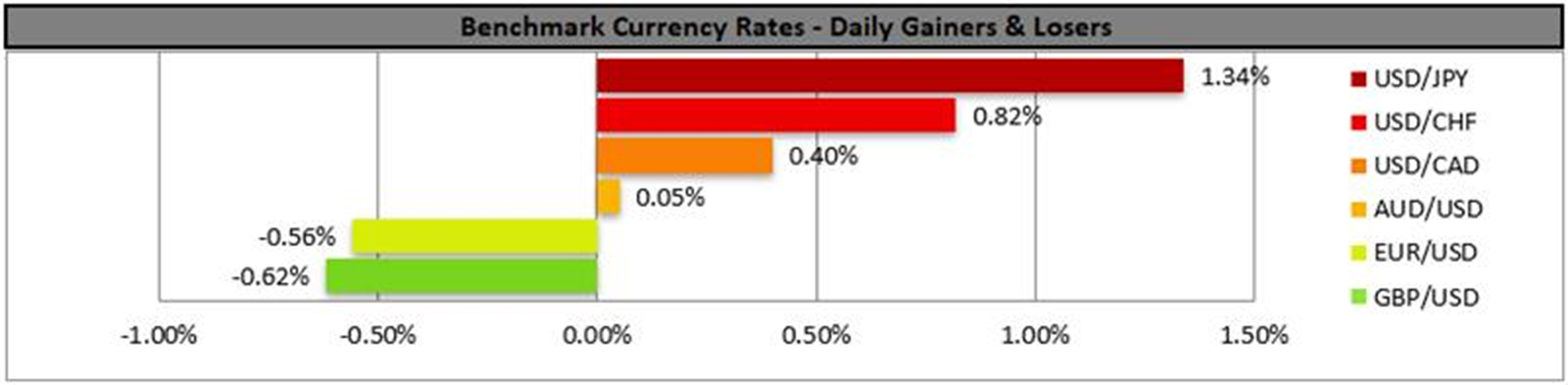

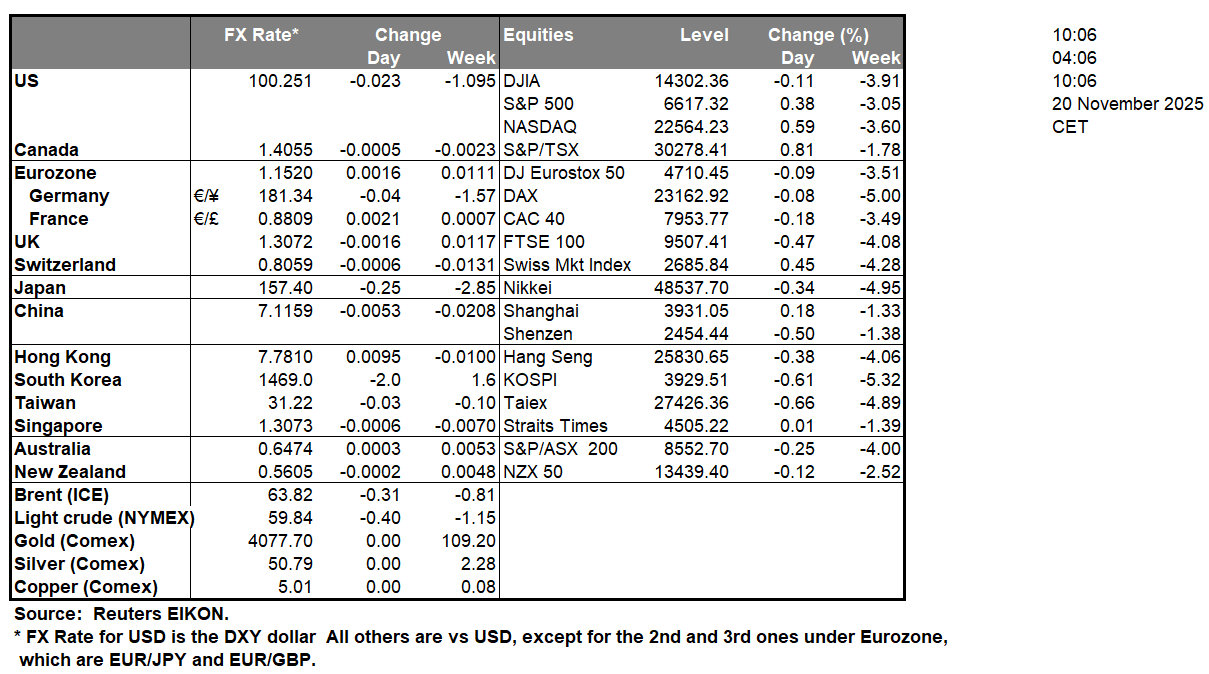

The US Employment data for September are due out today and could lead to significant volatility in the markets. Our reasoning is that following yesterday’s announcement from the BLS that the October jobs report will not be released, today’s employment data marks the last time that the Fed will gain insight into the state of the US Labour market prior to their last monetary policy decision for the year. In particular, the Fed’s last decision is set to occur on the 10th of December, whereas the November jobs report is due out on the 16th of December, hence today’s release is of even greater importance. The current expectations by economist are for the NFP figure to improve, which could aid the dollar but when looking at the big picture, the state of the US labour market still remains relatively loose. Nonetheless, should the employment data showcase an improvement in the US labour market in comparison to the prior release, it may aid the greenback and vice versa.The FOMC’s last meeting minutes were released yesterday and tended to point towards the Fed potentially remaining on hold in their final meeting of the year. Specifically, policymakers were concerned with inflation and that it had been above target for some time and had shown little sign of returning sustainably to the 2% inflation target in a timely manner. Hence, the bank’s minutes may have aided the dollar.In the US Equities markets, Nvidia’s earnings beat the street’s expectations, which may have aided the company’s stock price.

US500 appears to be moving in a sideways fashion after remerging above our 6635 (S1) support level. We opt for a sideways for the index and supporting our case is the RSI indicator below our chart which currently registers a figure near 55, implying a neutral towards bullish market sentiment. For our sideways bias to be maintained we would require the index to remain confined between our 6635 (S1) support level and our 6815 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 6815 (R1) resistance level with the next possible target for the bulls being our 6925 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below our 6635 (S1) support line with the next possible target for the bears being our 6515 (S2) support level.

