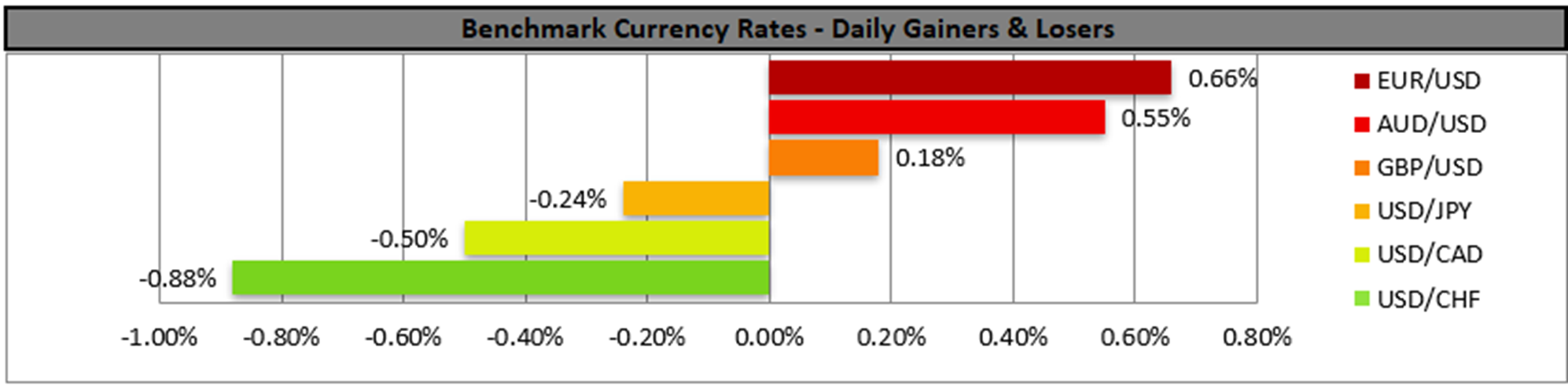

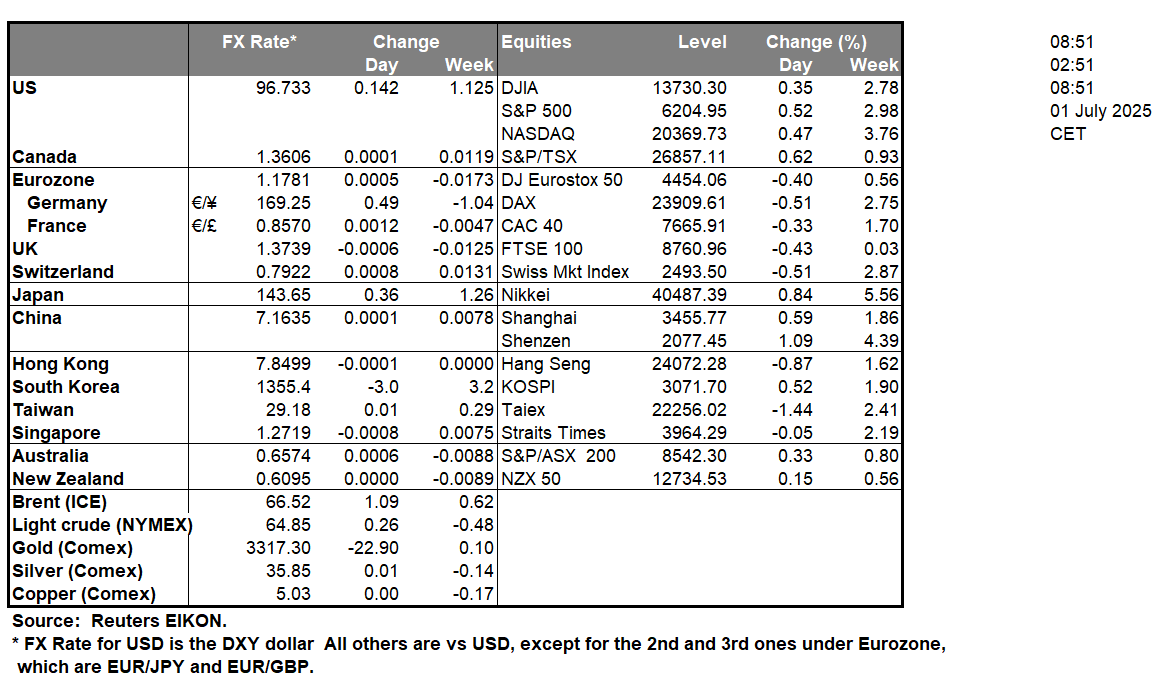

The USD continued to weaken against its counterparts yesterday in a six-day losing streak. On a fundamental level, an easing of market worries for Trump’s trade wars may emerge as the US is reported to be nearing a trade deal with China, while expectations for the US-Canadian trade talks to resume are on the rise. Overall, the uncertainty is still present given the erratic nature of the US President’s intentions which tends to weigh on the USD. On a fiscal level, Republican Congress members seem to be divided on whether to support the cutting of welfare programs to extend tax breaks in the “One Big Beautiful Bill” Act. The bill is considered as pivotal for US President Trump’s fiscal policy yet is highly controversial. Also, the undermining of Fed Chairman Powell by US President Trump, given the latter’s dovish wishes tends to weigh on the greenback as the independence of the Fed is set into doubt. Lastly, on a monetary level, we note the market’s dovish expectations for the Fed’s next moves, as the market expects the bank to start cutting rates in September and continue cutting rates in each and every following meeting until the end of the year. Yet the Fed’s next moves may be highly dependent on the summer data for inflation and employment. The next release, June’s employment report, is expected on Thursday, given that Friday is the 4th of July, a public holiday in the US. Should the data imply a beyond market expectations easing of the US employment market for the past month, we may see the USD tumbling as the market’s dovish expectations may intensify and vice versa.

