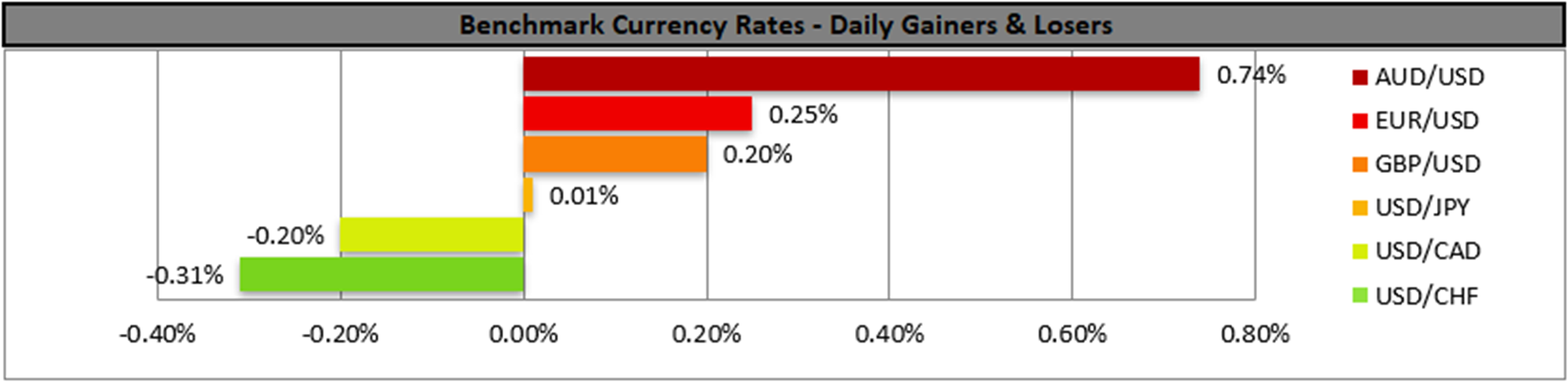

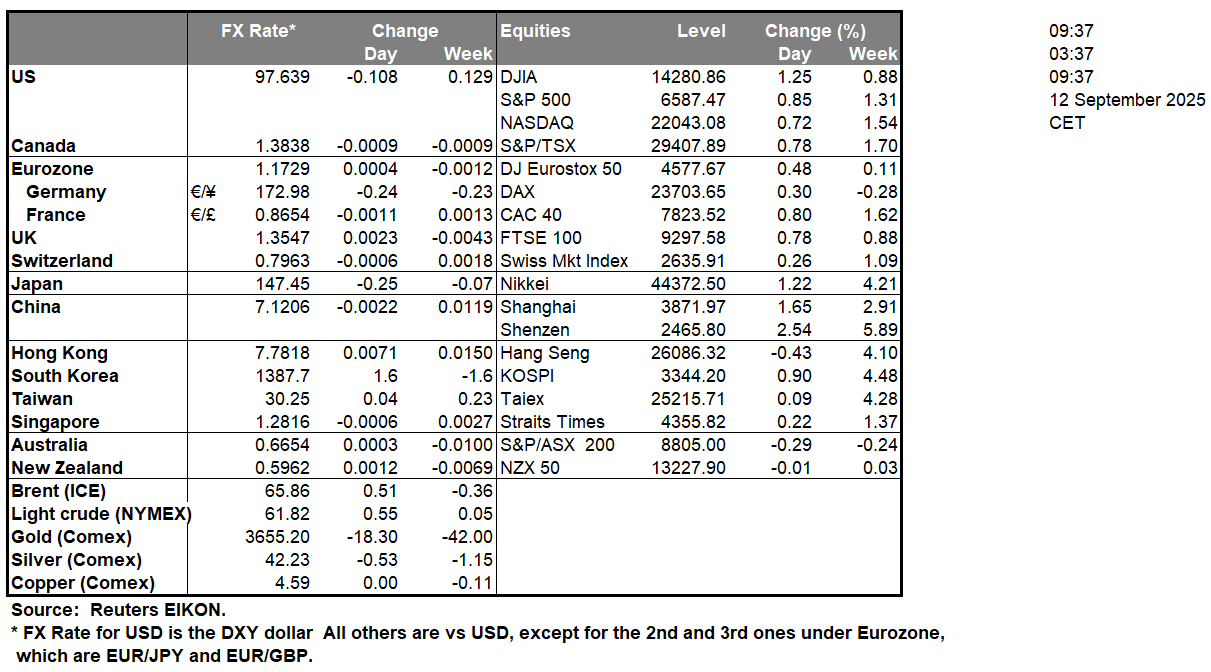

The greenback slipped against its counterparts yesterday as despite the US CPI rates for August showing a relative resilience of inflationary pressures in the US economy, the skyrocketing of the initial jobless claims figure for the past week was a painful reminder for the weakness of the US employment market. The indicator’s reading rose to 263k, if compared to last week’s 237k, a level not seen since early June 23. The release tended to imply that the weakness of the US employment market reported for August by the drop of the NFP figure and the tick up of the unemployment rate may have spilled over to the current month. Hence, the state of the US employment market is the epicenter of traders’ attention at the current stage, and its weak state tends to solidify the market’s substantial dovish expectations for the Fed’s interest rate decision next Wednesday. On the flip side the market’s rate cut bets for the Fed seem to continue to feed US stock market and gold bulls at the current stage. For the time being we see the USD being relatively stable against tis counterparts just like the calm before the storm. Today we highlight the release of the University of Michigan (UoM) consumer sentiment for September and should the indicators’ reading drop beyond market expectations we may see the USD being hit again.

