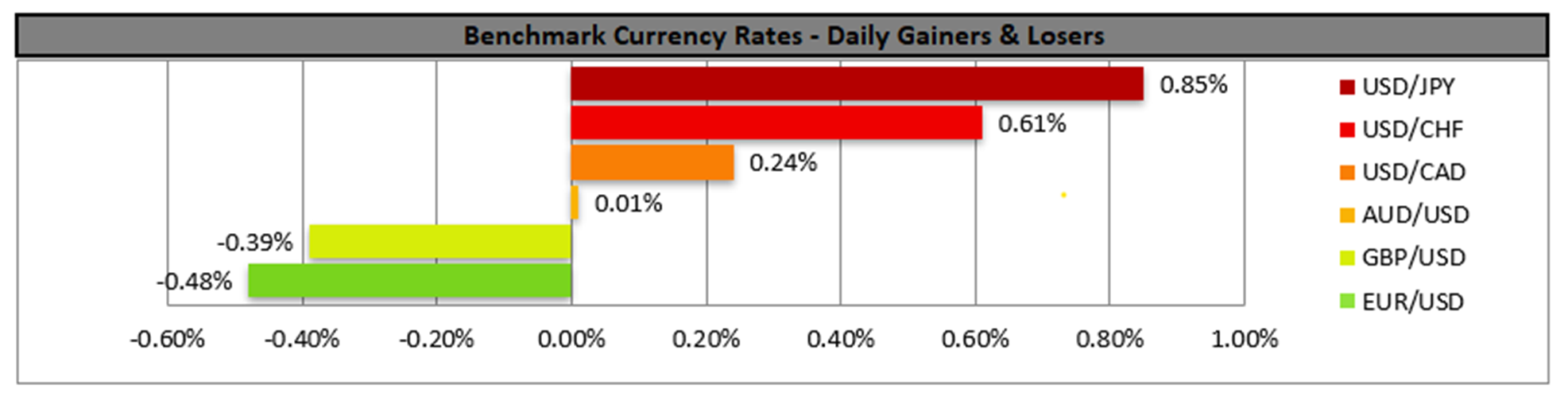

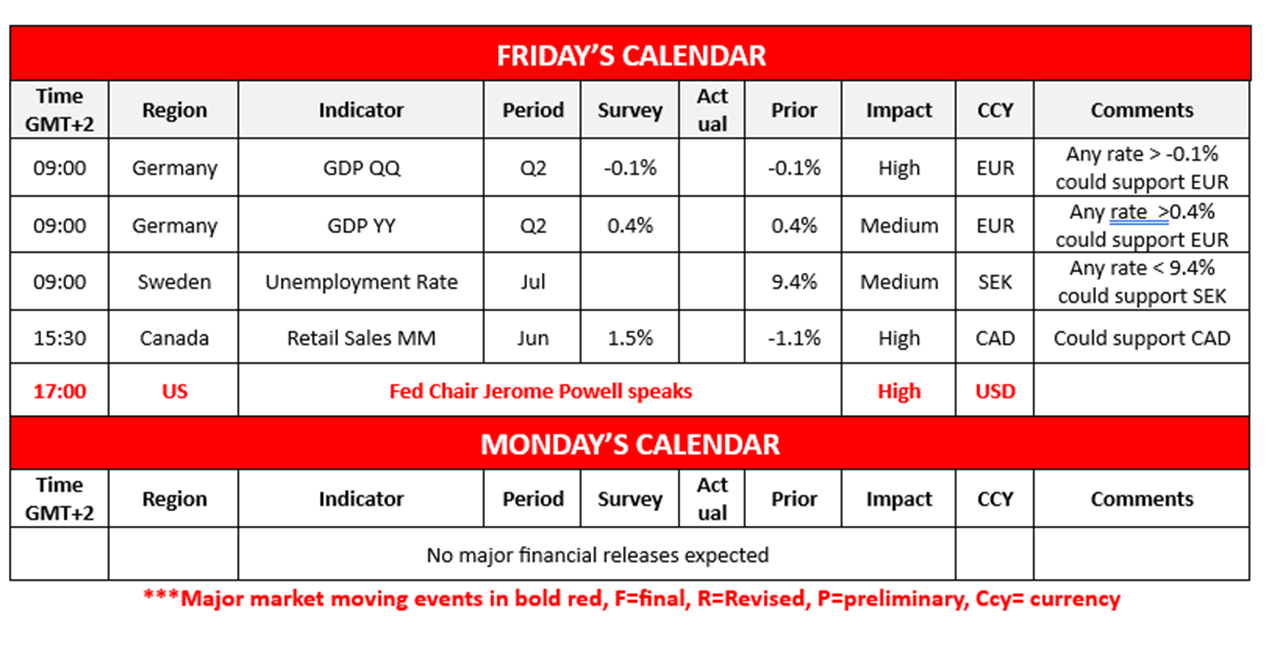

In today’s American session, the main attention of the market may be towards the anticipated speech by Fed Chair Powell. Market participants may be looking forward to whether the Fed Chair may provide guidance into the bank’s monetary policy path moving forward and as to whether or not the Fed may cut rates in the near future. Moreover, given the continued attacks on Fed policymakers as we have previously stated the Jackson Hole Symposium speech may take on an even greater importance this year. Furthermore, with the US PCE rates set to be released next week the narrative which emerges today could dictate the dollar’s direction up until next week’s key financial releases.In Europe, Germany’s GDP rate for Q2 was released earlier on today and came in lower than expected which may of be of concern for the overall economic narrative of the Zone. In turn the release of Germany’s GDP rate for Q2 and its failure to meet expectations may have weighed on the common currency.Canada’s retail sales rate for June is set to be released later on today during the American session and are expected to showcase an improvement which in turn could potentially aid the Loonie should in come in as expected or higher. Whereas should they come in lower than expected it may have the opposite effect.According to Reuters Russian President Putin is prepared to meet Ukrainian President Zelenksy. In turn the possibility of a face to face meeting between the two leaders which may eventually lead to a peace deal could weigh on gold’s price given its status as a safe haven asset.According