Across the pond we highlight the release of Euro Zone’s preliminary HICP rates for June and a possible acceleration could provide some support for the EUR as it may ease further ECB’s dovishness. Please note that the bank’s high-profile meeting in Sintra is currently ongoing and any hawkish comments by ECB policymakers could support the common currency. ECB seems to be considering the disinflation process as practically over and may be in search of a neutral stance.

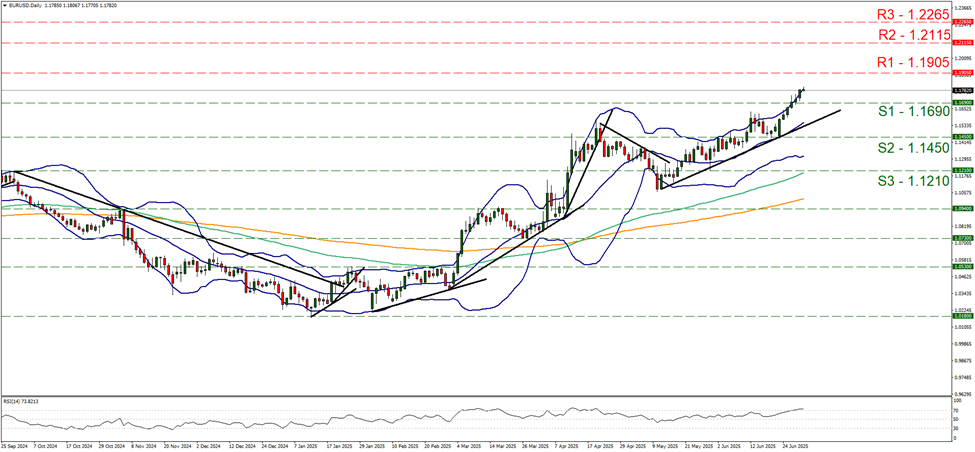

EUR/USD continued to rise [placing more distance between its price action and the 1.1690 (S1) support line. We maintain our bullish outlook for the pair as long as the upward trendline guiding the pair since the 13th of May remains intact. Yet the pair’s price action is flirting with the upper Bollinger Band for the past five days, which could slow down the bulls. The RSI indicator has surpassed the reading of 70, implying a strong bullish sentiment on behalf of market participants for the pair, yet at the same time may also imply that the pair is at overbought levels and may be ripe for a correction lower. Should the bulls maintain control, we may see it aiming if not breaking the 1.1905 (R1) resistance line. Should the bears take over, we may see the pair dropping, breaking the 1.1690 (S1) support line and continue to reach if not breach the 1.1450 (S2) level.