Across the pond, we note that ECB remained on hold as was widely expected yesterday. In its accompanying statement, the bank stated that it sees headline inflation averaging 2.1% in 2025, 1.7% in 2026 and 1.9% in 2027 and that the economy is projected to grow by 1.2% in 2025, revised up from the 0.9% expected in June and the growth projection for 2026 is now slightly lower, at 1.0%, while the projection for 2027 is unchanged at 1.3%. Overall the bank seems to be quite comfortable with the current levels of interest rates, more or less verifying the markets’ expectations for the ECB to remain on hold until the end of the year.

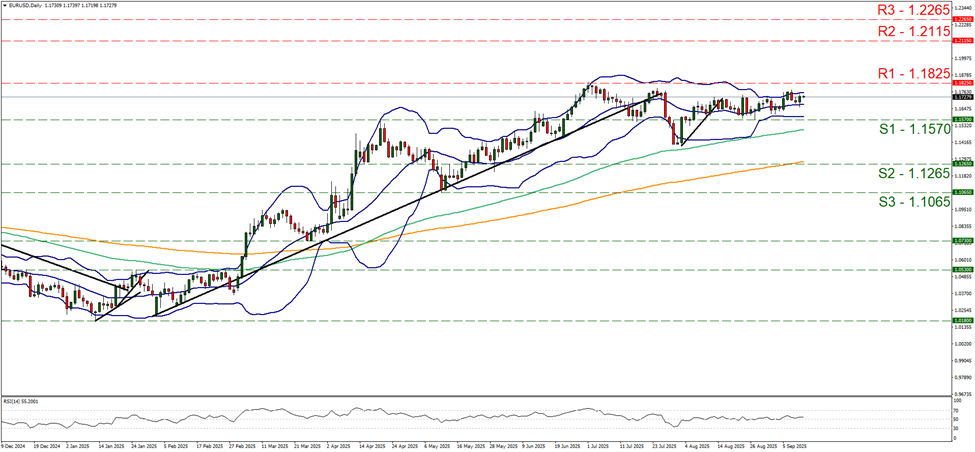

EUR/USD continues to move in a sideways motion between the 1.1570 (S1) support line and the 1.1825 (R1) resistance level. We intend to maintain our bias for a sideways motion of the pair as long as its price action remains within the corridor set by the prementioned levels. Supporting our case is the RSI indicator which continues to run along the reading of 50, implying an indecisive market for the pair’s direction. Also the narrow Bollinger bands tend to imply low volatility for the pair which could allow the sideways movement to be maintained. For a bullish outlook we would require a clear break above our 1.1825 (R1) resistance level with the next possible target for the bulls being our 1.2115 (R2) resistance line. On the flip side, for a bearish outlook we would require a clear break below our 1.1570 (S1) support level with the next possible target for the bears being our 1.1265 (S2) support line.

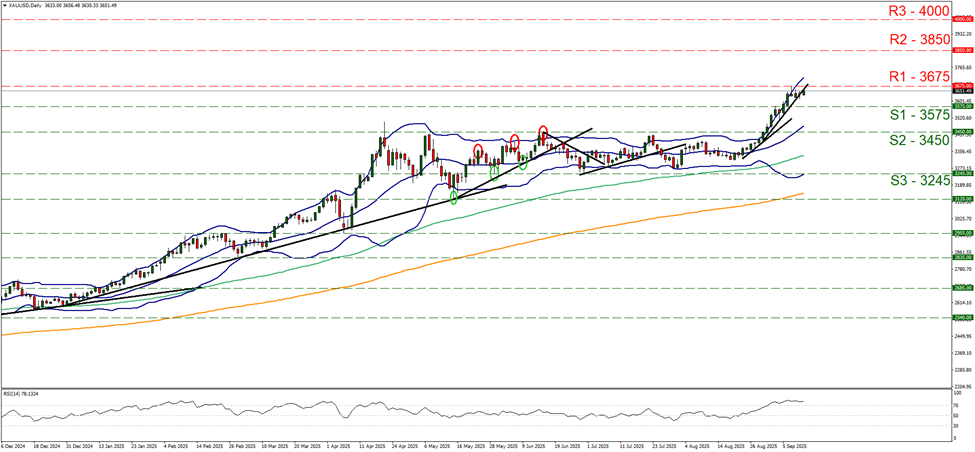

Gold’s price sems to be finding considerable difficulty in breaking the 3675 (R1) resistance line. The precious metal’s price action has breached the upward trendline guiding it since the 22nd of August hence we temporarily switch our bullish outlook in favour of a sideways motion. Should the bulls regain control over gold’s price, we may see it breaking the 3675 (R1) resistance line and continue higher aiming for the 3850 (R2) resistance level. Should the bears take over, we may see gold’s price dropping, breaking the 3575 (S1) support line and start aiming for the 3450 (S2) support level.