to a report by Reuters, the Trump administration is considering a plan to reallocate $2bn from the CHIPS act to fund critical mineral projects. In turn this may influence certain companies depending on which projects are funded.Lastly, Japan’s CPI rates came in hotter than expected which may provide some support for the JPY.

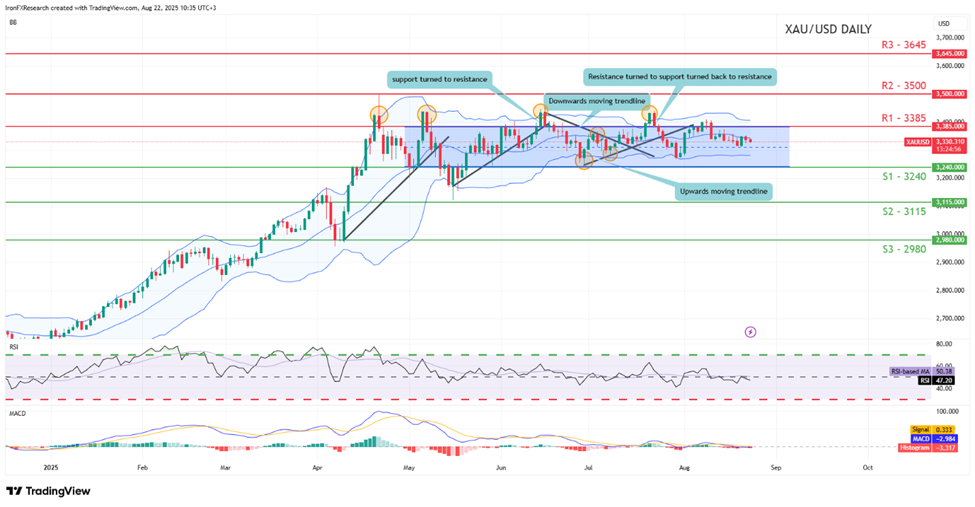

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30th of April, despite some breakouts. Nonetheless, we opt for a sideways bias for gold’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

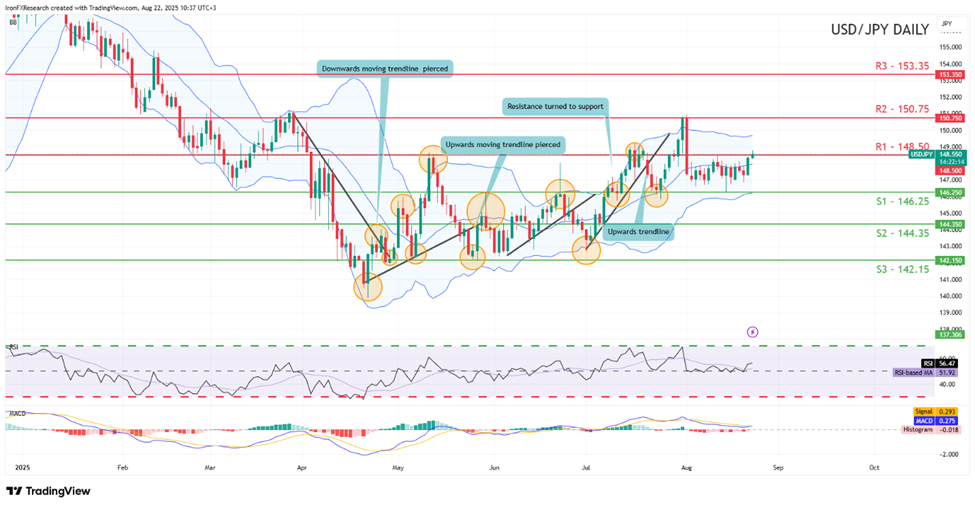

USD/JPY appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the pair’s current testing of our 148.50 (R1) resistance line. For our bullish outlook to continue we would require a clear break above our 148.50 (R1) resistance line with the next possible target for the bulls being the 150.75 (R2) resistance level. On the other hand for a sideways bias we would require the pair to remain confined between our 146.25 (S1) support level and our 148.50 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 146.25 (S1) support level with the next possible target for the bears being the 144.35 (S2) support line.

今日其他亮点:

Today we get the Germany’s GDP rates for Q2, Sweden’s unemployment rate for July, Canada’s retail sales rate for June and the main highlight of the day will be the speech by Fed Chair Powell during the American session at the Jackson Hole Symposium.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 144.35 (S2), 142.15 (S3)

- Resistance: 148.50 (R1), 150.75 (R2), 153.35 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.