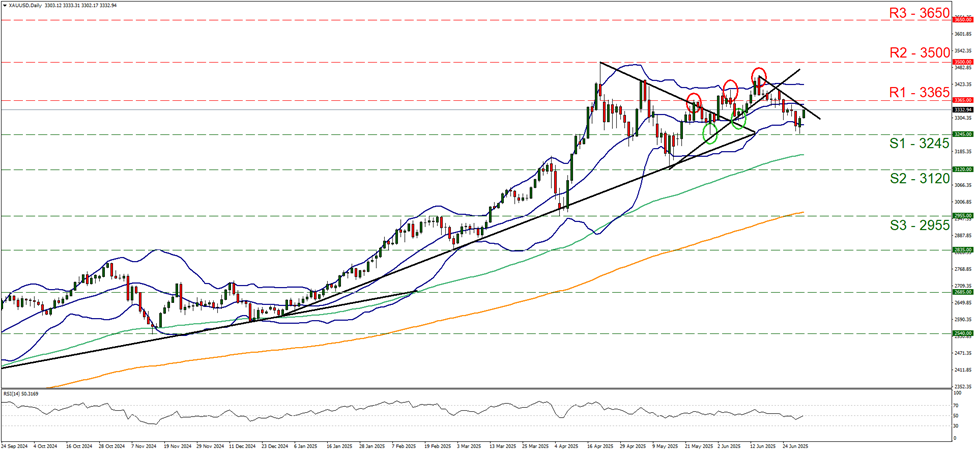

Gold’s price edged higher yesterday and during today’s Asian session remaining well between the 3365 (R1) and the 3245 (S1) levels. Neverthelss, we still maintain a bearish outlook for gold’s price as long as the downward trendline guiding the precious metal’s price since the 16th of June remains intact for a continuance of the bearish outlook we would require gold’s price to break the 3245 (S1) support line, thus opening the gates for the 3120 (S2) level. For a bullish outlook to emerge gold’s price would have to reverse direction by breaking initially the prementioned downward trendline, in a first signal of an interruption of the downward movement, continue to break the 3366 (R1) line and start aiming for the 6500 (S2) resistance level.

今日其他亮点:

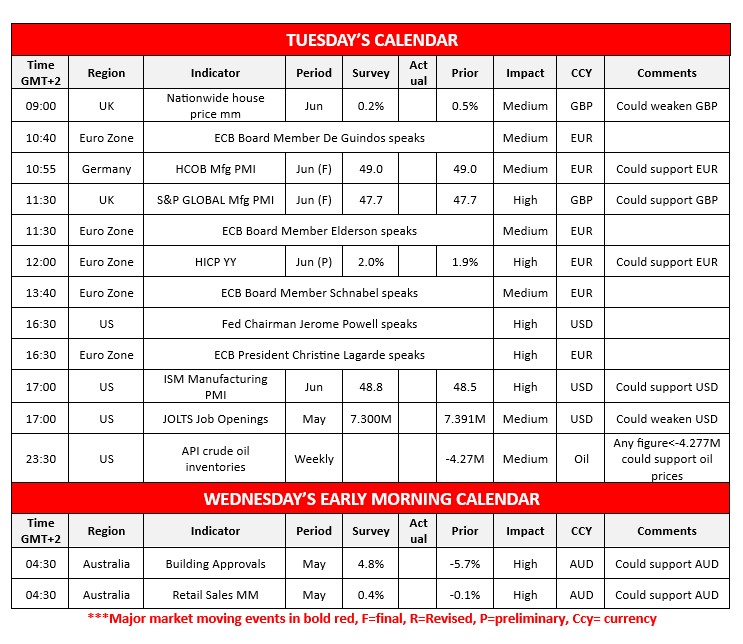

Today we get UK’s nationwide house prices for June, the US ISM manufacturing PMI figure for June, the US JOLTS job openings figure for May and the weekly API crude oil inventories figure, while Fed Chairman Powell and ECB President Lagarde are scheduled to speak. In tomorrow’s Asian session we get Australia’s building approvals and retail sales for May.

欧元/美元日线图

- Support: 1.1690 (S1), 1.1450 (S2), 1.1250 (S3)

- Resistance: 1.1905 (R1), 1.2115 (R2), 1.2265 (R3)

黄金/美元 日线图

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.