今日其他亮点:

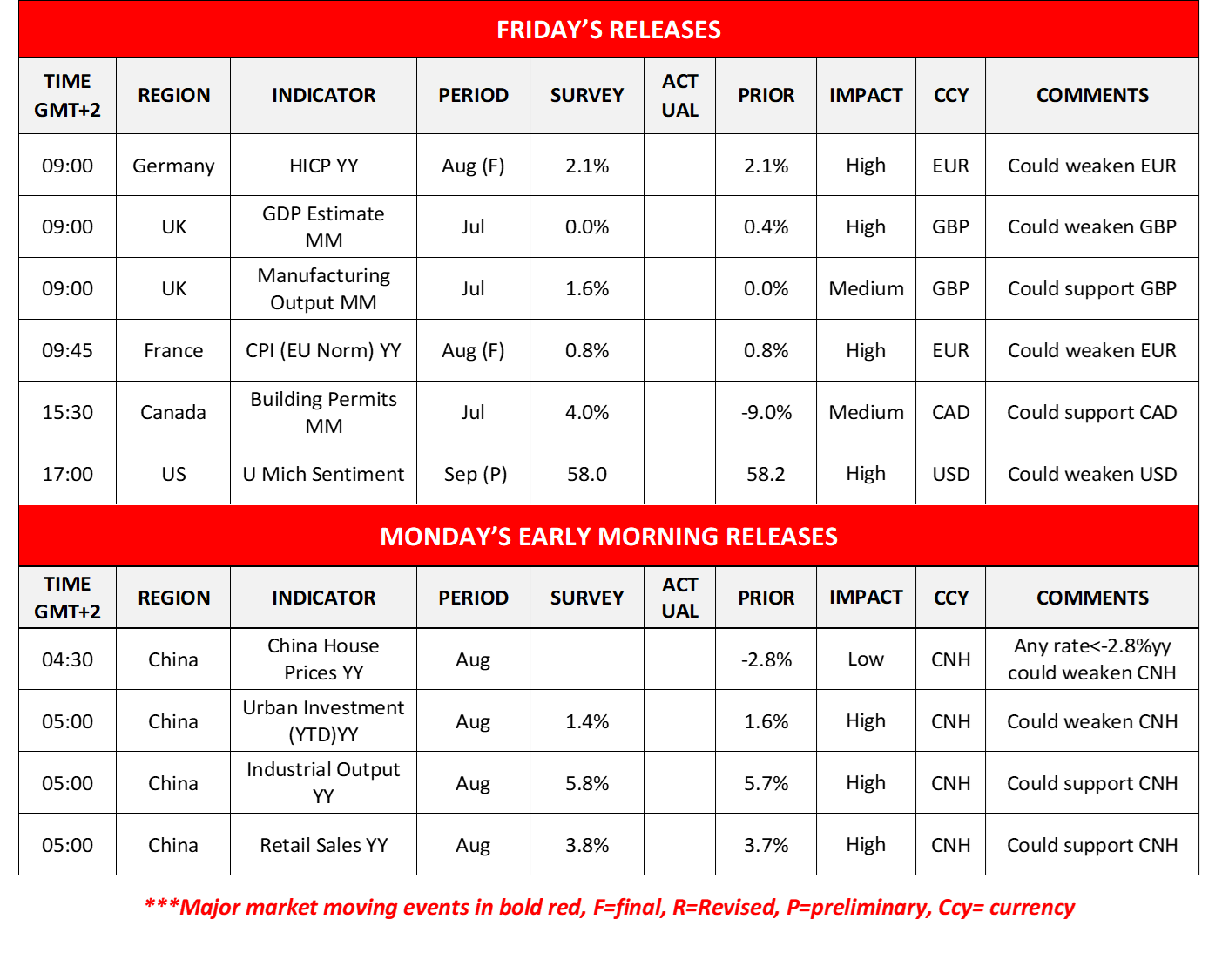

Today we get Germany’s and France’s final HICP rates for August, UK’s manufacturing output for July and Canada’s building permits also for July. In Monday’s Asian session, we get from China August’s house prices, urban investment, industrial output and retail sales growth rates.

欧元/美元日线图

- Support: 1.1570 (S1), 1.1265 (S2), 1.1065 (S3)

- Resistance: 1.1825 (R1), 1.2115 (R2), 1.2265 (R3)

黄金/美元 日线图

- Support: 3575 (S1), 3450 (S2), 3245 (S3)

- Resistance: 3675 (R1), 3850 (R2), 4000 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.