XAU/USD appears to have resurfaced above our resistance turned to support at the 4045 (S1) level. We opt for a sideways bias for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. For our sideways bias to be maintained we would require the commodity’s price to remain confined between our 4045 (S1) support level and our 4145 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 4145 (R1) resistance line with the next possible target for the bulls being our 4240 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 4045 (S1) support line with the next possible target for the bears being our 3980 (S2) support level.

今日其他亮点:

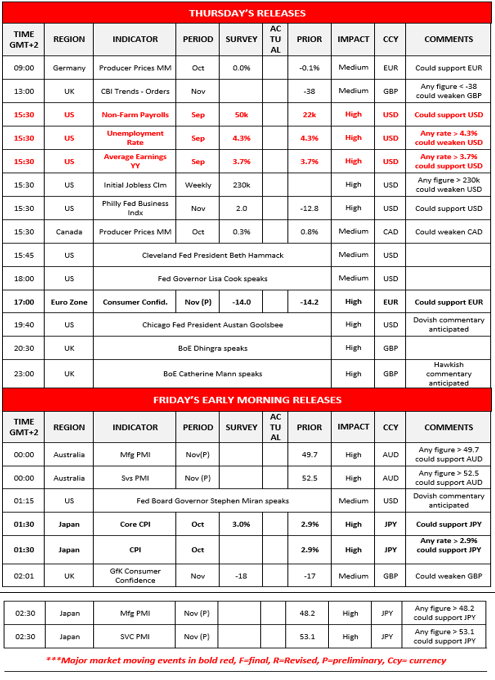

Today we get Germany’s producer prices rate for October, the UK’s CBI orders figure for November, the US Employment data for September, the US weekly initial jobless claims figure and the Philly Fed Business index figure for November, Canada’s producer prices rate for October and the Zone’s preliminary consumer confidence figure for November. On a monetary level, we note the speeches by Cleveland Fed President Hammack, Fed Governor Cook, Chicago Fed president Goolsbee, BoE Dhingra and BoE Mann. In tomorrow’s Asian session we note Australia’s preliminary manufacturing and services PMI figures for November, the speech by Governor Miran, Japan’s CPI rates for October, the UK’s Gfk consumer confidence figure for November and Japan’s preliminary services and manufacturing PMI figures for November.

US500 H4 Chart

- Support: 6635 (S1), 6515 (S2), 6415 (S3)

- Resistance: 6815 (R1), 6925 (R2), 7040 (R3)

黄金/美元4小时走势图

- Support: 4045 (S1), 3980 (S2), 3902 (S3)

- Resistance: 4145 (R1), 4240 (R2), 4340 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.